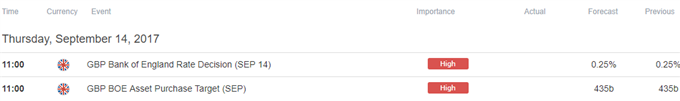

- Bank of England (BoE) to Keep Benchmark Interest Rate at Record-Low of 0.25%.

- BoE Minutes May Reveal 7 to 2 Split as Sir David Ramsden Joins Monetary Policy Committee (MPC).

- Sign Up & Join DailyFX Currency Analyst Christopher Vecchio LIVE to Cover the BoE Rate Decision.

Trading the News: Bank of England (BoE) Interest Rate Decision

The Bank of England (BoE) interest rate decision may undermine the near-term advance in GBP/USD should a greater number of central bank officials endorse a wait-and-see approach for monetary policy.

The BoE Minutes may reveal a 7 to 2 split to retain the current policy as Sir David Ramsden joins the MPC, and a growing majority to preserve the accommodative stance may trigger a bearish reaction in the British Pound as it drags on interest-rate expectations. On the other hand, a 6 to 3 split may generate a more bullish scenario for GBP/USD as BoE officials show a greater willingness to move away from the easing-cycle.

Impact that the BoE rate decision has had on GBP/USD during the previous meeting

| Period | Data Released | Estimate | Actual | Pips Change | Pips Change |

|---|---|---|---|---|---|

AUG 2017 | 08/03/2017 11:00:00 GMT | 0.25% | 0.25% | -97 | -98 |

August 2017 Bank of England (BoE) Interest Rate Decision

GBP/USD 5-Minute

The Bank of England (BoE) voted 6 to 2 to preserve the record-low interest rate, with Ian McCafferty and Michael Saunders pushing for a 25bp rate-hike as ‘the withdrawal of part of the stimulus that the Committee had injected in August last year would help to moderate the inflation overshoot while leaving monetary policy very supportive.’ Nevertheless, it seems as though the BoE remains in no rush to lift the benchmark interest rate as ‘GDP growth had been sluggish and was expected to remain so in the near term,’ and the central bank may carry the wait-and-see approach into 2018 as Brexit clouds the economic outlook with high uncertainty. The British Pound sold off amid the growing majority to retain the current policy, with GBP/USD slipping below the 1.3200 handle to end the day at 1.3137.

How To Trade This Event Risk(Video)

Bearish GBP Trade: BoE Votes 7 to 2 to Retain Record-Low Interest Rate

- Need a red, five-minute candle following the rate decision to favor a short GBP/USD trade.

- If market reaction favors a bearish British Pound position, sell GBP/USD with two separate lots.

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward.

- Move stop to breakeven on remaining position once initial target is met, set reasonable limit.

Bullish GBP Trade: MPC Shows Greater Willingness to Normalize Policy

- Need a green, five-minute GBP/USD candle to favor a long British Pound trade.

- Carry out the same setup as the bearish Sterling position, just in reverse.

Potential Price Targets For The Release

GBP/USD Daily Chart

Check out our GBP/USD quarterly projections in our FREE DailyFX Trading Forecasts

- Topside targets remain on the radar for GBP/USD as it clears the August-high (1.3268) and starts to carve a series of higher highs & lows, with a break/close above the 1.3300 (100% expansion) handle opening up the 1.3370 (78.6% expansion) hurdle; next region of interest comes in around 1.3460 (50% retracement), which sits just above the September 2016-high (1.3445).

- Keeping a close eye on the Relative Strength Index (RSI) as it struggles to push into overbought territory, but the broader outlook remains constructive as GBP/USD nullifies the threat of a head-and-shoulders formation, with the pair largely preserving the upward trend from earlier this year.

- Interim Resistance: 1.3460 (50% retracement) to 1.3481 (July 2016-high)

- Interim Support: 1.2630 (38.2% expansion) to 1.2680 (50% retracement)

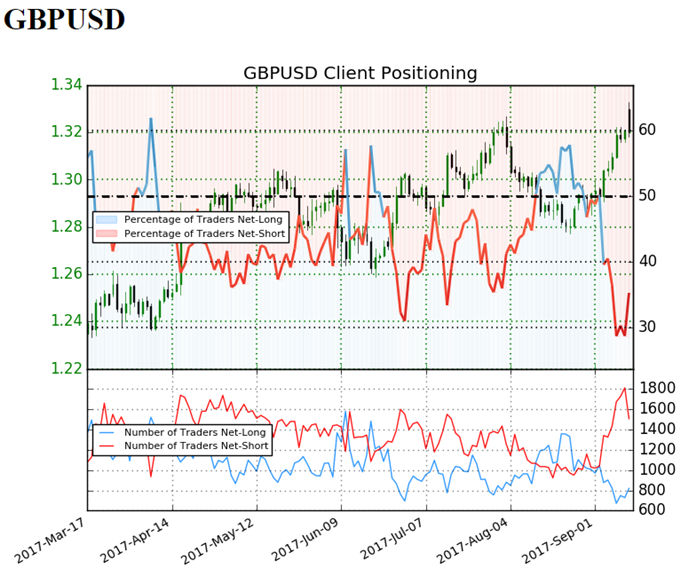

GBP/USD Retail Sentiment

Track Retail Sentiment in Real-Time with the New Gauge Developed by DailyFX

Retail trader data shows 35.2% of traders are net-long GBP/UISD with the ratio of traders short to long at 1.84 to 1. In fact, traders have remained net-short since September 05 when GBP/USD traded near 1.30402; price has moved 1.2% higher since then. The number of traders net-long is unchanged than yesterday and 15.5% lower from last week, while the number of traders net-short is 13.4% lower than yesterday and 6.9% higher from last week.

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.