Norwegian Krone, Crude Oil, AUD/USD, Energy - Talking Points

- Crude oil prices stormed higher along with other energy markets

- Other commodities joined the march upward, boosting commodity FX

- The Norwegian Krone benefitted from oil’s strength. Can crude make new highs?

Trade Smarter - Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

The Norwegian Krone moved up as crude oil prices continued to squeeze higher. Energy and commodity markets have had a positive session as the northern winter looms. The Australian Dollar found some respite after iron ore prices continued to steady. The Euro struggled to make a move with the German federal election stillundecided. US 10-year yield held levels above 1.45%.

WTI crude traded above US$ 75 a barrel today as buyers leaped into energy assets. Coal, gasoline and natural gas have all continued to rally. News has emerged of rolling blackouts in northern China due to coal shortages, despite the Chinese Communist Party (CCP) stipulating lower power consumption goals.

This is at a time when the UK is facing a looming fuel crisis going into the northern hemisphere winter. There are also some concerns about Russian energy supply to continental Europe. A beneficiary for high oil prices is the Norwegian Krone, and it has continued to outperform. EUR/NOK hit a 5-month low today.

Another worry for commodities are the increasing costs of shipping, with the Baltic Dry Freight Index climbing to 13-year highs. The upcoming OPEC+ meeting on 4th October will be a key focus for markets.

The positive sentiment in the commodity market spilled into commodity FX with AUD/USD recovering amid iron ore, copper, nickel, gold and silver finding firmer footing. The New Zealand and Canadian Dollars also gained traction.

The Evergrande saga moved off the front page today, but another USD coupon payment is due this Wednesday. Sunac, also a Chinese property developer, revealed their financial stress on Friday and there is little official guidance from the CCP at this stage on any efforts to avoid contagion.

The German election has failed to deliver a decisive result and as a result, EUR/USD has had a quiet session in Asia. Bank of Japan Governor Haruhiko Kuroda hit the wires late in the day and said the Bank of Japans won’t hesitate to add easing. This is a different stance to most other central banks globally, but it didn’t seem to bother USD/JPY.

Looking ahead, ECB President Christine Lagarde is due to speak at the EU Parliament and US durable goods data is scheduled for release.

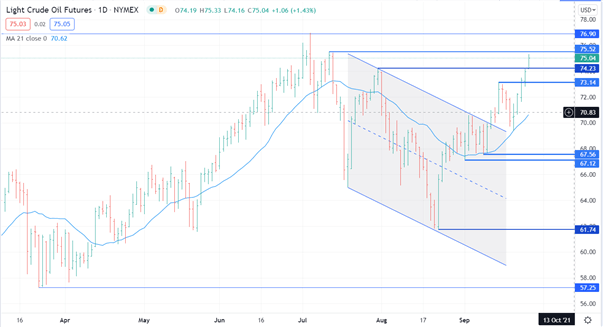

Crude Oil Technical Analysis

Since breaking up through trend line resistance, crude oil has continued to break upside barriers. The next level to watch is the most recent previous high at 75.52 for possible resistance

There might be further resistance at 76.90, which is the high from earlier this year and in 2018. A move above 76.90 would be the highest level since 2014 for crude oil.

Not surprisingly, the 21-day simple moving average (SMA) has a steep positive gradient which could be a bullish signal.

--- Written by Daniel McCarthy, Strategist for DailyFX.com

To contact Daniel, use the comments section below or @DanMcCathyFX on Twitter