AUSTRALIAN DOLLAR FORECAST – AUD PRICE ACTION EYES SUBDUED VOLATILITY DESPITE EXTENDED VIRUS LOCKDOWNS; RBA MINUTES ON DECK

- The AUD likely stands to be strong-armed by broader market sentiment

- Australian Dollar could keep marching higher if the absence of volatility is sustained

- RBA minutes, impact of coronavirus lockdown measures might undermine the Aussie

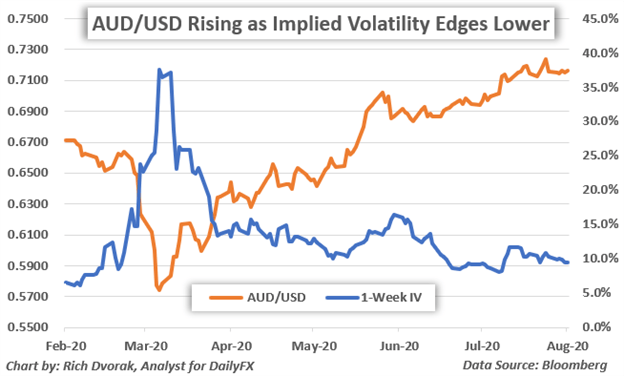

The Australian Dollar has notched an astounding rally against its US Dollar peer since AUD/USD price action bottomed in March amid peak coronavirus panic. Alongside improving risk appetite, as well as a notable retracement lower in currency volatility, Aussie bulls have steered the sentiment-linked AUD/USD broadly higher. Indicated by one-week AUD/USD implied volatility readings, volatility is expected to subside further, which could help keep the Australian Dollar in demand barring no unexpected bearish developments unfold.

| Change in | Longs | Shorts | OI |

| Daily | 2% | 3% | 2% |

| Weekly | 29% | -46% | 0% |

AUD/USD PRICE CHART: DAILY TIME FRAME (14 FEBRUARY TO 14 AUGUST 2020)

Chart created by @RichDvorakFX

That said, the Australian Dollar has lost upward momentum more recently. This appears to correspond with extended coronavirus lockdown measures put into effect across major regions of Australia and follows an initial upbeat reaction to the RBA meeting. Melbourne, for example, was placed under a stage-four lockdown for six weeks while a stage-three lockdown was announced for broader Victoria.

The Australian economy and AUD price action likely stands to face headwinds in turn – particularly seeing that there is evidence that the rebound in economic activity has already showed signs of stalling. Not to mention, as detailed in the latest RBA meeting press statement, the shape of the economic recovery is “dependent upon containment of the virus.”

RBA MEETING MINUTES MIGHT UNDERSCORE PROLONGED NEED FOR ACCOMMODATIVE POLICY

Check out the DailyFX Economic Calendar for more upcoming data releases and scheduled event risk

RBA meeting minutes are scheduled for release this coming Tuesday, August 18 at 01:30 GMT. The RBA minutes might underscore how fiscal stimulus and accommodative monetary policy measures “will be required for some time given the outlook for the economy and the labour market.” Contrasted against the backdrop of a potential second wave and freshly-enforced lockdown measures, it is possible that the Australian economy and employment situation, in addition to AUD price action, could weaken.

Also worth mentioning, the RBA outlined how the central bank planned to resume purchasing 3-year Australian Government Securities (AGS) after yields climbed above 25-basis points and its yield curve control target. This is the first time the Reserve bank of Australia purchased AGS in several weeks. Correspondingly, if the upcoming release of RBA minutes delivers a deeper undertone hinting at a need for more monetary support, there could be potential for Australian Dollar strength to sputter out.

Keep Reading – Australian Dollar Forecast: AUD/USD, AUD/NZD Levels to Watch

-- Written by Rich Dvorak, Analyst for DailyFX.com

Connect with @RichDvorakFX on Twitter for real-time market insight