US DOLLARFUNDAMENTAL FORECAST: NEUTRAL

- US Dollar may not capitalize on firm data flow, status-quo Fed

- Data from China and the Eurozone, Brexit vote menace markets

- US-China trade war talks a wildcard as China’s Liu visits DC

Gain confidence in your US Dollar trading strategy with our free guide!

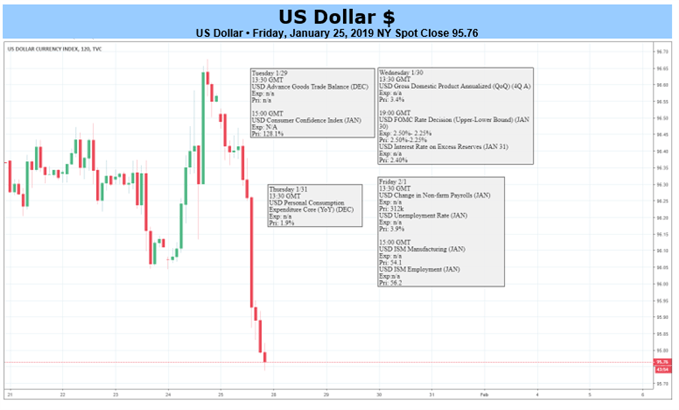

A deluge of scheduled event risk is due in the week ahead. Domestically, the year’s first FOMC rate decision and accompanying press conference with Fed Chair Jerome Powell will be accompanied by a first look at fourth-quarter GDP data and January’s jobs report. Meanwhile, Eurozone GDP and Chinese PMI data will inform global growth bets as the UK Parliament votes on a tweaked Brexit withdrawal bill.

A seemingly overlooked bit of timely US economic data – a rarity amid the US government shutdown of the past three weeks – painted a rosier picture than analysts predicted. January’s flash PMI surveys showed the pace of economic activity growth in the nonfarm sector unexpectedly accelerated from the prior month. That might foreshadow uplifting outcomes as next week’s statistical releases cross the wires.

For its part, the US central bank is unlikely to alter its core message calling for a wait-and-see approach on further interest rate hikes. If nothing else, policymakers will probably want to wait to backfill some of the economic data held up by the shutdown before turning the dial one way or another. That may be interpreted as modestly hawkish by markets hoping to see quantitative tightening slowed or paused.

Looking for a technical perspective on the US Dollar? Check out the Weekly USD Technical Forecast.

US DOLLAR AT RISK IF MARKET MOOD IMPROVES

While this seems like a broadly supportive backdrop for the US Dollar, that need not be the case. The currency has held up remarkably well against a backdrop of evaporating Fed rate hike expectations since October. Support looks to have come from haven-seeking flows driven by the very same late-2018 market rout that inspired the dovish adjustment in the priced-in policy outlook.

If incoming fundamental news-flow presents a stronger US economy than investors are envisioning, that will probably buoy risk appetite and punish safety-oriented assets. To the extent that the Greenback has been a beneficiary of anti-risk demand, this may emerge as a headwind. Any lasting upturn in sentiment will probably need compliance from macro level forces however.

DATA FROM EUROPE AND CHINA, TRADE WAR FEARS MAY SAP RISK APPETITE

This may be challenging. Economic data flow out of the Eurozone and China has increasingly deteriorated relative to consensus forecasts since September and November of last year, respectively. That bodes ill for next week’s releases. Meanwhile, proponents of the UK government’s updated Brexit deal seem unlikely to close the 230-vote gap needed for passage despite fresh support from the DUP.

The outcome of a visit by Chinese Vice Premier Liu He to Washington DC for renewed trade talks is something of a wildcard. Members of the Trump administration have offered conflicting cues, with economic adviser Larry Kudlow talking up progress even as Commerce Secretary Wilbur Ross said that the negotiating positions of the world’s top-two economies are still “miles and miles apart”.

--- Written by Ilya Spivak, Sr. Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter

US DOLLAR TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a free Q&A webinar and have your trading questions answered

OTHER FUNDAMENTAL FORECASTS:

Australian Dollar Forecast – Australian Dollar May Look Past CPI Report for the Fed and US Data