Fundamental Forecast for Dollar: Neutral

- Fed Funds futures show a 0% probability of a hike on June 15 but the July 27 meeting is still contested at a 17.6% chance

- With global monetary policy mattering more and more; Dollar traders will also watch BoJ, SNB, BoE this week

- See our 2Q forecasts for the US Dollar and market benchmarks on the DailyFX Trading Guides page

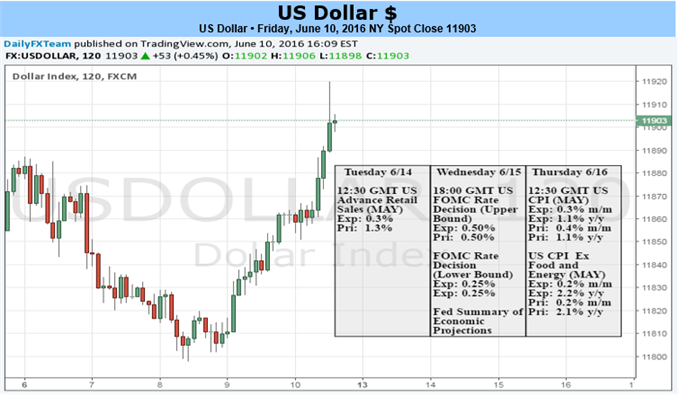

The Dollar clawed back much of the losses it suffered after the disappointing NFPs this past week. However, the true test for the currency lies ahead in the FOMC rate decision. Volatility in advance of the event has been exceptionally high. That is part due to the importance of speculation surrounding the divergent monetary policy course of the Federal Reserve. However, it is also an indication of the growing instability of the broader market. While traditional volatility indexes and similar measures seem to reflect quiet, conditions are ripe for fear and instability. While we keep tabs on the more ‘civil’ fundamental themes, it is important that all traders mind their systemic exposure.

For headline event risk, the FOMC rate decision on June 15 will certainly earn more than its fair share of digital ink. While there are global ramifications to this event, the first effort to respond to its outcome will look at the surface interpretation. A hike or no hike is the first evaluation. The market assesses a sparse 2 percent probability that the Fed would be so bold as to lift rates. While I tend not to believe in ‘sure’ scenarios, there is likely little tail risk that the central bank would entertain a surprise hike.

Given the market’s certainty of no change, current market positioning – and in turn stability – likely depends on such an outcome. With concerns surrounding slowing global growth, Brexit spillover risk, China’s ability to manage a moderation of GDP without tipping financial crisis and other themes circulating freely; the policy authority no doubt recognizes these are not conditions in which to generate a serious surprise. However, that does not necessarily translate into reason for the central bank to fully abandon a normalization policy. Quite the opposite. A reversal in path would likely generate concern that circumstances are dire to warrant such a reversal, and the effort to create buffer could prove problematic should global policy authorities need to act to stabilize an unforeseen shock.

The focus in the June FOMC event is therefore not in the rate decision itself, but in those components that will feed speculation surrounding subsequent meetings – monetary policy statement, Chair Yellen testimony and forecasts. The latter of these three is the hands-down most important factor. Projections for growth, employment, inflation and interest rates will be offered. The first three are the ‘justification’ for policy decisions in most investors’ minds rather than the economic mapping they are intended to be. The rate forecast is where most of the reaction will come into play.

In the last forecast updates in March, the Fed lowered its 2016 rate forecast from 100 basis points worth of hikes to 50 basis points. This is still very hawkish in contrast to the rest of the major central banks which leads to issues of its own. After the May NFPs printed one of the largest miss in net hires since the height of the financial crisis, the chances of rate hikes measured in swaps and Fed Funds futures have dropped sharply. This presents yet another problem for the Fed – stick to the commitment or submit to a fickle market (which is unlikely to find confidence in a reversal from the central bank even if it were offered). The market is pricing in around a 17 percent probability of a July hike and that is where the impact on Dollar rate advantage and general risk trends will play out.

Aside from monetary policy, however, the general conditions of the market are increasingly important. The Dollar hasn’t resorted to its ultimate safe haven status in some time as the market’s complacency has afforded an unsteady peace in the markets. However the degree of concern beneath the surface is increasingly clear to the market rank. If confidence falters, the Dollar may (begrudgingly) return to its haven roots. – JK