The bull flag pattern is a great pattern to add to a forex trader’s technical arsenal. Explosive moves are often associated with the bull flag. This article will look at the potentially higher probability forex trading opportunities of the bull flag pattern.

Learn to trade the bull flag pattern: Main talking points

- What is a bull flag?

- How to identify a bullish flag on forex charts

- Bull flag trading strategy

- How reliable is the bull flag?

- Bull flag vs bear flag

What is a bull flag?

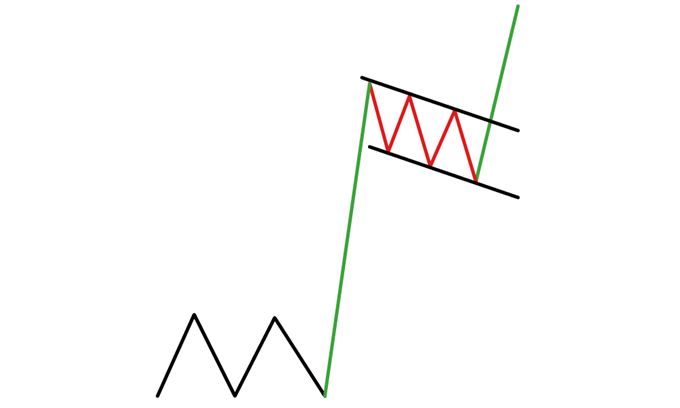

A bull flag is a continuation pattern that occurs as a brief pause in the trend following a strong price move higher. The bull flag chart pattern looks like a downward sloping channel/rectangle denoted by two parallel trendlines against the preceding trend.

During this period of consolidation, volume should dry up through its formation and resolve to push higher on the breakout. The actual price formation of the bull flag resembles that of a flag on a pole hence its namesake.

Bull flag pattern:

How to identify a Bullish Flag on Forex Charts

It can be complex identifying a bull flag on a chart because the pattern entails several different components. Traders will need to correctly identify and understand these components to trade this pattern successfully. Key things to look out for when trading the bull flag pattern are:

- Preceding uptrend (flag pole)

- Identify downward sloping consolidation (bull flag)

- If the retracement becomes deeper than 50%, it may not be a flag pattern. Ideally, the retracement ends at less than 38% of the original trend

- Enter at bottom of the flag or on the breakout above the high of the upper channel boundary

- Look for price to break higher with a length potentially equal to the size of the flag pole

Bull Flag Trading Strategy

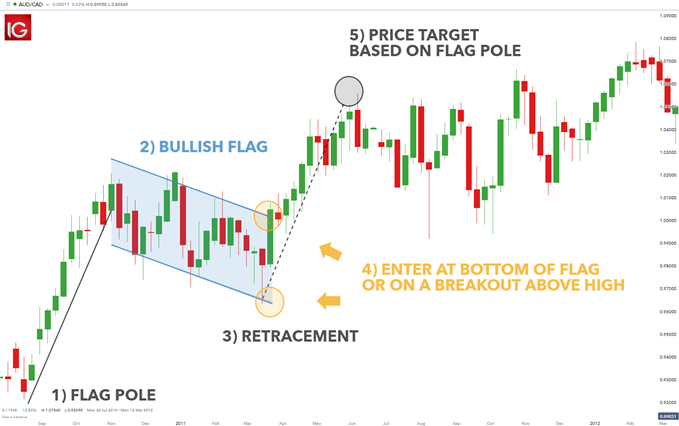

The following trading example shows the bull flag on a forex chart.

AUD/CAD bull flag pattern

As shown by the bull flag chart pattern above, traders have been buying risk through commodities, the stock market, and risk-based currencies. As a result, the AUD performed well against most other currencies in part because it offers a higher rate of return owing to its interest rate. Hence, traders have a fundamental back drop to support the technical picture for additional strength in AUD.

The AUD/CAD is no stranger to the flag pattern. The previous uptrend (flag pole) is noted in black. Prices consolidated in a gently downward sloping channel (blue). To trade the flag, traders can time an entry at the lower end of the price channel or wait for a break above the upper channel (yellow). Traders then look to take profits by projecting the length of the flag pole preceding the flag (black dotted line).

How reliable is the Bull Flag in forex trading?

The reliability of the bull flag pattern depends on the success of the checklist mentioned above. When all components of the bull flag are identified and present within the chart, the bull flag pattern is considered to be a formidable pattern to trade.

The table below identifies the advantages and limitations of the bull flag pattern:

| ADVANTAGES | LIMITATIONS |

|---|---|

| Works in all financial markets | Can be complex for novice traders |

| Pattern helps determine entry and limit levels | |

| Good risk-reward ratio |

Bull Flag vs Bear Flag

The bull flag and bear flag represent the same chart pattern however, just mirrored.

- The bear flag appears in a downtrend as opposed to the bull flag which occurs in an uptrend

- The bear flag pattern will breakout from the consolidation once price breaks the lower channel

- Both the bear and bull flag chart patterns measure the target price as a projection using the length of the flagpole

Further Reading on forex trading patterns

Consider other chart patterns like the head and shoulders, double top and double bottom in order to develop your pattern recognition. We also recommend taking our interactive forex trading patterns quiz to test your knowledge of some of the most commonly used patterns in forex trading.