Euro, EUR/USD, US Dollar, Eurozone Economy – Talking Points

- EUR/USD may extend decline if Eurozone GDP data sours sentiment

- Euro could fall if soft growth fuels ECB rate cut bets amid slowdown

- Policymakers anxious that slow growth may expose financial threats

Learn how to use politicalrisk analysis in your trading strategy !

Asia Pacific Recap

The Australian Dollar plunged alongside local government bond yields after a cascade of jobs data showed the unemployment rate had risen from 5.2 to 5.3 percent and a total of 19k jobs had been lost, missing the estimates calling for a 15k rise. The participation rate edged lower while both full- and part-time jobs declined. The prior month's results were also revised downward.

European Session Preview

EUR/USD may extend its decline if Eurozone GDP data disappoints and leads to capital flowing out of the Euro if traders speculate that softer growth data will pressure the ECB to inject additional stimulus. While overnight index swaps are overwhelmingly expecting for the central bank to hold rates through October 2020, the cumulative pressure of chronic underperformance may tilt officials to support additional liquidity provisions.

Eurozone Economy: Recession Ahead?

Preliminary year-on-year and month-on-month GDP data is expected to remain unchanged from their prior period at 1.1 and 0.2 percent, respectively. Economic data out of the Eurozone has been tending to underperform relative to economists’ expectations, so it would not be entirely surprising to see the data fall-line with this trend. Volatility may emerge in proportion to the degree that the report misses its estimates.

ECB Vice President Luis de Guindos on Tuesday said there remains scope for more stimulus if the economic conditions warranted it, especially against the backdrop of a “long low-growth” phase in the economy. However, Mr. de Guindos made a point to add that a prolonged period of economic weaker growth could pose a threat to the economy, especially as households in Europe become increasingly more leveraged.

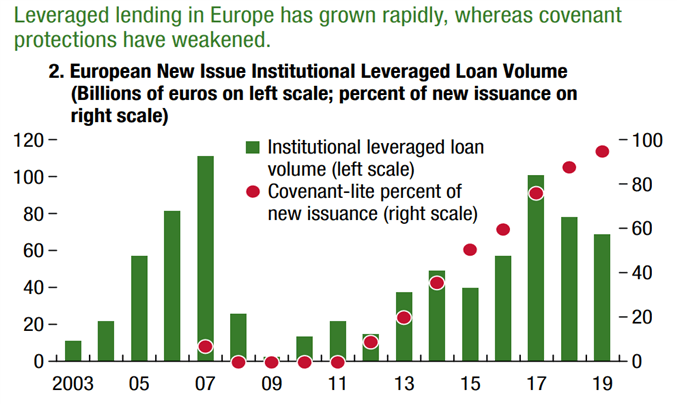

As global interest rates continue to fall as a result of central bank officials using easing measures to counter world-wide disinflation stemming in large part from the US-China trade war, yield-starved investors have flocked to higher-yielding assets. However, as the demand for these securities has risen, the credit standards associated with them have declined and left portfolio managers exposed to financially precarious assets.

"During the global financial crisis, countries with high leverage in the banking and household sectors experienced more severe recessions. But corporate leverage can also amplify shocks, as corporate deleveraging could lead to depressed investment and higher unemployment, and corporate defaults could trigger losses and curb lending by banks."

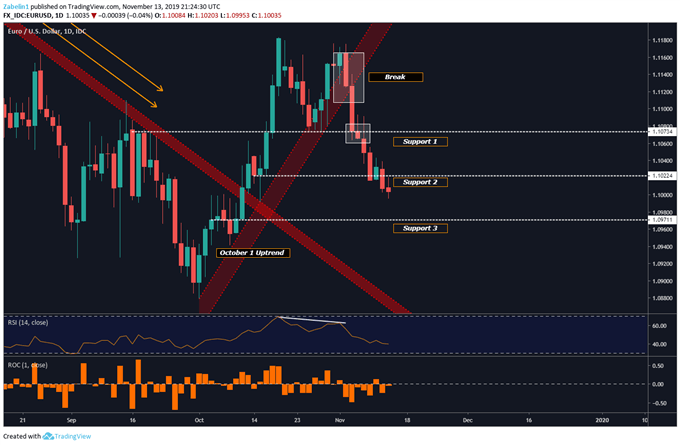

EUR/USD Technical Analysis

EUR/USD has been rapidly declining ever since it had broken the October 1 uptrend and is now aiming to test Support 3 (see chart below) at 1.0971. Traders may wait to add onto their short positions until a break below the upcoming floor is met with follow-through. Conversely, selling pressure may wane just before the pair hits 1.0971 and traders may start buying into what they see as a swing-low with upside potential.

EUR/USD Price Chart

EUR/USD chart created using TradingView

EURO TRADING RESOURCES

- Join a free webinar and have your trading questions answered

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

--- Written by Dimitri Zabelin, Jr Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitri on Twitter