US Market Snapshot via IG: DJIA 0.04%, Nasdaq 100 -0.1%, S&P 500 flat

Major Headlines

- G7 Communique was backed by all countries apart from the US

- UK Factory Output saw its largest monthly fall since October 2012

- Italian Economy Minister stated that Italy has no intention of abandoning the Euro

GBP: The Pound fell sharply following a raft of weaker than expected economic data points. UK Manufacturing Output saw its largest monthly fall since October 2012, falling 1.4% vs. expectations of a 0.3% rise amid continued slowing of international demand and a subdued domestic market. Construction Output fell 3.4%, sharpest decline since August 2012, while the UK posted its second widest deficit on record at £14bln. Consequently, this does not bode well for the BoE and rate hike expectations as this suggests that underlying economic factors remain week. GBP back to the mid-1.33 vs. the greenback, having pushed through 1.34. EURGBP looking at last week’s high situated at 88.38, a break could set up a move towards 0.8900.

EUR: The Euro has cheered remarks made by the Italian Economy Minister over the weekend, stating that Italy has no intention of abandoning the Euro. This has led to a narrowing of bund-BTP spreads, which in turn has underpinned EUR gains. Elsewhere, focus will be on the ECB meeting, where council members will discuss the process of exiting its current QE program. EUR buying likely to continue in the run up to the meeting, EURJPY looking for a break of 130.25 in order to open up a move towards 134.

CAD: The Loonie is the worst performing G10 currency amid the G7 row between President Trump and PM Trudeau. Subsequently, this has raised fears that the Trump administration could potentially scrap NAFTA negotiations altogether. Additionally, the weakness observed in oil markets have also contributed the softer CAD, which has now moved past 1.30 against the USD.

Oil: WTI and Brent crude futures are leaking lower this morning amid reports late last week that Russia and Saudi Arabia had increased output by 100k bpd with the latter planning to raise output again. This also comes ahead of the OPEC-Non-OPEC meeting on June 22nd where it is expected that Saudi Arabia will try to persuade other members to boost production. On the US front, drilling activity continued to be upped with oil rig counts rising for a third consecutive week, according to Baker Hughes, subsequently raising concerns of a flood of US oil supply.

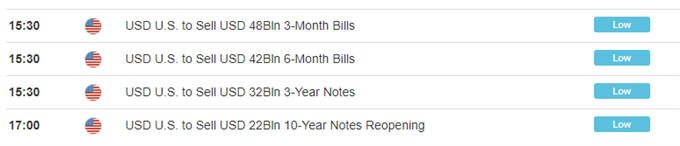

DailyFX Economic Calendar: Monday, June 11, 2018 – North American Releases

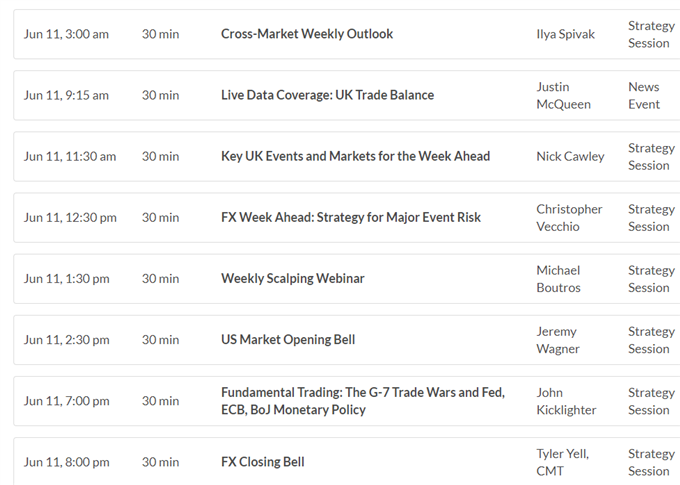

DailyWebinar Calendar: Monday, June 11, 2018

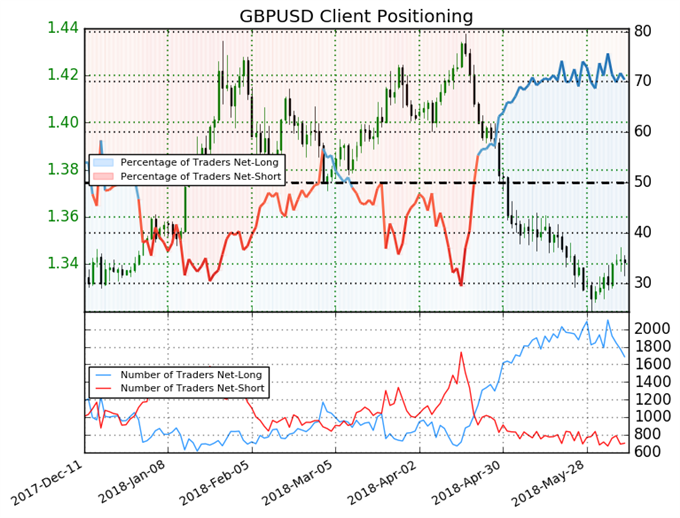

IG Client Sentiment Index: GBPUSD Chart of the Day

GBPUSD: Data shows 70.4% of traders are net-long with the ratio of traders long to short at 2.38 to 1. In fact, traders have remained net-long since Apr 20 when GBPUSD traded near 1.42303; price has moved 5.8% lower since then. The number of traders net-long is 6.6% lower than yesterday and 5.0% lower from last week, while the number of traders net-short is 10.7% lower than yesterday and 7.7% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests GBPUSD prices may continue to fall. Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger GBPUSD-bearish contrarian trading bias

Five Things Traders are Reading

- “Euro Forecast: Euro Rebound Faces Test with ECB Meeting on Thursday” by Christopher Vecchio, CFA, Sr. Currency Strategist

- “Weekly CoT Update for AUD, GBP, Euro, Oil, Copper, and Others” by Paul Robinson, Market Analyst

- “GBP Faces a Challenging Week of Heavyweight Data; Brexit Vote” by Nick Cawley, Market Analyst

- “GBPUSD Plunges as Factory Output Posts Largest Monthly Fall Since Oct’12” by Justin McQueen, Market Analyst

- “Bitcoin & Litecoin Charts – Broken Support to Lead to More Breaks” by Paul Robinson, Market Analyst

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX