Euro Outlook, EUR/USD, Eurozone Economy, PMI Data, Coronavirus – Talking Points

- Euro may fall if German IFO data underwhelms

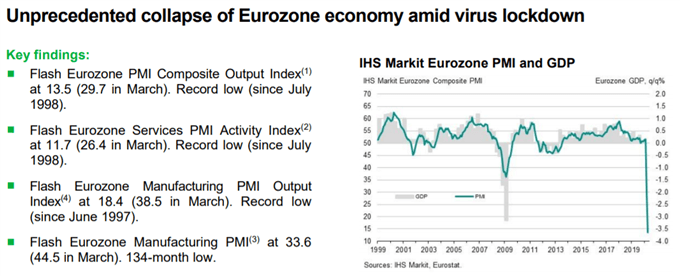

- Dismal PMI releases darkened growth outlook

- EUR/USD broke below key support: what next?

Asia-Pacific Recap

US equity futures along with APAC stocks aimed lower early into Asia’s Friday trading session while crude oil prices edged slightly higher. FX markets reflected what appeared to be a risk-off tilt in market dynamics with the Australian and New Zealand Dollars at the time suffering a similar affliction as their growth-oriented peers. There did not appeared to have been a clear catalyst behind the moves.

Euro May Fall on German IFO Data After Dismal PMI Report, Political Debacle

The Euro may fall if German IFO data reinforces the negative outlook for the Eurozone economy after flash PMI data for April showed alarming figures. European Central Bank President Christine Lagarde warned EU policymakers that Eurozone GDP could fall as much as 15 percent in 2020. This comes as European leaders continue to debate on how to best deal with the issue of paying for the coronavirus stimulus measures.

Source: IHS Markit

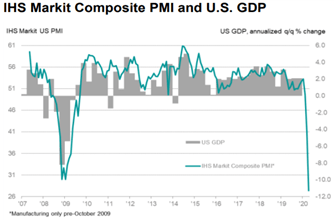

The gloomy outlook was amplified when the United States – the largest economy in the world – printed its own figures with similarly gloomy implications. According to the report “Services companies registered the steepest rate of decline in the survey’s history, while manufacturers recorded the sharpest fall in sales since the depths of the financial crisis in early-2009”.

Source: IHS Markit

Digression aside, German IFO data for Business Climate, Expectations and Current Assessment are anticipated to show a 79.7, 75.0 and 80.5 prints, respectively. An underwhelming reading could add to the slew of worrying data that continues to hammer the Euro as regional growth prospects deteriorate. Political tension – as I outlined this week – may magnify liquidation pressure in Euro crosses.

For more in-depth analysis be sure to follow me on Twitter @ZabelinDimitri.

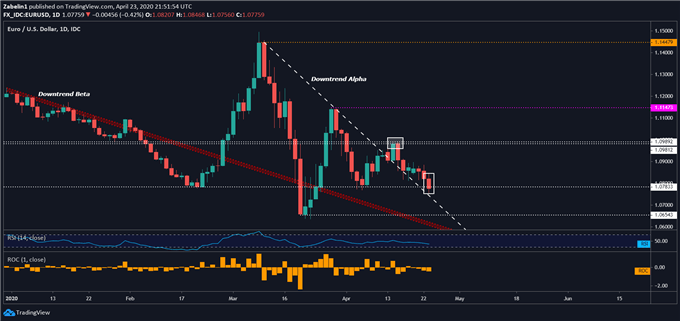

Euro Analysis vs US Dollar

As forecasted, EUR/USD broke below a key inflection point at 1.0783, potentially precipitating what could be an aggressive selloff if the breach is met with follow-through. While it appears that steep descending resistance (labeled as “Downtrend Alpha”) is invalidated, it is still possible for EUR/USD to decline at a similarly steep slope of depreciation. The next major point to monitor may then be support at 1.0654.

EUR/USD – Daily Chart

EUR/USD chart created using TradingView

EURO TRADING RESOURCES

--- Written by Dimitri Zabelin, Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitri on Twitter