Sterling/GBP Talking Points:

- UK inflation data may derail the current Sterling rally in the short-term.

- GBP rally continues against the weak US dollar but the EUR remains the strongest currency.

Fundamental Forecast for GBP: Bullish

We remain buyers of GBP going into the third week of January but caution that the current move may hit resistance if UK inflation remains above target. Headline UK inflation in November hit 3.1% - while core printed at 2.7% - above the Bank of England’s remit of around or close to 2%. December’s numbers are expected to tick down to 3.0% and 2.6% respectively, not enough for BoE governor Mark Carney to break open the champagne, but perhaps recognition that finally the recent strength of GBP has worked its way through the system and imported inflation has peaked. An unchanged figure would make any monetary tightening or guidance harder to justify, especially with UK growth still below par.

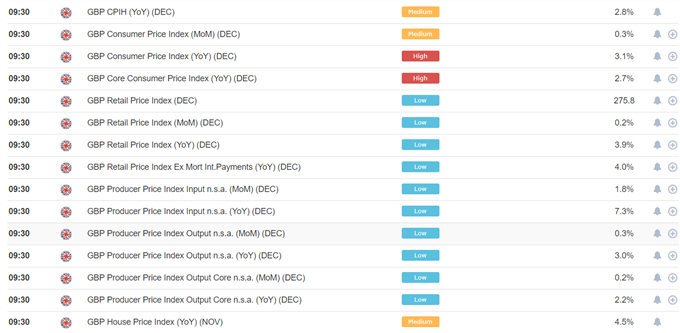

UK Economic Data Releases on Tuesday, January 16, 2018.

I will be taking a more in-depth look at the upcoming UK data releases at 11:30 GMT on Monday, January 15, 2018.

The British Pound remains strong against an admittedly weak US dollar and has pushed back up above 1.3600 and back towards levels last seen on Brexit day in 2016. Sterling has taken the recent, messy, UK cabinet re-shuffle in its stride while Brexit talk is, for the moment, no longer such a political risk as it was seen to be last year.

The pair have been aided by fears that the US dollar may not get the Trump tax plan uplift that investors first thought and that with US inflation still below target, the expected three US interest rate hikes in 2018 may be pushed back along the calendar.

GBP/USD Price Chart Daily Timeframe (March 30, 2017 – January 12, 2018)

--- Written by Nick Cawley, Analyst

To contact Nick, email him at nicholas.cawley@ig.com

Follow Nick on Twitter @nickcawley1