Fundamental Forecast for Gold: Neutral

- Gold prices set monthly opening-range just below structural resistance

- What’s driving gold prices? Review DailyFX’s 2018 Gold Projections

- Join Michael for Live Weekly Strategy Webinars on Mondays at 12:30GMT to discuss this setup

Gold prices are attempting to close out a fifth consecutive week of gains with the precious metal up nearly 0.4% to trade at 1324 heading into the New York open on Friday. The advance comes alongside continued strength in U.S. equity markets and crude prices and although further gains are likely, the immediate advance in gold looks vulnerable heading into next week.

It’s another quiet week for data with the release of the Federal Reserve’s Beige Book and the University of Michigan confidence surveys highlighting the economic docket. Keep in mind it’s a shortened holiday week with U.S equity and bond markets close on Monday in observance of Martin Luther King Jr. Day.

The focus for gold is on the technical picture with the +7% advance off the December low now eyeing key technical resistance. Interestingly enough, a similar setup exists in oil prices and if the current interpretation is correct, we’ll be looking for a possible exhaustion trade early in the session.

New to Trading? Get started with this Free Beginners Guide

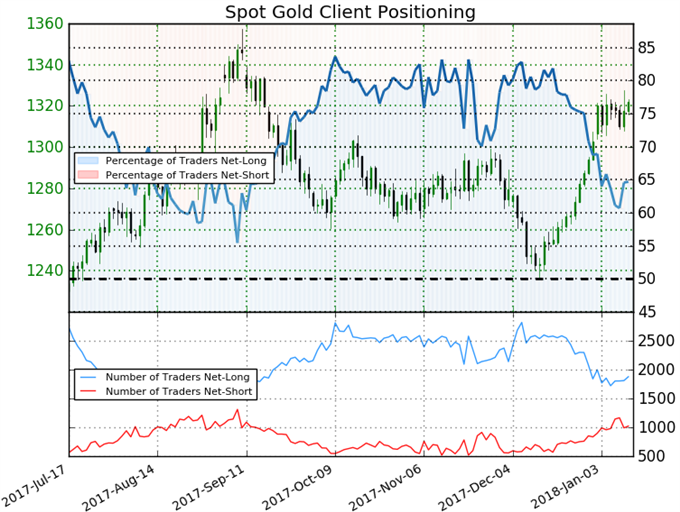

- A summary of IG Client Sentiment shows traders are net-long Gold - the ratio stands at +1.83 (64.7% of traders are long)- bearishreading

- Long positions are 0.7% lower than yesterday and 2.9% lower from last week

- Short positions are 1.4% higher than yesterday and 4.8% lower from last week

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests Spot Gold prices may continue to fall. Positioning is less net-long than yesterday but more net-long from last week. The combination of current sentiment and recent changes gives us a further mixed Spot Gold trading bias.

Review Michael’s educational series on the Foundations of Technical Analysis

Gold Daily

Gold prices broke above basic trendline resistance late-last month with the advance now targeting confluence resistance at 1329/30- this region is defined by the 76.4% retracement of the 2017 decline and the upper median-line parallel of the broader ascending pitchfork formation (blue) extending off the October low. Interim support rests at the 50-line which converges on the 61.8% retracement into the start of the week at 1311.

What are the traits of a Successful Trader? Find out with our Free eBook !

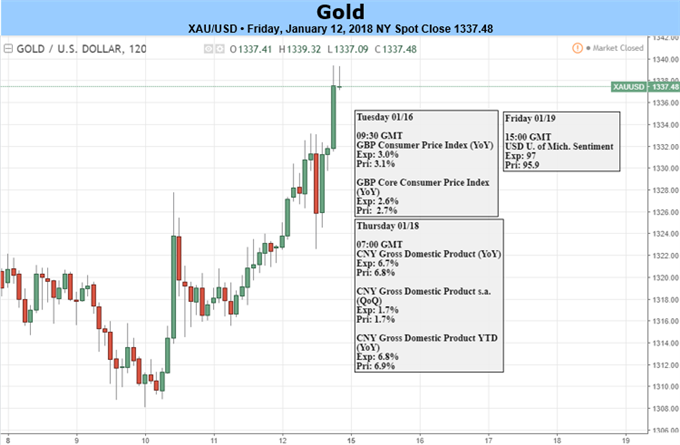

Gold 240min

A closer look at near-term price action sees gold carving the monthly opening-range just below the aforementioned resistance zone with basic trendline support extending off the December lows highlighting near-term support just above 1300. A break below this threshold would risk a larger set-back in prices before resumption with such a scenario targeting 1295 backed by the 100-day moving average / median-line at 1289. That said, price is simply testing up-trend resistance.

Bottom line: The broader focus remains higher but from a trading standpoint, the immediate advance remains vulnerable while below structural resistance. IF the monthly opening range breaks lower, look for larger set-back to offer more favorable long entries, with a breach of the highs targeting subsequent resistance objectives at the 2017 & 2016 high-day closes at 1346 and 1355 respectively.

---Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michaelon Twitter @MBForex contact him at mboutros@dailyfx.com or Click Here to be added to his email distribution list.