US DOLLAR, AUSTRALIAN DOLLAR, S&P 500, COVID-19, EARNINGS – TALKING POINTS:

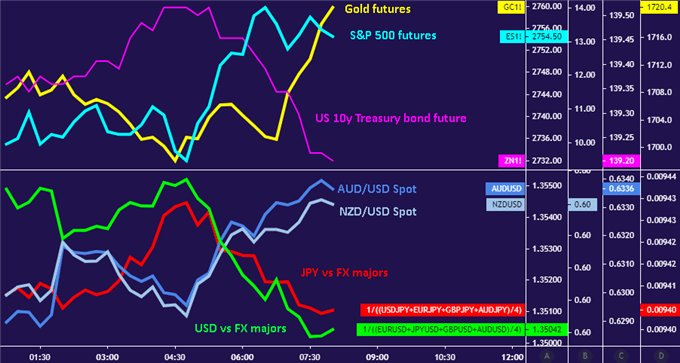

- US Dollar broadly lower as sentiment improves across global markets

- S&P 500 futures suggest a risk-on tilt will prevail in the hours ahead

- Q1 earnings reports may sour the mood with Covid-19 impact weighed

The safe-haven US Dollar traded broadly lower in Asia Pacific trade, retracing some of the prior day’s outsized gains as the broader financial markets digested after another bout of liquidation. Commodity-linked currencies rose alongside other cyclical assets, with the Australian Dollar leading the way. The New Zealand Dollar was not far behind and the Canadian Dollar managed gains despite another drop in crude oil prices.

The chipper mood has bled into pace-setting S&P 500 futures, which now point assertively higher to suggest that a risk-on tilt may persist in the hours ahead. The economic calendar does not seem to offer anything potent enough to derail momentum. The earnings docket may stir volatility however, as Q1 reports from bellwether firms like Delta Air Lines, CSX and Alcoa cross the wires.

The forward guidance on offer may be of greatest interest as traders try to establish a baseline for the severity of disruption caused by the coronavirus outbreak. Particular dour prognoses may further amplify already swelling global recession fears, souring sentiment anew. With about 15 percent of S&P 500 firms having reported thus far, actual results have trailed analysts’ forecasts by close to 9 percent.

USD, JPY DOWN WITH BONDS AS AUD AND NZD RISE WITH STOCKS

Chart created with TradingView

FX TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- What is your trading personality? Take our quiz to find out

- Join a free webinar and have your trading questions answered

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter