S&P 500 FUNDAMENTALFORECAST: BULLISH

- US indices retreated from their record highs into the weekend as tax hike proposals dented sentiment

- Strong earnings and upbeat economic data may cushion the downside, with investors eyeing FAANG results next week

- The S&P 500 index is trading at a 32.0 price-to-earnings (P/E) ratio, far above its five-year mean

A slew of upbeat bank results kicked off a robust earnings season, sending the Dow Jones, S&P 500 and Nasdaq 100 indices to record highs last week. Sentiment turned sour towards the weekend however, after President Joe Biden proposed capital gain tax hikes on wealthier Americans. Although there are uncertainties surrounding the passing of the tax bill in the Senate, the market remained jittery about potential profit-taking.

Individual investors who are concerned about rising tax rates may consider unloading shares to lock in current rates, especially when stocks are at their record highs. This assumption rendered the tech-heavy Nasdaq index more vulnerable to a selloff due to tremendous gains it registered over the past 12 months. The Dow Jones and S&P 500 index, however, may suffer to a lesser extent as higher dividend-paying stocks may become more attractive compared to growth stocks if capital gains taxes rises.

Nonetheless, investors may not necessarily have to worry too much about the potential tax hikes, as improving fundamental metrics and aggressive fiscal spending remain the primary drivers behind asset prices.

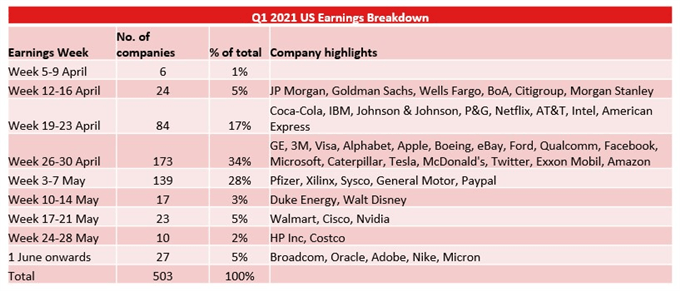

Corporate America delivered solid results for the first quarter. Among the 103 S&P 500 companies that have reported results so far, more than 84% delivered positive earnings surprises. According to FactSet, the blended earnings growth rate for the S&P 500 is 30.2% YoY so far this season. Analysts also expect double-digit growth rates for the remaining three quarters of 2021, with growth expected to peak in Q2 2021 at 54.6%. Against this backdrop, the stock market may yet drive deeper into record territory.

Looking ahead, the bulk of the FAANG group of companies and other tech giants are due to release earnings in the coming week. They include Facebook, Apple, Google, Microsoft, Amazon, and Tesla (chart below). Should these companies disappoint investors like Netflix did last week, a deeper pullback for Nasdaq 100 index is possible. Meanwhile, worsening pandemic situations in India and Japan could also serve as negative catalysts.

Q1 2021 Earnings Highlights

Source: Bloomberg, DailyFX

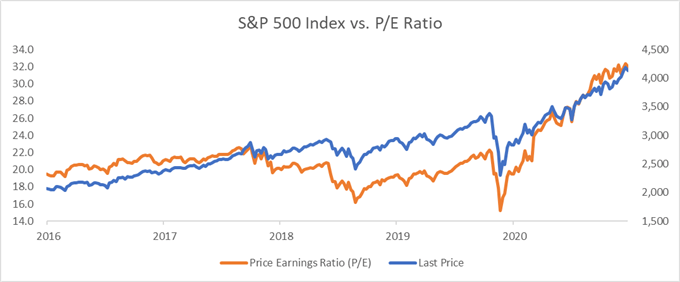

Valuation-wise, the S&P 500 index is trading at a 32.0 price-to-earnings (P/E) ratio, more than two standard deviations above its five-year mean. Relatively high valuations render the index vulnerable to a technical pullback should profit-taking accelerate. In the medium term, earnings normalization may help to bring down the P/E ratio and create room for the S&P 500 to edge upwards.

S&P 500 Index vs. P/E Ratio – 5 Years

Source: Bloomberg, DailyFX

--- Written by Margaret Yang, Strategist for DailyFX.com

To contact Margaret, use the Comments section below or @margaretyjy on Twitter