TALKING POINTS – BRITISH POUND, UK CPI, EURO, DRAGHI, US DOLLAR, FOMC

- British Pound may overlook UK CPI on muted rate hike bets

- Euro unlikely to find a lasting lead as ECB’s Draghi speaks

- US Dollar may rise in pre-positioning for Fed rate decision

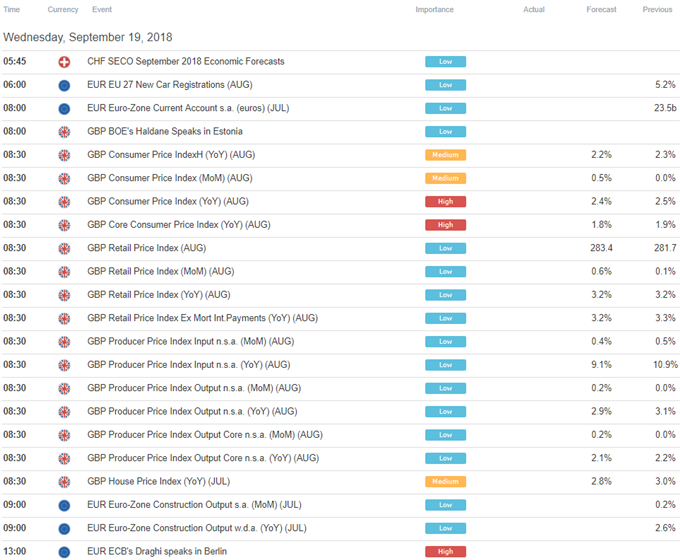

UK CPI data headlines the economic calendar in European trading hours. The headline on-year inflation rate is expected to tick down to 2.4 percent in August. The outcome may pass without a meaningful response from the British Pound considering its limited implications for Bank of England monetary policy. Markets are not pricing in another rate hike at least until August 2019.

Another scheduled speech from ECB President Mario Draghi is also on tap. An appearance yesterday offered next to nothing by way of direction cues for the Euro, with Mr Draghi pointedly avoiding anything that might be seen as a near-term policy signal. More of the same seems likely this time around, especially so soon after last week’s formal announcement put the central bank effectively on autopilot through year-end.

Meanwhile, pre-positioning for next week’s FOMC monetary policy announcement might boost the US Dollar. The benchmark unit already advanced against some of its lower-yielding counterparts yesterday following impressive results of a 4-week Treasury note auction as rate hike bets swelled. The move may extend to commodity currencies as the dust settles after the latest burst of trade war influence.

See our study on the history of trade wars to learn how it might influence financial markets!

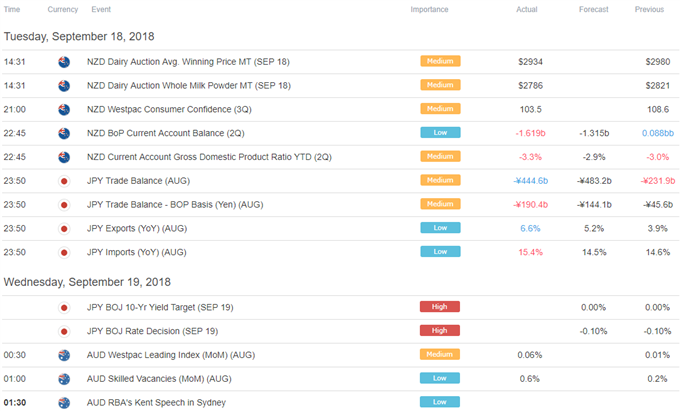

ASIA PACIFIC TRADING SESSION

EUROPEAN TRADING SESSION

** All times listed in GMT. See the full economic calendar here.

FX TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a free Q&A webinar and have your trading questions answered

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter