Talking Points:

- US Dollar Shows Strength Ahead of ECB, BoJ Rate Decisions.

- JPY in the Spotlight: Yen Weakness Shows Ahead of Japanese Inflation.

- Trading USD Pairs? Our IG Client Sentiment follows traders’ positioning on key Dollar-pairs like EUR/USD, GBP/USD and USD/JPY.

Fundamental Forecast for JPY: Bearish

The Quarterly Forecast for the US Dollar has just been released for Q2, Click here for full access to the DailyFX Q2 Forecasts.

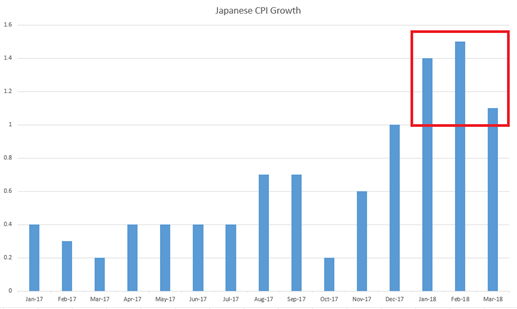

This week saw a continuation of Yen-weakness as the currency continues to step back from the ledge of risk aversion. The first quarter of this year saw considerable Yen-strength, and this was driven by a couple of factors. Global risk aversion began to heat up in February, and this certainly helped to drive Yen-strength as safe-haven flows sought out more secure harbors. But also of issue was a continued rise in Japanese inflation, as December produced a 33-month high, followed by a 34-month high in January and another increase in February. By the time we got February inflation data, Japan was seeing price growth faster than what we were seeing in Europe, bringing with it the very requisite question as to when the BoJ might look to start planning their exit from stimulus.

At the bank’s March rate decision, the BoJ continued to strike a dovish tone. BoJ Governor, Haruhiko Kuroda, also openly voiced concern about a strong Yen negatively impacting the Japanese economy, in both consumption and capital expenditures. And earlier this week, we got a piece of data that may help to support those dovish drives as Japanese inflation receded back towards one-percent after the rather aggressive jump from the prior two months.

Japanese Inflation Calms in March After Aggressive Jumps in January, February

Chart prepared by James Stanley

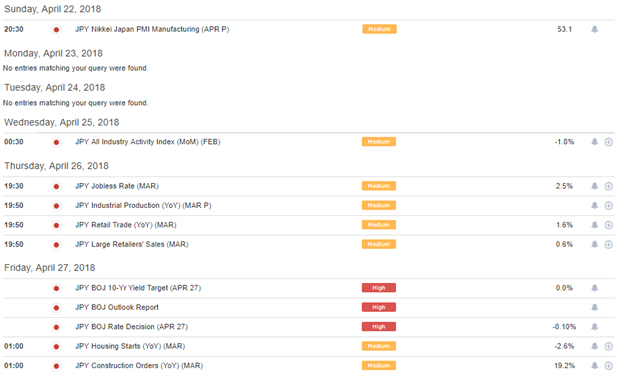

Next Week’s Economic Calendar

Next week’s economic calendar has a number of pertinent items for the Japanese Yen, with the highlight loaded in the latter-portion of the week for the Bank of Japan’s April rate decision. As has become usual, there are few expectations for any actual moves from the bank; but the bigger question will be just how unnerved the BoJ might be from that earlier-year inflation spike; and whether the pullback in March has the potential to keep inflation rates pegged closer to one-percent, allowing the BoJ the flexibility to continue with their ‘yield curve control’ QE program without having to start looking for the exit.

Bank of Japan April Rate Decision Highlights Next Week’s Calendar

Chart prepared by James Stanley

Potential for a Continuation of Yen-Weakness

As we move into next week, the big question is whether we might see the further return of a trend that’s been relevant for almost six years now. With the re-election of Shinzo Abe was the introduction of Abenomics; and this created a backdrop of Yen weakness that remains as relevant. To this day, the Bank of Japan remains fully engaged in QE with no signs of slowing or stopping, and that’s what we’ll be looking for clues around at next week’s BoJ rate decision.

With inflation settling after the spike seen earlier in the year, the backdrop may be a bit more accommodating for Mr. Kuroda’s dovishness, and this could help to continue the trend of Yen weakness as we move deeper into Q2.

The fundamental forecast for the Japanese Yen will be set to bearish for next week.

USD/JPY Four-Hour Chart: Yen-Strength in Q1 Reverses and Recedes in Q2

Chart prepared by James Stanley

To read more:

Are you looking for longer-term analysis? Our DailyFX Forecasts for Q1 have a section for each major currency, and we also offer a plethora of resources on USD-pairs such as EUR/USD, GBP/USD, USD/JPY, AUD/USD. Traders can also stay up with near-term positioning via our IG Client Sentiment Indicator.

--- Written by James Stanley, Strategist for DailyFX.com

To receive James Stanley’s analysis directly via email, please SIGN UP HERE

Contact and follow James on Twitter: @JStanleyFX