Talking Points:

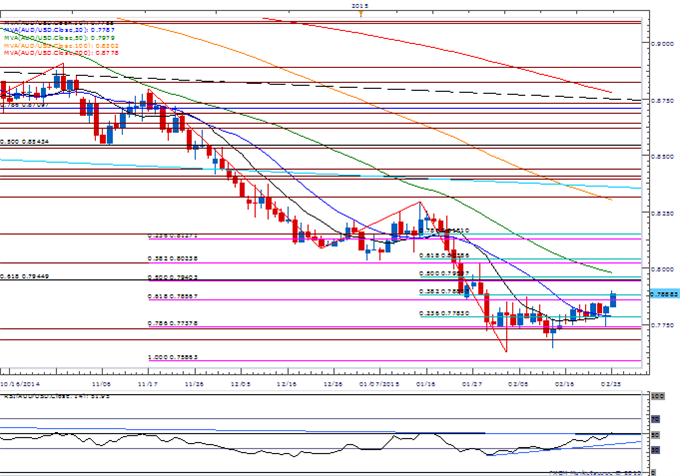

- AUD/USD Breaks Out, Threatens Bearish Momentum Ahead of RBA March Meeting.

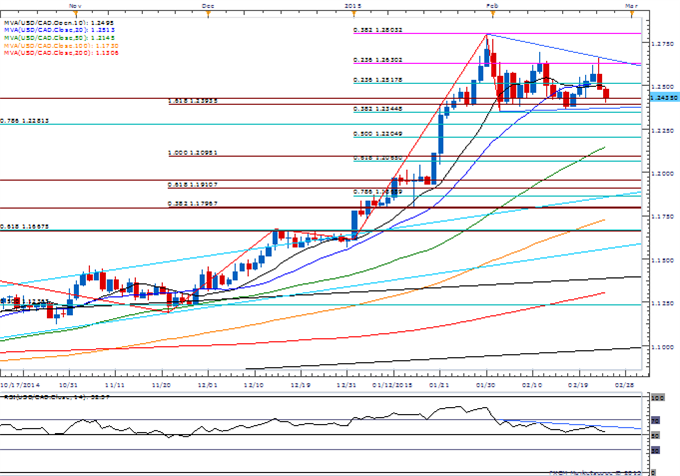

- USD/CAD Holds Monthly Opening Range as BoC Governor Poloz Talks Down Rate-Cut Bets.

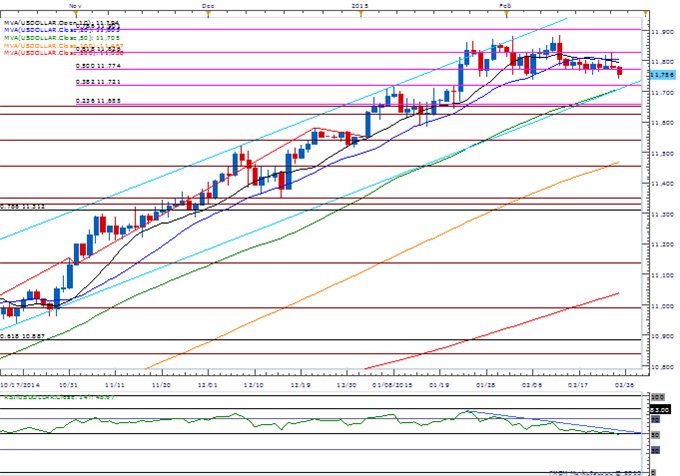

- USDOLLAR Risks Larger Correction as Fed Chair Janet Yellen Remains in No Rush to Normalize.

For more updates, sign up for David's e-mail distribution list.

Chart - Created Using FXCM Marketscope 2.0

- AUD/USD breaking out following the positive data prints out of Asia-Pacific; will keep a close eye on former support around 0.8020 (38.2% expansion) to 0.8030 (61.8% retracement) as the Relative Strength Index (RSI) threatens the long-dating bearish momentum.

- Despite the surprise rate cut, seeing narrowing expectations for another move at the Reserve Bank of Australia’s (RBA) March 3 meeting as Governor Glenn Stevens adopts a more neutral tone.

- Nevertheless, DailyFX Speculative Sentiment Index (SSI) shows retail crowd turned net-short AUD/USD yesterday, with the ratio currently holding at -1.44.

USD/CAD

- USD/CAD may continue to consolidate and retail the opening monthly range as Bank of Canada (BoC) Governor Stephen Poloz argues that the surprise rate cut was an ‘insurance’ move; looks as though the central bank will retain its current policy at the March 4 meeting.

- With that said, may need a larger fundamental catalyst to spur a break of the February range; keeping a close eye on the RSI as it retains the bearish momentum from earlier this month.

- Long-term outlook remains bullish amid the policy divergence, but need a close above 1.2630 (23.6% expansion) to favor another run at 1.2800 (38.2% expansion).

Join DailyFX on Demand for Real-Time SSI Updates Across the Majors!

Read More:

Price & Time: The March Inflection Point in Crude

GBPNZD Responds to Key Support- Scalps Target Resistance at 2.0550

USDOLLAR(Ticker: USDollar):

| Index | Last | High | Low | Daily Change (%) | Daily Range (% of ATR) |

|---|---|---|---|---|---|

| DJ-FXCM Dollar Index | 11756.16 | 11779.21 | 11740.32 | -0.20 | 68.87% |

Chart - Created Using FXCM Marketscope 2.0

- Dow Jones-FXCM U.S. Dollar remains under pressure as Fed Chair Janet Yellen appears to be in no rush to normalize monetary policy; close below 11,774 (50% expansion) to favor downside targets as the bearish RSI momentum continues to take shape.

- U.S. Consumer Price Index (CPI) may also dampen interest rate expectations as the headline reading is expected to show the first annualized contraction since July 2009..

- Downside region of interest comes in around 11,721 (38.2%), which also lines up with channel support and the 50-Day SMA (11,705).

Join DailyFX on Demand for Real-Time SSI Updates!

| Release | GMT | Expected | Actual |

|---|---|---|---|

| MBA Mortgage Applications (FEB 20) | 13:00 | -- | -3.5% |

| MBA Mortgage Foreclosures (4Q) | 15:00 | -- | 2.27% |

| MBA Mortgage Delinquencies (4Q) | 15:00 | -- | 5.68% |

| New Home Sales (JAN) | 15:00 | 470K | 481K |

| New Home Sales (MoM) (JAN) | 15:00 | -2.3% | -0.2% |

| Fed Chair Janet Yellen Delivers Humphrey-Hawkins Testimony | 15:00 |

Click Here for the DailyFX Calendar

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.

Trade Alongsidethe DailyFX Team on DailyFX on Demand

Looking to use the DailyFX Trade Signals LIVE? Check out Mirror Trader.

New to FX? Watch this Video

Join us to discuss the outlook for the major currencies on the DailyFXForums