Nasdaq 100, DAX 30, CAC 40 Forecasts:

- After suffering early last week, the Nasdaq 100 is back within reach of record highs

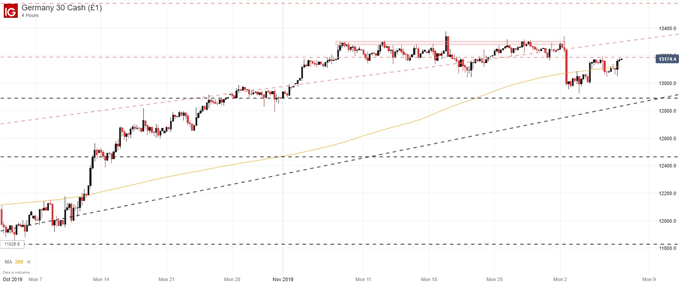

- The DAX 30 will likely follow the lead of US stocks unless the ECB surprises on policy

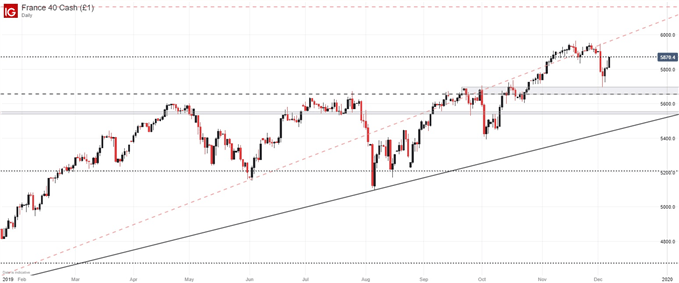

- Meanwhile, the CAC 40 will have to negotiate the impact of widespread protests in France

Nasdaq 100 Fundamental Forecast

The Nasdaq 100 brushed off trade concerns last week as robust employment data and strong consumer confidence helped to drive the tech-heavy index back near record levels. While the data helped to ward off concerns last week, time ahead of the December 15 tariff deadline in the US-China trade war continues to wind down. With recent remarks from various Trump administration officials suggesting the tariffs will go into effect, and a trade deal may have to wait until after the 2020 US election, the Nasdaq 100 is in a precarious position – and last week may have offered an early glimpse at the consequences if the deadline is not pushed back.

Nasdaq 100 Price Chart: Daily Time Frame (June 2019 – November 2019) (Chart 1)

To be sure, all-time highs are an encouraging sign, but they do not insulate the index from risk aversion should investors be faced with a deterioration in the fundamental landscape. Such an opportunity is present next week on December 11 when the WTO’s appeal panel will cease to function and on December 15 when the Trump administration is scheduled to hike tariffs on China.

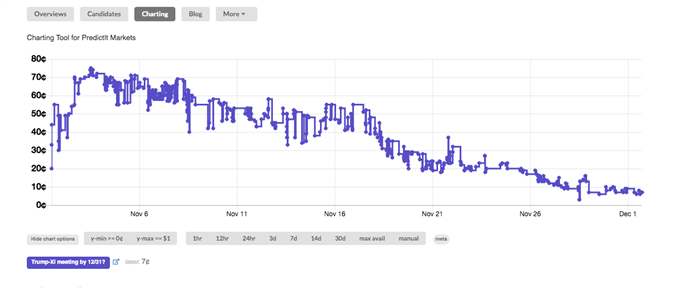

Odds President Trump and President Xi meet to discuss trade before December 31 according to PredictIt

In the lead up, officials from both sides should offer plenty of commentary – as they have in the past – on how talks are progressing. The tone of the remarks will likely dictate how the Nasdaq, Dow Jones and S&P 500 trade next week in conjunction with the Federal Reserve’s December rate decision.

DAX 30 & CAC 40 Fundamental Forecast

The DAX 30 will look to a central bank decision of its own next week, in an event that will likely stir volatility in all European equities. Trade headlines and the tone of the Federal Reserve will also play a role in the outlooks of both the DAX 30 and CAC 40. Finally, the French index will have to negotiate ongoing protests throughout France – a theme that could see it underperform its peers while the unrest continues.

DAX 30 Price Chart: 4 - Hour Time Frame (October – December) (Chart 2)

CAC 40 Price Chart: Daily Time Frame (February 2019 – December 2019) (Chart 3)

--Written by Peter Hanks, Junior Analyst for DailyFX.com

Read more: Stock Market Crashes: Current Climate Compared to Prior Conditions