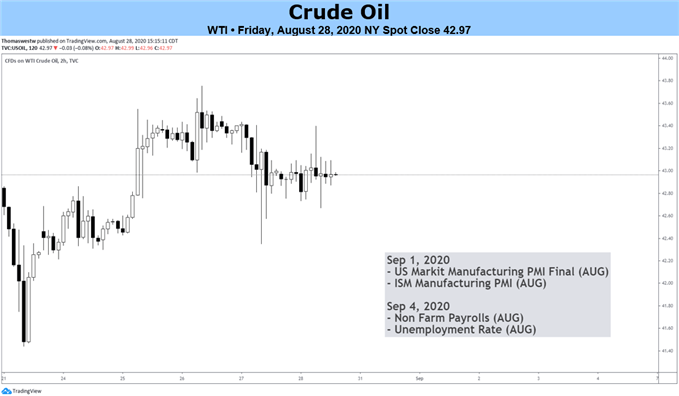

Chart created with TradingView

Oil Talking Points

The price of oil pulls back from a fresh monthly high ($43.78) even though US Crude Inventories contract for six consecutive weeks, and energy prices may continue to consolidate over the coming days as the Organization of the Petroleum Exporting Countries (OPEC) gradually rollback the voluntary production cuts in response to COVID-19.

Fundamental Forecast for Oil: Neutral

The price of oil may continue to retrace the decline from the March high ($48.66) as it breaks out of the range bound price action from earlier this month, with the developments coming out of the Joint Ministerial Monitoring Committee (JMMC) meeting doing little to detail the recovery in crude prices even though OPEC and its allies “observed that there are some signs of gradually improving market conditions, including the inventory build in July 2020 being reversed and the lessening of the gap between global oil demand and supply.”

It seems as though as OPEC and its allies will continue to coordinate throughout the remainder of the year as the press rerelease from the August JMMC meeting emphasizes the “ongoing positive contributions of the Declaration of Cooperation (DoC) in supporting a rebalancing of the global oil market,” but the expiration of the COVID-19 compensation mechanism may rattle the recovery in crude prices as companies like Lukoil, one of Russia’s largest oil producer, increased production in earlier August according to the company’s second quarter earnings report.

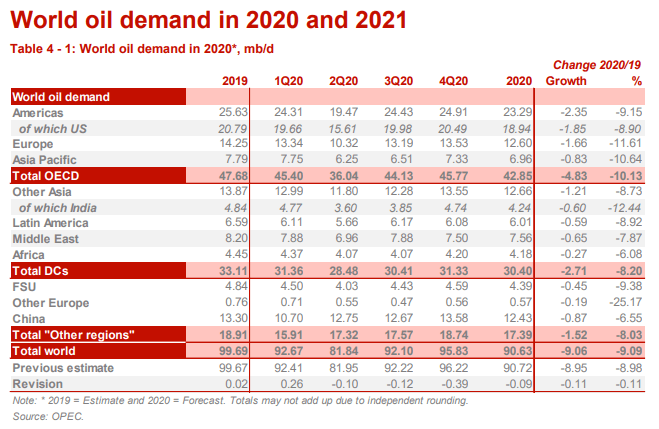

It remains to be seen if demand will continue to recover ahead of the next JMMC meeting scheduled for September 16-17 as OPEC’s most recent Monthly Oil Market Report (MOMR) states that “world oil demand in 2020 is estimated to decrease by 9.1 mb/d, adjusted lower by around 0.1 mb/d ascompared to last month’s assessment.”

The update goes onto say that “the downward revision is mainly to reflect weaker-than-expected data in 2Q20 in a few non-OECD countries, in addition to considering the recent adjustment to global GDP in 2020 from -3.7% in July to -4.0% in August.”

In turn, little signs of a V-shape recovery may produce headwinds for oil despite the ongoing contraction in US Crude Inventories as global production appears to have bottomed in August.

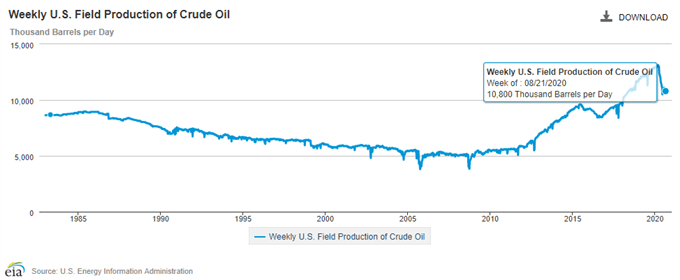

In fact, US stockpiles narrowed 4689K in the week ending August 21 after contracting 1632K the week prior, but the fresh figures coming out of the Energy Information Energy (EIA) showed production increasing for the first time since late-February, with weekly output climbing to 10,800K b/d from 10,700K b/d in the week ending August 14.

With that said, a further rebound in crude production may drag on the price of oil as signs of a protracted recovery dampens the outlook for global demand.

--- Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong