Fundamental Australian Dollar Forecast: Neutral

- The Australian Dollar was pressured last week when the Reserve Bank of Australia declined to turn hawkish

- No such obvious banner event looms in the coming week

- But there are plenty of likely market movers, from Australia, China and the US

Find out where your currency-of-the-moment stands in the trading community’s affections at the DailyFX sentiment page

The Australian Dollar took a knock last week when its central bank just refused to play.

Investors had hoped that the Reserve Bank of Australia might have joined other developed-market monetary authorities in suggesting that higher interest rates were coming. In the event it didn’t. Instead it left the Official Cash Rate at its 1.50% record low and gave no hint that any changes were in the wind.

In truth it was always rather doubtful that enough had changed for the Australian economy to justify a policy shift, whatever central bankers in Canada, the UK and the Eurozone may feel. Moreover, although the next move in Australian rates probably will be to the upside, rate-futures markets still don’t price this in until the second half of next year.

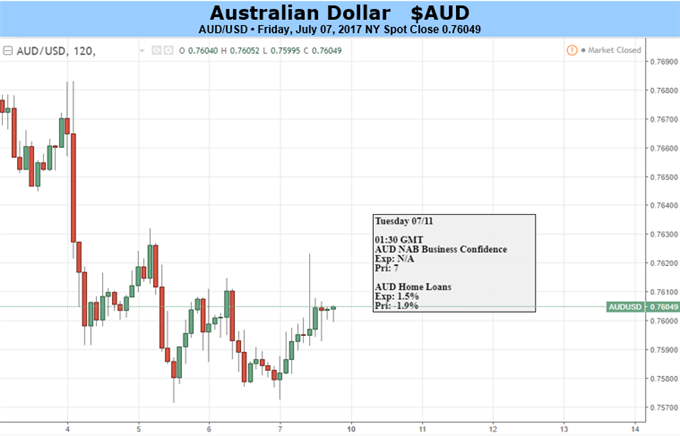

So, what of this week? Well, the Aussie will face some interesting economic data out of its homeland, notably surveys of both business and consumer confidence. If they can trounce expectations, as Australia’s trade balance did last week then AUD/USD should at least find some support and may well push higher.

However, economic numbers are also due out of China and here risks seem a little asymmetric- the Aussie may not rise much on strong data, but it has shown a recent propensity to slide on disappointments. There’s reason for this. The RBA has often worried aloud that Chinese demand for Australian raw materials may moderate. And the Australian government said just last week that the price of iron ore will be back below US$50/tonne next year as China’s steelmakers takes less of this key Australian export. Signs that any of these worries are justified tend to spook the currency.

We will also here fulsomely from Federal Reserve Chair Janet Yellen. If she sticks to her upbeat tone on the US economy then there could be pressure on AUD/USD.

All up it seems likely that the Aussie could face moderate, contradictory influences in the coming week, which is why the call must be a neutral one.

--- Written by David Cottle, DailyFX Research

Contact and follow David on Twitter: @DavidCottleFX