Gold Talking Points:

- Gold prices are range-bound since last week’s Powell-fueled breakout.

- Gold prices amazingly closed August in the green after a nasty spill to start the month.

- The analysis contained in article relies on price action and chart formations. To learn more about price action or chart patterns, check out our DailyFX Education section.

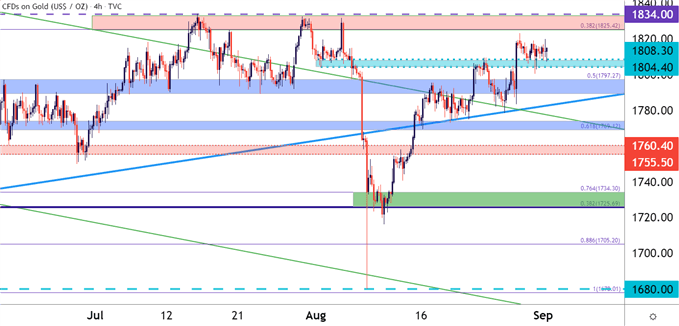

It’s been slow moving in Gold prices so far this week. The yellow metal jumped up to a fresh three-week-high around Powell’s Jackson Hole comments last Friday. But since then, Gold price action has meandered within a relatively tight range between support at 1808 and resistance at 1825.

That zone of support-turned-resistance-turned-support was looked at last week, both ahead of the breakout and after the move.

At this point, it appears as though price action is coiling in anticipation of Friday’s Non-farm Payrolls report, which will be widely watched for clues of FOMC policy ahead of the September rate decision. As we heard last Friday and then saw priced into Gold shortly after, Jerome Powell remains cautious around the labor market and that could lead to further can kicking as the Fed debates proper timing of taper liftoff. Powell had also said that employment would be closely watched in the coming months, and given the fact that Friday’s NFP report is the only such release ahead of the September FOMC rate decision, it seems as though that print will be a key decision point for the FOMC ahead of the meeting.

So, similar to the recent proclivity for USD-weakness, we’ve seen Gold strength. And at this point, Gold prices are staring down a big level on the chart at 1834 that could lead to an extended breakout run if/when taken out.

To learn more about Non-farm Payrolls, check out DailyFX Education

Gold Four-Hour Price Chart

Chart prepared by James Stanley; Gold on Tradingview

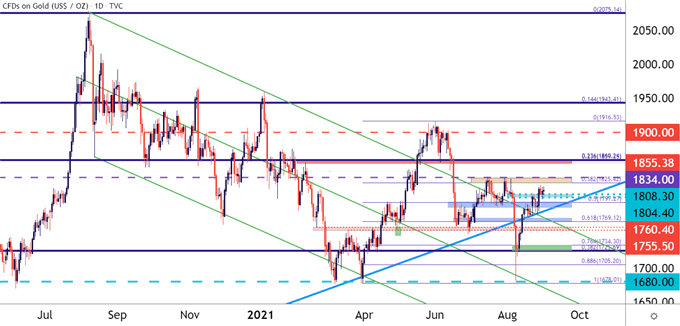

Longer-Term Implications, XAU/USD Levels

At this point, Gold prices still retain the bull flag formation that’s brewed over the past couple of years. The early-August sell-off did threaten to break that pattern but, support showed up above the previously-established 2021 low and buyers pushed right back up to the 1800’s.

To learn more about bull flags, check out DailyFX Education

The bigger question is whether we’ll get continuation of the bullish trend that showed with such prominence last year. A breach of 1834 will make that theme look considerably more attractive.

Beyond 1834 is a confluent batch of resistance from 1855-1860; and if that’s taken-out, the next big spot on the chart is around 1900 followed by the current seven-month-high at 1916.

Gold Daily Price Chart

Chart prepared by James Stanley; Gold on Tradingview

--- Written by James Stanley, Senior Strategist for DailyFX.com

Contact and follow James on Twitter: @JStanleyFX