To receive Michael’s analysis directly via email, please SIGN UP HERE

- Crude price rally vulnerable below near-term resistance confluence at 64.78

- Check out our New Crude Oil quarterly projections in our Free DailyFX Trading Forecasts

- Join Michael for Live Weekly Strategy Webinars on Mondays at 12:30GMT

Crude Oil Weekly Chart

Technical Outlook: Last month we highlighted that a multi-month consolidation break was imminent in crude prices with a topside breach favored. Oil broke out into the close of the year with the advance now eyeing near-term confluence resistance at 64.78- this level is defined by the 100% extension of the 2016 advance and converges on the median-line of the ascending pitchfork formation we’ve been tracking for months now.

New to Forex Trading? Get started with this Free Beginners Guide

Crude Oil Daily Chart

The daily chart further highlights this region with near-term embedded ascending channel resistance also converging on the threhshold. Note that daily & weekly momentum remain in overbought territory and we’ll be looking for the break back below 70 to suggest a near-term correction is underway. A topside breach above this mark keeps the long-bias in play with such a scenario targeting the 2010 low at 67.17 backed by the 50% retracement at 70.41.

Why does the average trader lose? Avoid these Mistakes in your trading

Crude Oil 240min Chart

Notes: Interim support rests at 63.23 (the measured consolidation target) with a break below the 2015 highs at 62.56 / trendline support needed to shift the medium-term focus lower. Bottom line: The immediate advance is at risk while below 64.78 but the broader focus remains constructive while above 59.12(bullish invalidation). From a trading standpoint we’re on the lookout for a pullback to ultimately offer more favorable long-entries while within the confines of the broader bullish formation.

For a complete breakdown of Michael’s trading strategy, review his Foundations of Technical Analysis mini-series

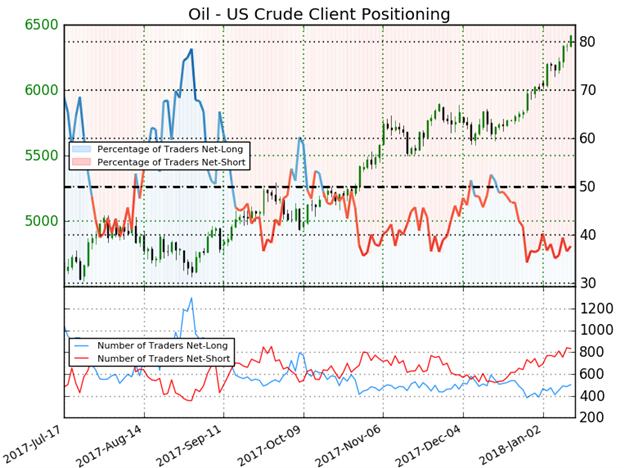

- A summary of IG Client Sentiment shows traders are net-short Crude Oil- the ratio stands at -1.66 (37.6% of traders are long) – bullishreading

- Retail has remained net-short since Dec 19; price has moved 12.3% higher since then

- Long positions are 0.8% higher than yesterday and 7.0% higher from last week

- Short positions are 0.4% lower than yesterday and 6.9% higher from last week

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests Oil - US Crude prices may continue to rise. Yet traders are less net-short than yesterday and compared with last week. Recent changes in sentiment warn that the current Oil - US Crude price trend may soon reverse lower despite the fact traders remain net-short.

See how shifts in Crude retail positioning are impacting trend- Click here to learn more about sentiment!

---

Other Setups in Play

- GBP/USD Monthly Range-Break Appears Imminent

- AUD/USD Price Rally Vulnerable- Pullback to Offer Opportunity

- Weekly Technical Outlook- USD Crosses Grind into 2018 Open

- Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michael on Twitter @MBForex or contact him at mboutros@dailyfx.com