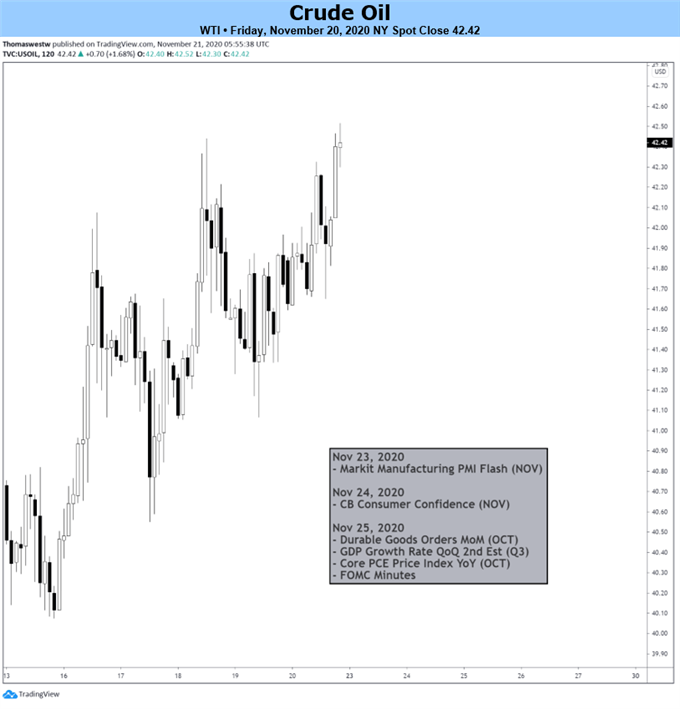

CRUDE OIL PRICE PRIMED FOR VOLATILITY AMID CONFLICTING FUNDAMENTAL DRIVERS

- Crude oil has climbed a whopping 18.5% higher month-to-date

- Potential for oil price volatility looks likely due to mixed outlook

- Commodity traders clash over lockdown risk, vaccine optimism

Crude oil price action climbed 5.7% this past week. The latest advance solidified three consecutive weeks of gains, extending the month-to-date rally to an impressive 18.5%, and propelling the commodity to its highest close since early September.

Oil prices have broadly benefited from encouraging vaccine results and corresponding improvement in market sentiment. This is because the direction of crude oil broadly tracks global GDP growth expectations, and optimistic covid vaccine headlines have reinforced prospects for future economic activity.

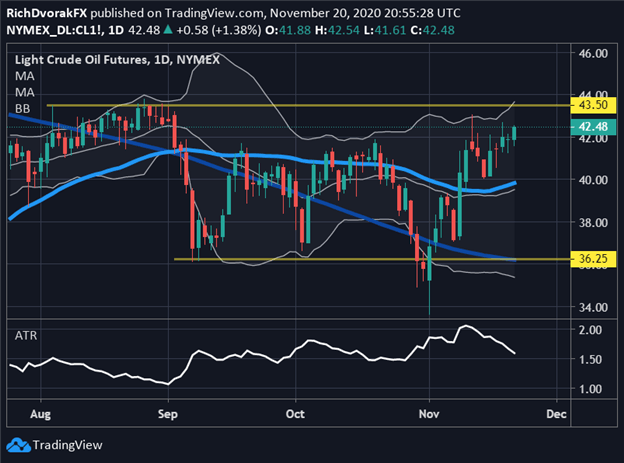

CRUDE OIL PRICE CHART: DAILY TIME FRAME (27 JUL TO 20 NOV 2020)

Chart by @RichDvorakFX created using TradingView

Following the sharp ascent over recent trading sessions, however, crude oil upside potential now looks largely exhausted. This is primarily considering that material downside risks, such as mounting coronavirus lockdown measures, stand to curb demand for crude oil and weigh negatively on short-term outlook.

Complacency thus seems increasingly prevalent at current levels as oil traders dismiss nearside threats to demand while vaccine hope keeps markets forward-looking. Furthermore, the JMMC meeting this past week failed to soothe supply concerns with OPEC+ reluctant to delay its planned production hike.

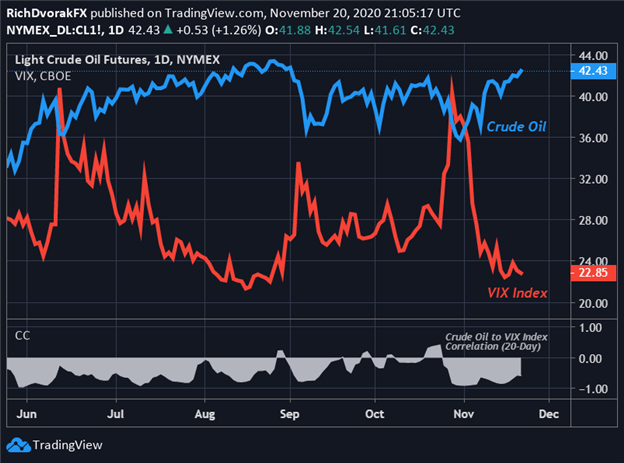

CRUDE OIL PRICE CHART WITH VIX INDEX OVERLAID: DAILY TIME FRAME (26 MAY TO 20 NOV 2020)

Chart by @RichDvorakFX created using TradingView

That said, crude oil price volatility could accelerate in the days ahead as the commodity continues to fluctuate within the confines of its broad trading range formed over the last three months. The general lack of direction appears facilitated by this juxtaposition of bearish short-term headwinds and bullish long-term outlook.

| Change in | Longs | Shorts | OI |

| Daily | 3% | -7% | 1% |

| Weekly | 31% | -38% | 7% |

As such, crude oil prices might struggle to sustain the recent bid. Also, there is a strong possibility that crude oil price action pivot back lower if bearish catalysts materialize and risk aversion takes hold. This would likely correspond with a notable rise in the S&P 500-derived VIX Index. Crude oil and the VIX ‘fear-gauge’ typically maintain a strong inverse relationship as indicated by the mostly negative correlation coefficient in the chart above.

Keep Reading - How to Trade Crude Oil: Top Oil Trading Strategies & Tips

-- Written by Rich Dvorak, Analyst for DailyFX.com

Connect with @RichDvorakFX on Twitter for real-time market insight