Gold Fundamental Outlook: Neutral

- Gold price upside momentum lackluster since mid-April

- The story remains between USD, government bond yields

- Focus next on FOMC minutes, Powell and balance sheet

Gold prices spent most of this past week trading cautiously higher, but on the whole the precious metal has been struggling to make significant upside progress since the middle of April. Risk aversion seemed to play a key fundamental roll over the past 5 trading sessions and may likely continue doing so ahead. A source of anxiety this past week was Fed Chair Jerome Powell pouring cold water on negative rate expectations.

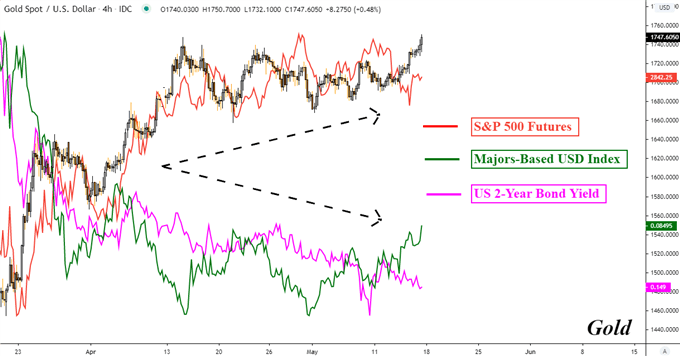

That pushed the S&P 500 lower as 2-year government bond yields struggled to find much upside progress. This likely continues to reflect prolonged economic uncertainty that may keep the Federal Reserve holding still on current zero-interest-rate settings. The anti-fiat yellow metal understandably found some support. Having no inherent yield, gold can struggle in an environment where interest rates rise and vice versa.

But also, strength in the haven-linked US Dollar may have worked against gold’s favor, depriving bullion from its full potential as an anti-fiat asset. Taking this into account, it seems reasonable why the yellow metal has been rising since March – see chart below. As central banks slashed benchmark lending rates across the world, gold found itself in a rather relatively attractive environment. But will this continue?

Discover your trading personality to help find forms of analyzing financial markets

A downside risk for gold in the immediate sense could be a surge in market volatility whereby investors prioritize preserving capital. In that scenario, the US Dollar could stand to benefit relative to the yellow metal. FOMC minutes and a speech from Fed Chair Jerome Powell are due ahead. Lately, central bankers have been increasingly warning about the long term threat to growth, undermining quick recovery bets.

Meanwhile there have been rising concerns over US-China trade relationships as tensions simmer. At the same time, the Fed has undertaken extraordinary measures to lubricate capital markets. Last week, its balance sheet grew the most in over 3 weeks as it launched historic efforts to buy corporate debt. But also, the same vigor seen from the central bank at the onset of the crisis in open market operations has been fading.

In the long run, depressed yields across the globe can work in gold’s favor and that may keep prices elevated despite near term noise. With that in mind, it’s a neutral call for the weekly gold fundamental outlook.

Gold Fundamental Drivers – (4-Hour Chart)

Gold Chart Created in TradingView

--- Written by Daniel Dubrovsky, Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter