Ripple Price, Analysis and Chart

- A tortuous grind lower with further losses expected.

- Retail remain heavily long XRP from much higher levels.

Ripple (XRP) – Losses Continue to Rack-Up

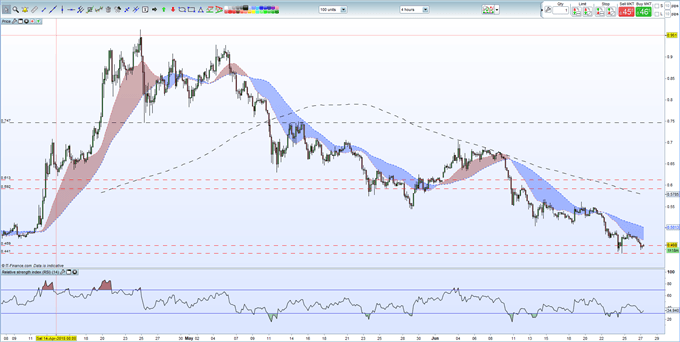

The third-largest crypto token by market capitalization continues to leak lower and changes hands at levels last seen nearly three months ago. After rallying back to around $0.90 - $0.95 in late-April/early-May, XRP has shed 50% of its value and now threatens weak support around $0.45. If this support breaks - which currently looks likely when observing recent momentum – XRP may well fall all the way back to the $0.20 area seen before the sharp December rally. The RSI indicator is nearing oversold territory which may stem losses in the near-term but recent price actions shows rebounds are being sold and prices then move lower.

And despite this heavy sell-off, retail investors continue to hold Ripple, according to the IG Client Sentiment. This indicatorshows clients remain heavily long XRP and have remained net-long since December 25 when Ripple traded near $2.49.This indicator shows the number of client’s net-long of XRP - not the volume of client holdings – and signals an extreme one-way positioning in the token.

In the Advanced Section of the DailyFX Forex University we cover trader psychology and how mastering it can help you make better trading decisions.

Ripple Price Chart Four Hour Time Frame (April 7 – June 27, 2018)

Cryptocurrency Trader Resources

If you are interested in trading Bitcoin (BTC), Bitcoin Cash (BCH), Ethereum (ETH), Ripple (XRP) or Litecoin (LTC) we can offer you an informative Introduction to Bitcoin Trading Guide.

What’s your Opinion on Ripple – Will the Dam Burst?

Share your thoughts and ideas with us using the comments section at the end of the article or you can contact me on Twitter @nickcawley1 or via email at nicholas.cawley@ig.com.

--- Written by Nick Cawley, Analyst.