Fundamental Australian Dollar Forecast: Bearish

- The Australian Dollar was hit by a variety of factors last week

- Perhaps the most notable was weak full-time job creation, formerly a reliable prop

- It’s hard to spot reasons why it should gain in the coming sessions

Find out what retail foreign exchange traders make of the Australian Dollar’s prospects right now, in real time, at the DailyFX Sentiment Page

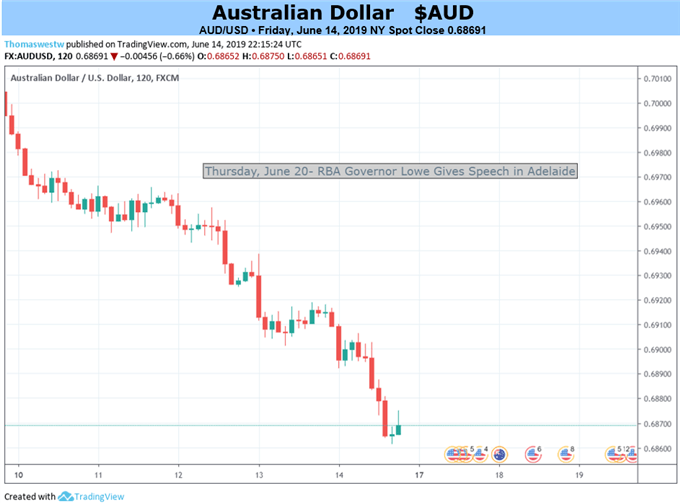

The Australian Dollar endured another punishing week last week but may not face a repeat performance in coming sessions if only because market focus is likely to be elsewhere. Even so it is hard to get bullish on a currency facing not so much headwinds as roaring gales.

The US Federal Reserve will give its June monetary policy decision on Wednesday (early Thursday for Asia Pacific). Economists don’t expect any changes but the chance of a move lower for the Federal Funds Target Rate in July is now deemed to be very high. The ‘Fedwatch’ tool from the Chicago Mercantile Exchange puts it at more than 80%.

One slight problem for Aussie bulls may be that it may now be hard for the US central bank to appear more ‘dovish’ in its policy prognosis than the market. This may mean at least short-term gains for the greenback against major rivals in the wake of the Fed’s June call, even if lower rates next month remain very much in prospect.

On the domestic front Australian Dollar watchers can look forward to house price data, the minutes of this month’s Reserve Bank of Australia monetary policy meeting, which produced a rate cut, and Purchasing Managers Index data for June.

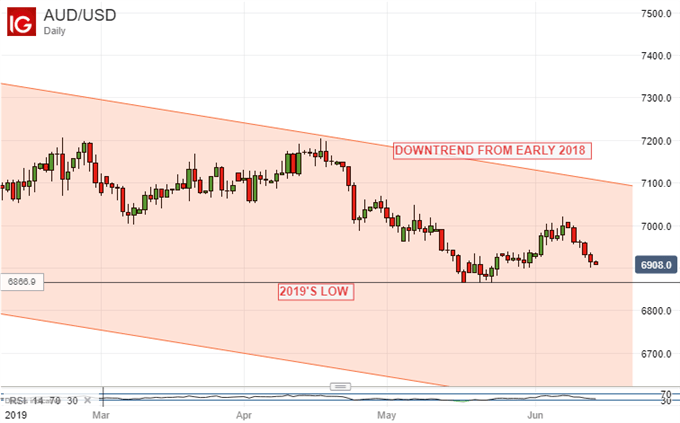

None of these is likely to move the dial on expectations that Australian rates will head lower again, possibly quite soon. The currency was hit last week by news of feeble full-time job creation and by a rise in Chinese inflation, which may have raised expectations that Beijing could cut stimulus. This is never a sight welcomed by those who view the Australian Dollar as a handy China proxy bet.

More broadly US accusations that Iran was behind last Thursday’s attacks on oil tankers in the Gulf of Oman may keep a firm lid on risk appetite, even if the State Department’s response has so far emphasized diplomacy over force. There’s still no sign of trade peace between China and the US either.

Given all of the above, it is still very hard to get bullish about the Aussie. There are some glimmers of light behind it, notably from the direction of iron ore prices. High and likely to go higher, they can probably slow the currency’s fall but, in an environment in which interest rates are effectively gravity, they can’t stop it.

It’s another bearish call, with the caveat perhaps that the bears may already be a little exhausted and in need of another catalyst before they really push on.

Resources for Traders

Whether you’re new to trading or an old hand DailyFX has plenty of resources to help you. There’s our trading sentiment indicator which shows you live how IG clients are positioned right now. We also hold educational and analytical webinars and offer trading guides, with one specifically aimed at those new to foreign exchange markets. There’s also a Bitcoin guide. Be sure to make the most of them all. They were written by our seasoned trading experts and they’re all free.

--- Written by David Cottle, DailyFX Research

Follow David on Twitter @DavidCottleFX or use the Comments section below to get in touch!