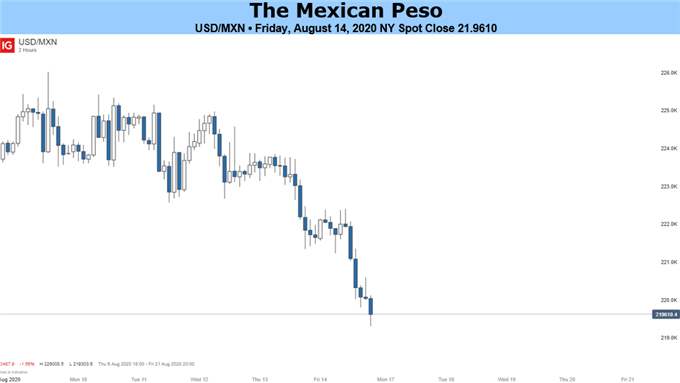

Source: IG Charts

Main USD/MXN Talking Points:

- The number of coronavirus cases in Mexico rises above 500,000

- Banxico cuts interest rates by 50 basis points to 4.5%

- USD/MXN breaks below downward support

Risk appetite is undoubtedly an important part of USD/MXN trading, and the past week has been no different. News about a possible Covid-19 vaccine produced by Russia broke early on in the week, helping the Mexican Peso recover some lost ground against the Dollar.

But many uncertainties remain, and renewed worries about the spread of the virus have caused risk assets to falter towards the end of the week, helped by the inability of US politicians to find a common ground when agreeing their highly anticipated stimulus package.

Mexico has crossed the 500.000 infection line as a further 7.371 cases were reported on Thursday, and new deaths rose by 627 to a total of 55.293. The country has been struggling to keep the virus under control and economic pressures are leading to an increase in violence and social unrest.

To help reactivate the economy, Banxico, Mexico’s central bank, has once again cut interest rates by 50 basis points, taking it from 5% to 4.5%, making this its sixth cut since the start of the year. In the second GDP contracted 18.9% on an annualized basis, which follows the 2.2 percent annual drop in the first three months of the year.

Banxico referred to this point in its meeting on Thursday, adding that some indicators pointed to a recovery in June, when the federal government began the phase of “new normality”. "A recovery was observed from low levels of activity, in response to the reopening of some sectors, the relaxation of restrictions on mobility and a certain recovery in external demand, although an environment of uncertainty remains. Because of this, greater easing may be needed as significant downside risks persist, "the institution said.

The reaction if FX markets was slightly muted, and after an initial uptick in USD/MXN once the rate decision was announced, the pair ended the week by dropping around 2%, a contrast to the previous week where after a rush to safety saw impulse buying from the July 31st lows.

The question now is whether the Mexican Peso will be able to maintain this relative strength. Fundamentals remain weak and risk-on assets have been enjoying some upside as the US Dollar faced problems of its own, but that is unlikely to last forever. Saying that, before the pandemic struck, USD/MXN was heading for yearly lows below 19 pesos per dollar, and the Peso didn’t have much going for it back then either, if anything, carry trade value was the one thing keeping flows coming towards Mexico, and even that seems to be diminishing as Banxico goes on a rate cutting spree.

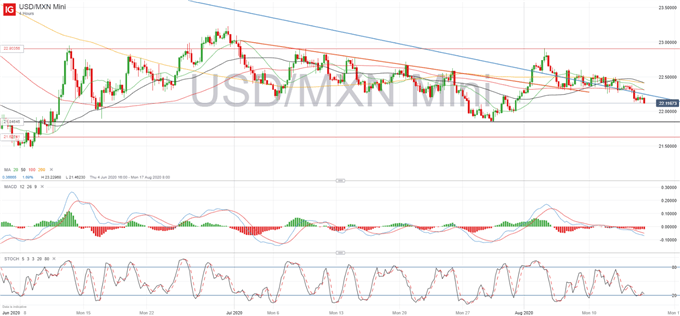

USD/MXN 4-hour chart (04 June – 14 August 2020)

From a technical standpoint, USD/MXN has managed to break below the downward trendline from the highs in March, which has been centred around the choppy price action in recent weeks. Daily resistance was located at 22.20 on Friday, and a successful break below that level meant a new attempt to break below 22. Target for bears remains at 21.84, although further downward pressure is likely to be limited, and a support emerges at 21.62.

On the upside, 22.28 could now be a new area of resistance as the pair tries to push above the downward trendline as 22.50 remains as a key target towards monthly highs at 22.91.

--- Written by Daniela Sabin Hathorn, Market Analyst

Follow Daniela on Twitter @HathornSabin