Australian Dollar Talking Points

AUD/USD appears to be reversing course ahead of the 50-Day SMA (0.7149) as it quickly bounces back from a fresh monthly low (0.7192), and the exchange rate may stage a larger rebound ahead of the Federal Reserve interest rate decision on September 16 as key market themes remain in place.

AUD/USD Flips Ahead of 50-Day SMA Despite Break of Trendline Support

AUD/USD is little changed from the start of the week after threatening the upward trend established in June, and the pull back from the 2020 high (0.7414) may turn out to be an exhaustion in the bullish behavior rather than a change in trend as the Reserve Bank of Australia (RBA) relies on its current policy tools to support the economy.

The recent tweak to the Term Funding Facility suggests the RBA is in no rush to deploy more non-standard measures as the central bank rules out a negative interest rate policy (NIRP) for Australia, and it seems as though the board will retain the current policy at the next meeting on October 6 as Governor Philip Lowe and Co. “consider how further monetary measures could support the recovery.”

Looking ahead, it remains to be seen if the RBA will adjust the forward guidance ahead of 2021 as the economic recovery is “likely to be both uneven and bumpy,” and the central bank may show a greater willingness to expand the scope of its yield target program as Governor Lowe and Co. insist that “further purchases will be undertaken as necessary.”

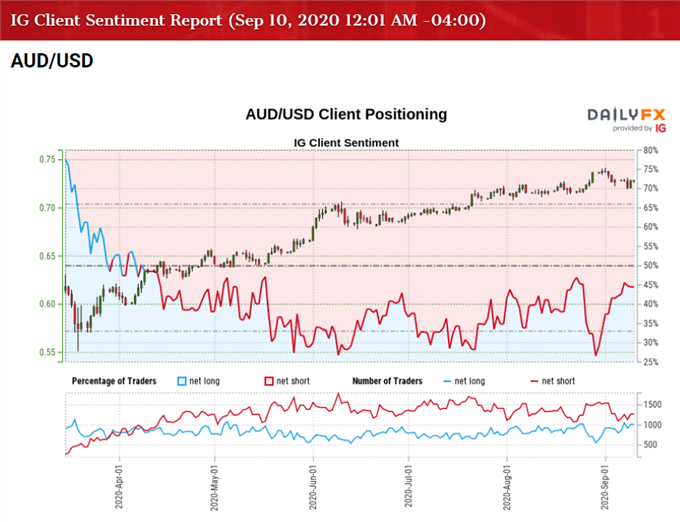

Until then, current market trends may keep AUD/USD afloat as the Federal Reserve’s balance sheet climbs back above $7 trillion in August, and the crowding behavior in the US Dollar may continue to coincide with the appreciation in the exchange rate as retail traders have been net-short the pair since April.

The IG Client Sentiment report shows 43.83% of traders are net-long AUD/USD, with the ratio of traders short to long at 1.28 to 1. The number of traders net-long is 4.89% higher than yesterday and 13.00% higher from last week, while the number of traders net-short is 10.33% higher than yesterday and 14.32% lower from last week.

The rise in net-long interest has helped to alleviate the tilted in retail sentiment as only 37.17% of traders were net-long AUD/USD last week, but the recent pick up in net-short position suggests the crowding behavior in the Greenback will persist ahead of the Fed rate decision even though a bear-flag formation emerges in the DXY index.

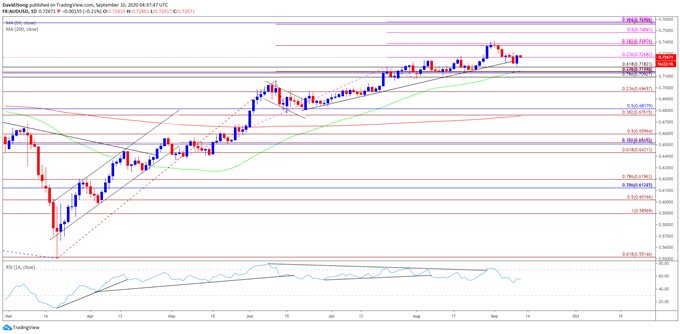

With that said, AUD/USD may continue to exhibit a bullish trend as it trades to a fresh yearly high (0.7414) in September, but the break of trendline support keeps the 50-Day SMA (0.7149) on the radar as the Relative Strength Index (RSI) continues to pullback from overbought territory.

Sign up and join DailyFX Currency Strategist David Song LIVE for an opportunity to discuss potential trade setups.

AUD/USD Rate Daily Chart

Source: Trading View

- Keep in mind, the advance from the 2020 low (0.5506) gathered pace as AUD/USD broke out of the April range, with the exchange rate clearing the January high (0.7016) in June as the Relative Strength Index (RSI) pushed into overbought territory.

- AUD/USD managed to clear the June high (0.7064) in July even though the RSI failed to retain the upward trend from earlier this year, with the exchange rate pushing to fresh yearly highs in August and September to trade at its highest level since 2018.

- Recent developments in the RSI instilled a bullish outlook for AUD/USD as it threatened the downward trend from earlier this year to push into overbought territory for the fourth time in 2020, but a textbook sell-signal has emerged as the indicator falls back below 70.

- In turn, the bullish momentum may continue to abate following the failed attempt to test the July 2018 high (0.7484), with the 50-Day SMA (0.7149) on the radar for AUD/USD as it threatens the upward trend established in June.

- Failure to hold above the 0.7270 (23.6% expansion) region may push AUD/USD back towards 0.7180 (61.8% retracement), with the next area of interest coming in around 0.7090 (78.6% retracement) to 0.7140 (23.6% retracement), which incorporates the 50-Day SMA (0.7149).

- At the same time, a larger rebound in AUD/USD may bring the Fibonacci overlap around 0.7370 (38.2% expansion) to 0.7390 (38.2% expansion) back on the radar, with a break above the 2020 high (0.7414) opening up the 0.7480 (50% expansion) region.

--- Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong