S&P 500, Jerome Powell, Fed, US Dollar, Japanese Yen – Asia Pacific Market Open

- S&P 500 dropped as Fed Chair Powell struck down negative rate bets

- US Dollar and Japanese Yen rose, New Zealand Dollar depreciated

- Asia stocks may fall, weakening the Australian Dollar. AU jobs eyed

S&P 500 Drops as Fed Chair Powell Cools Negative Rate Bets, US Dollar and Yen Gain

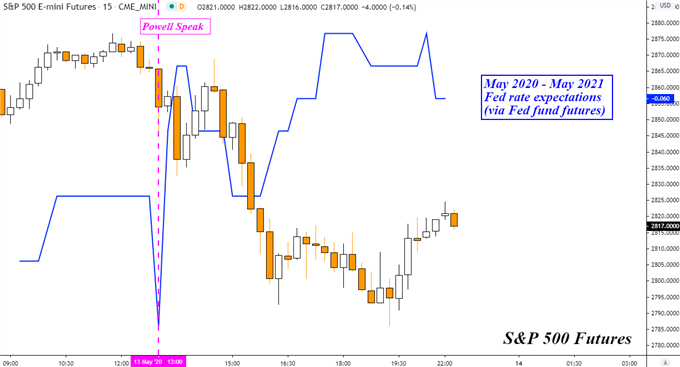

The S&P 500 could be increasingly approaching a tipping point after Fed Chair Jerome Powell struck down negative rate expectations. On the chart below, Fed Funds Futures can be seen slowly pricing out negative rates one year out as Mr Powell spoke. Simultaneously, risk aversion began picking up pace. As the North American session wrapped up, the S&P 500 and Dow Jones closed -1.75% and -2.17% lower respectively.

The Chair of the central bank from the world’s largest economy also offered sobering comments about growth. He mentioned that the virus raises concerns of long-term economic harm and that the outlook is ‘highly uncertain’. His commentary has been echoing what heads of central banks from other major economies have been saying, in particular from the Bank of Japan and Reserve Bank of New Zealand (RBNZ).

The haven-linked US Dollar and similarly-behaving Japanese Yen were the best-performing major currencies on Wednesday. This is as the growth-oriented Australian Dollar trimmed gains from the European session. The worst-performing major currency was the New Zealand Dollar, which was crushed as the RBNZ expanded quantitative easing and unlike the Fed, left the door open to negative rates.

Jerome Powell Cools Dovish Expectations as S&P 500 Sinks

Thursday’s Asia Pacific Trading Session

Asia Pacific stocks may follow Wall Street lower Thursday. Risk aversion may bode ill for the Australian Dollar which is awaiting local employment data. Australia may lose 575k jobs in April as unemployment ticks up to 8.2% from 5.2%. A worse-than-expected outcome may push AUD/USD lower. Down the road, the Aussie may stay tuned on broader market sentiment as the RBA stands put on monetary policy.

S&P 500 Technical Analysis

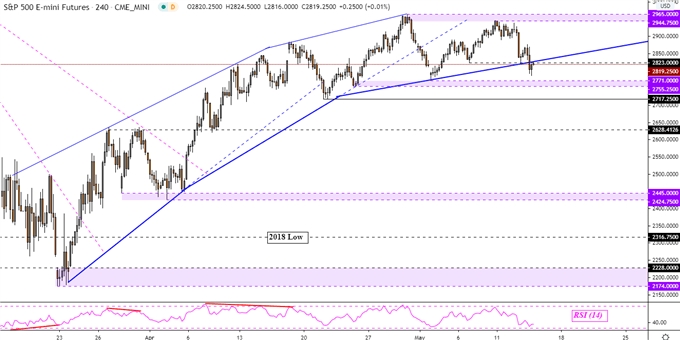

S&P 500 futures, on the 4-hour chart below, appear to be attempting to break under rising support from late April. The slope of appreciation in US equities has on the whole been fading as of late. Still, key support stands further below at 2755 – 2771. That may pause declines in the index and perhaps translate into a bounce. Otherwise, descending further may open the door to a broader reversal.

| Change in | Longs | Shorts | OI |

| Daily | 1% | -1% | 0% |

| Weekly | 15% | -13% | -1% |

S&P 500 Futures – 4-Hour Chart

--- Written by Daniel Dubrovsky, Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter