Australian Dollar Fundamental Forecast: Bearish

- Australian Dollar set new lows against the US Dollar last week

- Omicron Covid-19 variant poses a risk if strict lockdowns ensue

- Focus shifts to the Reserve Bank of Australia, 2022 guidance

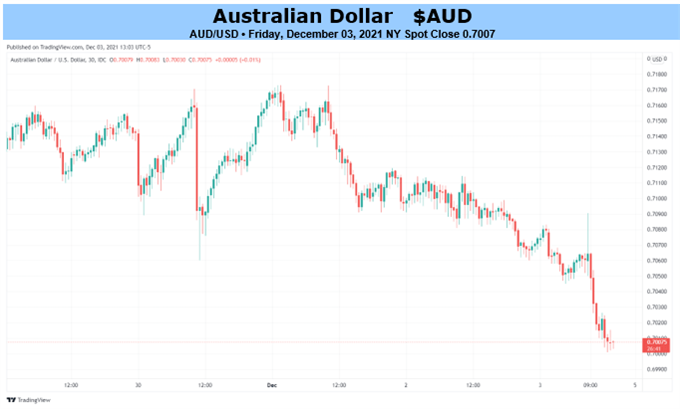

The Australian Dollar continued to set new lows against the US Dollar this year, falling the most over 2 weeks since June, closing at the lowest since July 2020. The risk-sensitive currency was battered by the emerging Omicron Covid-19 variant, which could weaken global growth prospects. This is as the Federal Reserve delivered a fairly hawkish pivot this past week, removing the word ‘transitory’ from describing inflation.

Australia’s economy finds itself at the front-end of the global supply chain, making following developments around Omicron important. Lockdowns risk denting local growth. While the nation’s first few cases of the new variant have already been found, Chief Medical Officer Paul Kelly noted that there is no indication that it is more deadly than other strains.

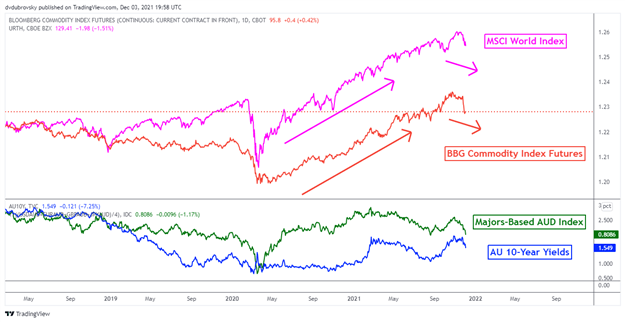

Still, AUD has been tracking a decline in commodity prices alongside a dip in global equities – see chart below. Iron ore, the nation’s key export, remains over 55% lower from peaks earlier this year. This leaves the commodity around levels before Covid. Meanwhile, the economy is rebounding from lockdowns earlier this year triggered by the Delta Covid-19 variant.

Domestically, the Aussie will be keeping a close eye on the Reserve Bank of Australia rate decision. This follows the central bank abandoning yield curve control as the RBA continues tapering bond purchases. But, Governor Philip Lowe has been reiterating that data and forecasts do not warrant a rate hike in 2022. This is contrary to what the markets are pricing in.

Taking a look at forward curves from Bloomberg, markets are seeing rates one year out around 0.9% versus 0.1% today. This may actually open the door to disappointment if the central bank continues to reiterate that policy tightening in 2022 is unlikely. Meanwhile, another strong CPI report from the United States in the week ahead may benefit the US Dollar at the expense of its major counterparts.

Australian Dollar Vs. MSCI World Index, BBG Commodity Index Futures and AU Bond Yields

Chart Created Using TradingView

*Majors-based AUD index averages AUD against USD, EUR, GBP and JPY

--- Written by Daniel Dubrovsky, Strategist for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter

Trade Smarter - Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team