TALKING POINTS – TRADE WAR, BREXIT, EURO, USD

- The Euro and USD may ignore local data

- Volatility may come from external shocks

- Brexit, US-China trade war still in focus

See our free guide to learn how to use economic news in your trading strategy !

APAC RECAP

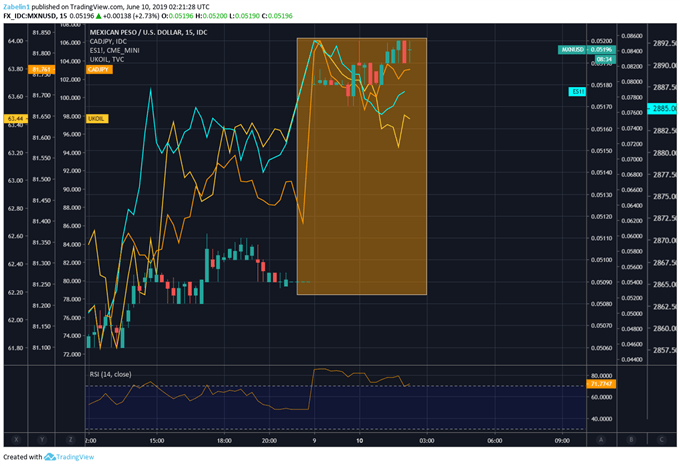

Asia Pacific markets woke up with a pep in their step after US-Mexico trade tensions were alleviated. US President Donald Trump announced on June 8 that tariffs are indefinitely suspended after a deal was reached with Mexican officials. The Mexican Peso and Canadian Dollar gapped higher amidst renewed hopes that the USMCA – NAFTA’S replacement– will pass.

LIGHT ECON DOCKET EXPOSES EURO, USD TO EXTERNAL SHOCKS

Since the economic docket both in Europe and the US will likely offer little volatility – due to the relatively benign nature of these indicators – the Euro and Greenback’s price movement will likely be dictated by external shocks. Familiar fundamental themes such as the US-China trade war, Brexit and ongoing political risk in Europe between Rome and Brussels may rear their ugly heads and cause volatility.

At the end of June, US President Donald Trump will decide whether he wants to impose an additional $325 billion worth of tariffs against China. However, officials in Washington will take note of the PBOC’s statement – or what some might call a veiled threat – on June 7. Officials said that China has more tools in its arsenal that it is ready to utilize if relations worsen. Some of these might include a ban or restricted supply of rare earth metals.

Looking ahead, most of the major event risk – barring any unexpected developments – will likely occur in the mid-to-tail end of the week. This could mean that markets may start coiling up before major volatility-inducing indicators are published, leading to potentially greater volatility. Some of these include US retail sales, U. of Michigan sentiment survey, and the meeting between Euro Area finance ministers over how to deal with Italy’s budgetary ambitions.

CHART OF THE DAY: CADJPY, S&P 500 FUTURES, MXNUSD GAP HIGHER ON TRADE HOPES

FX TRADING RESOURCES

- Join a free webinar and have your trading questions answered

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

--- Written by Dimitri Zabelin, Jr Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitri on Twitter