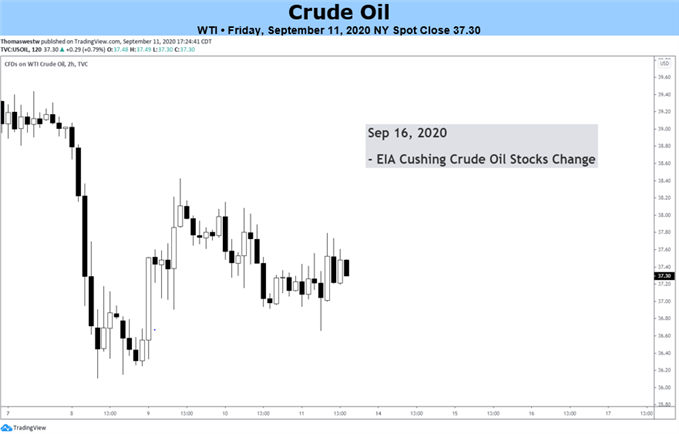

Chart created with TradingView

Oil Talking Points

The price of oil has slipped below the $40 mark to trade at its lowest level since June, and crude prices may continue to weaken in September as the Organization of the Petroleum Exporting Countries (OPEC) rollback the voluntary production cuts in response to COVID-19.

Fundamental Forecast for Oil: Bearish

The price of oil approaches the June low ($34.27) ahead of OPEC’s Joint Ministerial Monitoring Committee (JMMC) meeting on tap for September 16-17 as US crude inventories unexpectedly increase for the first time since July, with output also recovering during the same period.

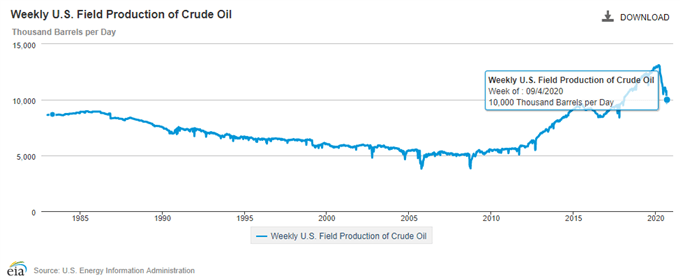

Oil stockpiles increased 2033K in the week ending September 4 versus forecasts for a 3000K decline, while the fresh figures coming out of the Energy Information Energy (EIA) showed US field production climbing to 10,000k b/d from 9,700K b/d in the week ending August 28.

Looking ahead, US output may continue to recover following Hurricane Laura, and a further pick up in crude inventories may keep energy prices under pressure as OPEC’s most recent Monthly Oil Market Report (MOMR) shows a reduction in the global demand forecast, with “the downward revision is mainly to reflect weaker-than-expected data in 2Q20 in a few non-OECD countries, in addition to considering the recent adjustment to global GDP in 2020 from -3.7% in July to -4.0% in August.”

It remains to be seen if OPEC and its allies will take additional steps to prop up the price of oil as “the pace of recovery appeared to be slower than anticipated with growing risks of a prolonged wave of COVID-19,” but the group may merely reiterate the “ongoing positive contributions of the Declaration of Cooperation (DoC) in supporting a rebalancing of the global oil market” as the COVID-19 compensation mechanism expires.

With that said, more of the same at the September JMMC meeting may do little to influence the price of oil, and the rebound in US output along with signs of a protracted recovery may continue to drag on crude prices as global demand remains subdued.

--- Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong