S&P 500, DAX 30, FTSE 100 Analysis and News

- S&P 500 | Escalation in US-China Tensions Raises Macro Shock Risk

- DAX | Investors More Bearish on Europe

- FTSE 100 |Brexit Deadlock

Source: DailyFX

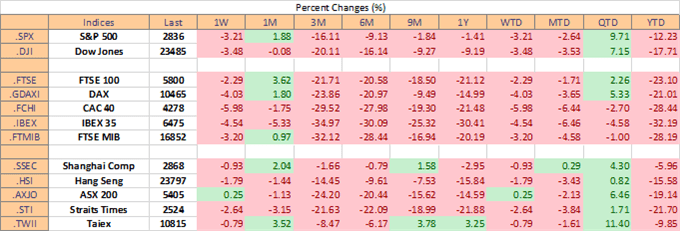

A weak performance across global equities despite several economies beginning to reopen. Concerns over a second wave of COVID-19 cases and rising US-China tensions continue to pressure risk sentiment will continue to drive sentiment with next week being no exception. Alongside this, on the economic data front, global PMIs will be the main focal points given its timeliness and likely to dampen expectations of a “V” shaped recovery.

Source: DailyFX

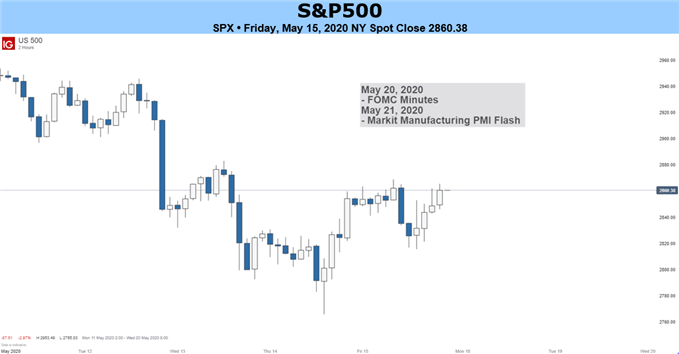

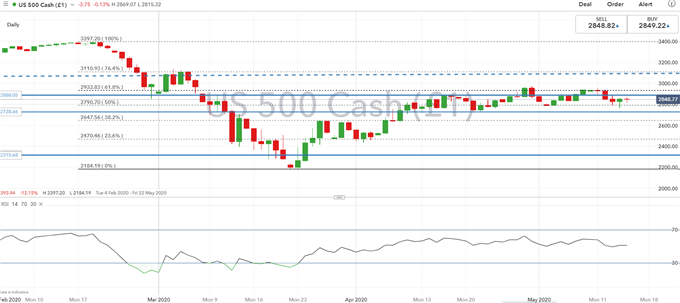

S&P 500 | Escalation in US-China Tensions Raises Macro Shock Risk

Following the latest actions by the US to block shipments of semiconductors to Huawei from global chipmakers, we continue to monitor developments that will likely guide price action for the S&P 500. As the US Presidential election gets underway, this will a theme that carries on for the long haul. Despite the soft performance in the S&P 500 the index has remained confined to its range with 2880-2930 capping upside, while dips are supported from 2730-2750. Given the weak economic backdrop, risks remain tilted to the downside.

| Change in | Longs | Shorts | OI |

| Daily | 1% | -1% | 0% |

| Weekly | 15% | -13% | -1% |

S&P 500 Price Chart: Daily Time Frame

Source: IG Charts

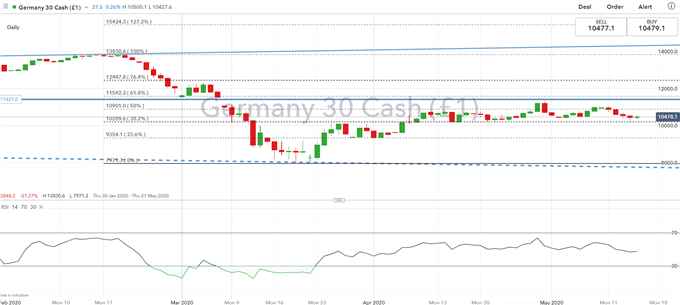

DAX | Investors More Bearish on Europe

Arguably, Eurozone PMIs may have seen the low point with the May readings expected to show a marginal uptick at best from April’s figures. Unlike its US counterparts, the DAX alongside other European indices has come under greater pressure suggesting that market participants are taking a greater bearish stance towards Europe. On the downside, 10,200 is the key level for the DAX, in which a break below opens the door to a move south of 10,000. On the upside, bounces in the DAX may well be capped at the 10,900 (50% Fibonacci retracement of coronavirus crash).

| Change in | Longs | Shorts | OI |

| Daily | -9% | 7% | 2% |

| Weekly | -27% | 9% | -5% |

DAX 30 Price Chart: Daily Time Frame

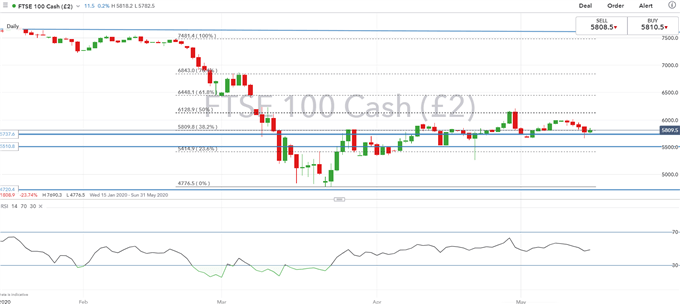

FTSE 100 |Brexit Deadlock

Another macro theme that is re-emerging is the showdown between the UK and EU as both parties look to agree on a trade deal. However, the third round of talks yielded very little progress with EU Chief Negotiator Barnier stating that the UK and EU’s trade stance is “extremely divergent”. With only one more round of talks in June (1st-5th) before the deadline of the transition period extension request (June 30th) the FTSE 100 looks set to come into the crossfires yet again.

| Change in | Longs | Shorts | OI |

| Daily | -30% | 25% | 2% |

| Weekly | -44% | 44% | 0% |

FTSE 100 Price Chart: Daily Time Frame

Source: IG Charts

RESOURCES FOR TRADERS

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

--- Written by Justin McQueen, Market Analyst

Follow Justin on Twitter @JMcQueenFX