Cryptocurrency News and Talking Points

- Bitcoin (BTC) now 40% lower from mid-December as South Korea ban talk continues to rumble on.

- Other digital coins, including Ethereum (ETH) and Ripple (XRP) slump as selling becomes indiscriminate.

Cryptocurrency Market under Heavy Selling Pressure

“Only when the tide goes out do you discover who has been swimming naked,” stock market guru Warren Buffett once observed and it looks like the cryptocurrency tide has definitely receded in the last 24 hours with the market showing double digit percentage losses right across the board.The sell-off started in Asia and accelerated when European traders entered the fray, as talk continued to circulate that South Korea was preparing a cryptocurrency ban. Bitcoin and Ethereum prices fell sharply last week after South Korean authorities raided a range of cryptocurrency exchanges.

What makes the sell-off more worrying, for the market bulls, is that these rumors have been around for at least a couple of weeks and overall nothing new has been said. The South Korean Fin Min said on a radio interview today that the shutdown of virtual currency exchanges “is still an option” and while negative it adds little to Monday’s news that before South Korean authorities make a decision, they said they would need “sufficient consultation and coordination of options.”

China is also upgrading its crackdown on cryptocurrency trading, according to a number of market reports, after clamping down on cryptocurrency exchanges last year. According to unconfirmed reports, China is looking to ban companies offering market making, settlement and clearing services for centralized trading.

Bitcoin (BTC) Price Chart Daily Timeframe (October 10, 2017 – January 16, 2018)

Bitcoin Price Slumps but Support May be Near

A look at the latest BTC daily price chart aboveshows the token breaking below the ascending triangle and into a 50% ($12,690) - 61.2% ($10,970) Fibonacci retracement zone of the November 12 – December 17 rally. There is also a support zone between $10,700 and $11,600 that may provide comfort for bullish traders, although a break and close below could see BTC fall back to around $8,500, the 78.6% Fibonacci retracement.

DailyFX analyst Paul Robinson looked at other digital token set-ups in his latest Cryptocurrency Price Analysis.

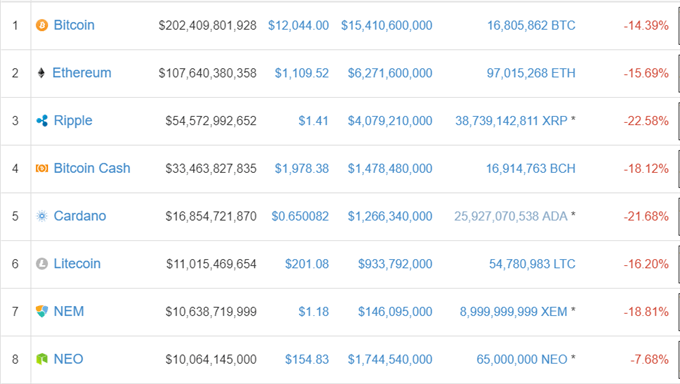

Top 8 Cryptocurrencies by Market Capitalization – January 16, 2018

Cryptocurrency Trader Resources – Free Practice Trading Accounts, Guides, Sentiment Indicators and Webinars

If you are interested in trading Bitcoin (BTC), Bitcoin Cash (BCH), Ethereum (ETH), Ripple (XRP) or Litecoin (LTC) check out our Introduction to Bitcoin Trading Guide.

--- Written by Nick Cawley, Analyst.

To contact Nick, email him at nicholas.cawley@ig.com

Follow Nick on Twitter @nickcawley1