Source: IG Charts

Nasdaq 100, DAX 30, ASX 200 Price Outlooks:

- The Nasdaq 100 will look to capitalize on strong earnings from its most important members

- The DAX 30 suffered a breakdown last week but could look to ride the coattails of US indices

- Elsewhere, the ASX 200 will await an interest rate decision and monetary policy report from the RBA

Nasdaq 100 Forecast

Outlook: Bullish

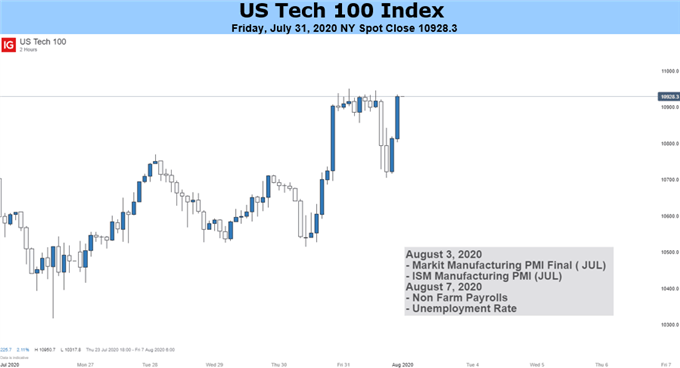

The Nasdaq 100 climbed higher last week as stellar earnings from big tech companies and an accommodative Federal Reserve worked to override abysmal GDP readings. Still, turbulent price action on Friday could suggest a continued surge in risk appetite following the positive quarterly results is far from certain. As the major Nasdaq 100 components have already reported, earnings season will begin to see its influence over tech sentiment wane which will leave the tech-heavy index grasping for the next influencer.

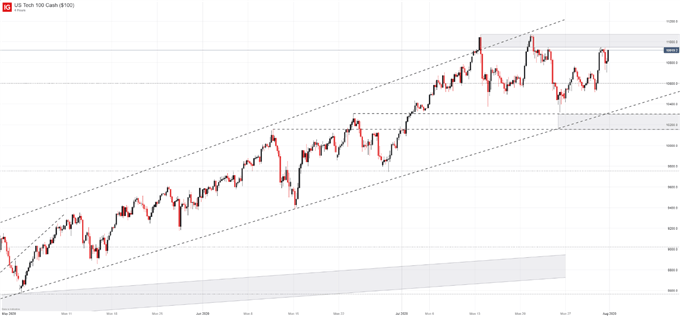

Source: DailyFX Economic Calendar

To that end, US unemployment figures slated for release on Friday could present the next major data point for the Nasdaq. Thus, the lack of scheduled event risk compared to the week prior may allow traders to establish a trend in price action after apprehension crept into the market last week. Further still, the remarkable results from the leaders of the covid recovery rally should help stoke risk appetite, so if bulls are looking to capture higher ground, they have ammunition and a relatively clear horizon.

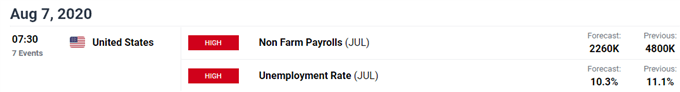

Nasdaq 100 Price Chart: 4 – Hour Time Frame (May 2020 – August 2020)

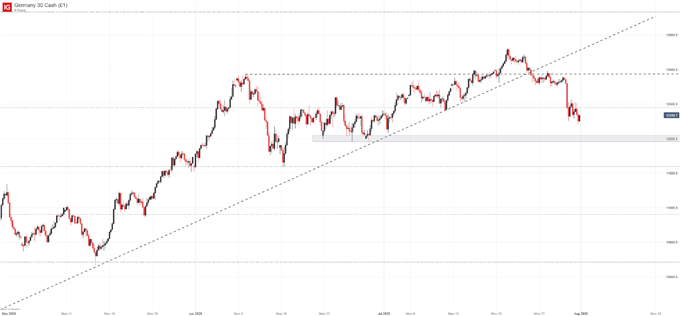

DAX 30 Forecast

Outlook: Neutral

Similarly, the DAX 30 has little to work with next week in regards to scheduled event risk. Therefore, the DAX may do as it has done for weeks – follow the lead of the US indices. That said, a bearish breakdown last week marked an infrequent divergence between the two markets and the catalyst for the DAX decline was not immediately obvious, so it is hard to rule out further turbulence for the German equity index.

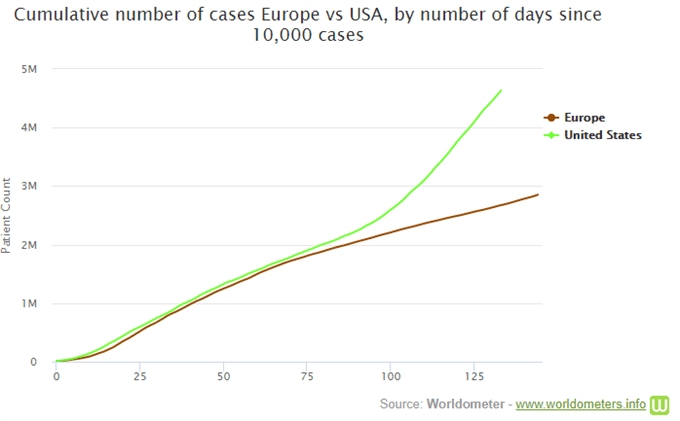

One consideration to be made for European equities is the possibility of a second coronavirus wave on the continent. While the United States remains embattled with the virus, Europe has displayed an ability to stem its spread somewhat and economic measures in the region have recovered more quickly as a result. However, a few European countries have shown a modest uptick in covid cases, prompting some regions to reinstate quarantine measures which could begin to erode economic activity once more.

DAX 30 Price Chart: 4 – Hour Time Frame (May 2020 – August 2020)

The New DAX Decade: The Past, Present and Future of the DAX 30

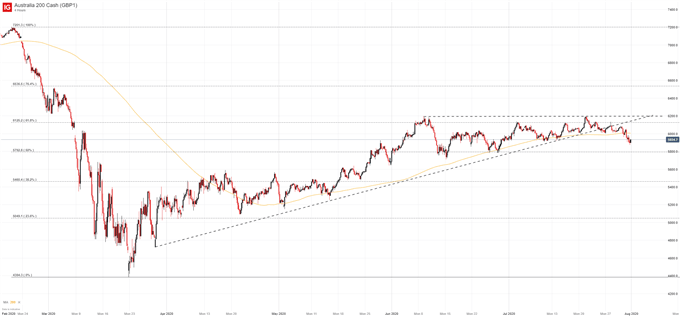

ASX 200 Forecast

Outlook: Neutral

In contrast to the Nasdaq and DAX 30, ASX 200 traders have a notable event on the calendar in the form of an interest rate decision from the RBA. Further still, the central bank will offer a subsequent report on monetary policy. Together, analysts and economists should enjoy greater insight into the country’s recovery outlook and, in turn, the status of the ASX 200 in relation to underlying economic conditions.

ASX 200 Price Chart: 4 – Hour Time Frame (February 2020 – August 2020)

If the central bank delivers an optimistic outlook while pledging further accommodation, the ASX 200 may look to reverse some of its recent losses. On the other hand, a dire projection could see recent declines continue in the week ahead. In the meantime, follow @PeterHanksFX on Twitter for updates and analysis.

--Written by Peter Hanks, Strategist for DailyFX.com