Fundamental Forecast for Gold: Bullish

- Gold defends monthly open support post-NFP; near-term outlook constructive

- What’s driving gold prices? Review DailyFX’s 2018 Gold Projections

- Join Michael for Live Weekly Strategy Webinars on Mondays at 12:30GMT to discuss this setup and more!

Gold prices are poised to close the week fractionally high with the precious metal trading at 1323 ahead of the New York close on Friday. It’s been a volatile week for bullion but the precious metal continues to hold a well-defined range after turning sharply from key support last week and prices are struggling to hold on to the early March gains.

A strong jobs report on Friday offered some support to gold prices with U.S. Non-Farm Payrolls (NFP) topping expectations with a print of 313K for the month of February. A strong read on labor force participation also highlighted underlying strength in the employment sector with a print of 63% (highest since September). Despite the job gains however, wage growth remained sluggish a downward revision to last month’s average hourly earnings accompanied by a miss in February at just 2.6% y/y (previously 2.8% y/y). The release is unlikely to alter the Federal Reserve’s expectations for three rate-hikes this year with gold finding solace into the close of the week.

Review Michael’s educational series on the Foundations of Technical Analysis: Building a Trading Strategy

Last week we noted that, “the technical levels remain clear with this week’s low marking a precise 100% extension off the highs - so is a low in place?” Gold prices have preserved this low with near-term price action pointing to a more constructive outlook next week. All eyes will be on the U.S. Consumer Price Index (CPI) report on Tuesday for an updated assessment on inflation outlook.

New to Trading? Get started with this Free Beginners Guide

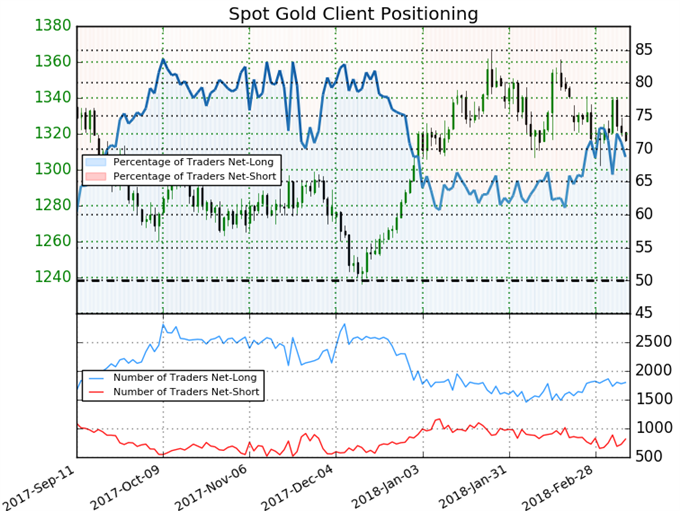

- A summary of IG Client Sentiment shows traders are net-long Gold - the ratio stands at +2.2 (68.8% of traders are long)- bearishreading

- Long positions are 1.8% lower than yesterday and 5.8% lower from last week

- Short positions are4.9% higher than yesterday and 14.6% higher from last week

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests Spot Gold prices may continue to fall. Yet traders are less net-long than yesterday and compared with last week. Recent changes in sentiment warn that the current Spot Gold price trend may soon reverse higher despite the fact traders remain net-long.

See how shifts in Gold retail positioning are impacting trend- Read more about how to impliment Sentiment in your trading!

Gold Daily

Price Chart

Failure to close below the March 1st low-day close at 1316 this week would keep the rebound play viable next week. Initial resistance now at 1325 backed by 1339 with a breach above the 2016 high-day close at 1355 needed to mark resumption of the broader uptrend. Key confluence support & bullish invalidation steady at 1301/02 where the 100-day moving average, 100% extension and 50% retracement converge on a pair of slope lines.

What are the traits of a Successful Trader? Find out with our Free eBook !

Gold 120min Price Chart

A closer look at gold sees prices trading within the confines of a proposed modified pitchfork formation extending off the monthly lows. It may be a bit too early to rely on this slope but it does further highlight near-term support at 1316/17 where the low-day close converges on a basic 61.8% retracement of the advance.

Bottom line: IF prices are heading higher, support into this level should hold. A breach above the median-line shifts the focus back towards the 1339 target and the upper parallel / 2017 high-day close at 1346.

---Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michaelon Twitter @MBForex contact him at mboutros@dailyfx.com or Subscribe to his email distribution list.