EUR/USD, Eurozone Finance Minister Meeting, Coronavirus – Talking Points

- Asia-Pacific recap: RBA holds rates at 0.25%, warned of hard times ahead

- Eurozone finance minister meeting could elicit notable volatility in the Euro

- EUR/USD may bounce from key support and retest descending resistance

Asia-Pacific Recap

The Australian and New Zealand Dollars rose vs their G10 counterparts as part of what appeared to be a spillover of optimism from Wall Street. The haven-linked US Dollar was in the red while Asia-Pacific equities were green, reflecting market-wide risk appetite. AUD rose over one percent after the RBA held interest rates at 0.25 percent and gave a press brief outlining their decision. Read the full report here.

Euro Eyes Eurozone Finance Minister Meeting

In the absence of major market-moving data, the Euro will be putting its focus primarily on the meeting between Eurozone finance ministers. The meeting the prior week failed to yield anything of substance as policymakers debated how to address stimulus concerns. The relatively fiscally conservative North is more inclined to give loans with conditions attached while Southern members states appear to strongly reject it.

Instead, they are proposing – along with some colleagues in the North – to issue joint debt via so-called corona-bonds. However, debt mutualization has been a controversial topic that has been a point of division between North and South for over a decade. Now, when the Eurozone edges closer to the precipice of a deep recession, this tension has been revived with unprecedented urgency.

The Euro may suffer in a politically-static environment if policymakers are unable to reach a consensus on a way forward. Regional consumer confidence data yesterday reported a -42.9 reading, missing the already-low -37.5. The report marked the weakest figures on record. To get a full breakdown of the financial, political and economic implications of the upcoming meeting, click here.

EUR/USD Analysis

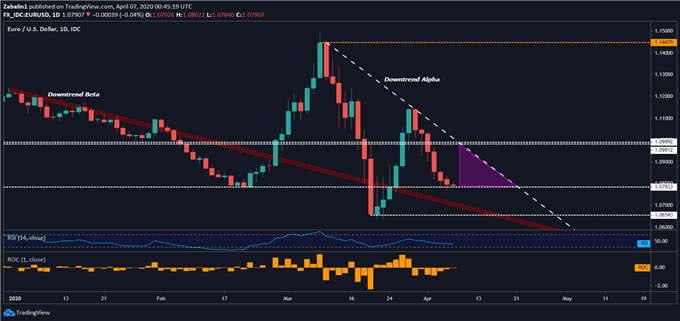

Since topping at 1.1139, EUR/USD has faced severe liquidation pressure and has fallen over three percent as it trades below the steep guidance of descending resistance (labelled as “Downtrend Alpha”). If support at 1.0783 holds, the pair may then challenge the slope of depreciation. Having said that, failure to clear it could lead to capitulation and retesting a key floor, which if broken could catalyze a deeper selloff.

EUR/USD – Daily Chart

EUR/USD chart created using TradingView

EURO TRADING RESOURCES

- Tune into Dimitri Zabelin’s webinar outlining geopolitical risks affecting markets in the week ahead !

- New to trading? See our free trading guides here !

- Get more trading resources by DailyFX !

--- Written by Dimitri Zabelin, Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitri on Twitter