Fundamental Forecast for Gold:Bearish

- Gold Rebounds from Previous Congestion Zone

- Crude Oil, Gold Prices Look to European PMI Data for Direction

- Subscribe to SB Trade Desk For More Gold Updates/Analysis Throughout the Week

Gold prices are weaker for a second consecutive week with the precious metal off by more than 1% ahead of the New York close on Friday. The losses come alongside a quiet week off economic data with equity markets on a slow grind higher into the close of the week. The outlook for gold remains broadly unchanged and heading into next week, a near-term recovery may offer another opportunity to take prices lower.

All eyes will once again fall on the FOMC next week with the central bank interest rate decision slated for Wednesday. Fed Fund Futures are showing the first material expectation (>50%) for a rate hike to be in March 2017 and although no change is anticipated tomorrow, traders will be looking for any changes to the policy statement / vote count that could suggest the committee may look to hike rates at the next quarterly monetary policy meeting on September 21st. Expectations for higher interest rates will tend to weigh on gold which does not pay a dividend, and with markets more-or-less on a steady footing, the near-term outlook for bullion prices remains vulnerable.

In addition to FOMC, the advanced read on U.S. 2Q GDP on Friday may spur added volatility in gold prices. Consensus estimates are calling for an annualized print of 2.6% q/q, up from just 1.1% q/q with personal consumption expected come in at 4.1%, up from 1.5%. We’ll want to keep a close eye on the core personal consumption expenditure (PCE) -which is the Fed’s preferred gauge on inflation- with estimates calling for a 0.3% decline to 1.7% q/q. With inflation continuing to be the laggard of the Fed’s dual mandate, a weaker-than-expected read could put a near-term floor under gold prices as interest rate expectations are pushed out further.

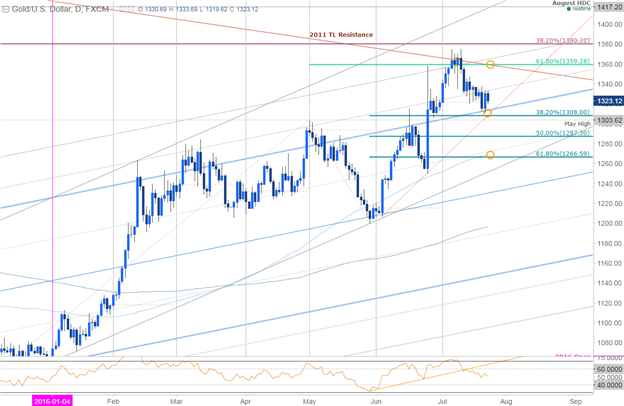

Gold Daily

From a technical standpoint, our outlook for gold remains unchanged from last week. Key near-term confluence support extends into 1303/08 with the immediate short-bias at risk heading into this zone. With that said, the region could prompt a near-term recovery- look for initial resistance at 1337 backed by our bearish invalidation level at 1359 (both areas of interest for possible exhaustion / short-entries).

A break below confluence support targets subsequent downside targets at 1287 & confluence support into 12665/70. We would be looking for long-triggers on a move into this region. Ahead of next week’s Bank of Japan (BOJ) interest rate decision, it’s worth noting that the Yen (inverse of USD/JPY) vs. gold correlation is at its strongest 20-day rolling correlation since 2008 at 0.82. With that in mind, keep an eye out for USDJPY support around 104.16/59.Continue to track this trade throughout the week on SB Trade Desk.

Looking longer-term?

Click here to review DailyFX’s 3Q Gold Projections

---Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michael on Twitter @MBForex contact him at mboutros@dailyfx.com or Click Here to be added to his email distribution list

Join Michael for Live Scalping Webinars on Mondays on DailyFX and Tuesday, Wednesday & Thursday’s on SB Trade Desk at 12:30 GMT (8:30ET)