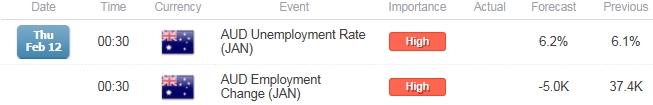

- Australia Employment Projected to Contract for First Time Since September 2014.

- Jobless Rate to Uptick to Annualized 6.2% While Participation is Expected to Narrow Further.

For more updates, sign up for David's e-mail distribution list.

Trading the News: Australia Employment Change

A contraction in Australian Employment may undermine the near-term rebound in AUD/USD as the weakening outlook for the $1T economy fuels expectations for additional monetary support.

What’s Expected:

Click Here for the DailyFX Calendar

Why Is This Event Important:

Indeed, there’s growing bets that the RBA will continue to reduce the cash rate in an effort to further assist with the rebalancing of the real economy, but we may see Governor Glenn Stevens relay a more neutral tone at the March 2 meeting as the central bank head anticipants the 2.25% benchmark interest rate to further boost economic activity.

Expectations: Bearish Argument/Scenario

| Release | Expected | Actual |

|---|---|---|

| NAB Business Confidence (JAN) | -- | 2 |

| Retail Sales (MoM) (DEC) | 0.3% | 0.2% |

| Gross Domestic Product s.a. (QoQ) (3Q) | 0.7% | 0.3% |

The downturn in business sentiment along with the ongoing slack in the real economy may drag on hiring, and a marked decline in job growth may spur a bearish reaction in the Australian dollar as it fuels expectations for another RBA rate cut.

Risk: Bullish Argument/Scenario

| Release | Expected | Actual |

|---|---|---|

| Home Loans (MoM) (DEC) | 2.0% | 2.7% |

| Building Approvals (YoY) (DEC) | 5.1% | 8.8% |

| Private Sector Credit (MoM) (DEC) | 0.5% | 0.5% |

However, the expansion in private-sector credit paired with the expansion in the housing market may generate a positive employment print, and another better-than-expected development may encourage a large recovery in AUD/USD as it limits the RBA’s scope to offer lower borrowing-costs.

Join DailyFX on Demand for Real-Time SSI Updates!

How To Trade This Event Risk(Video)

Bearish AUD Trade: Australia Employment Contracts 5.0K or Greater

- Need red, five-minute candle following the report for a potential short AUD/USD trade

- If market reaction favors a bearish aussie trade, sell AUD/USD with two separate position

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to breakeven on remaining position once initial target is met, set reasonable limit

Bearish AUD Trade: Labor Report Exceeds Market Expectations

- Need green, five-minute candle to consider a long AUD/USD position

- Carry out the same setup as the bearish aussie trade, just in the opposite direction

Read More:

Price & Time: USD/JPY Breaks Through Another Key Resistance Barrier

AUDCAD Threatens Weekly Opening Range- Long Scalps Favored Above 9750

Potential Price Targets For The Release

AUD/USD Daily Chart

Chart - Created Using FXCM Marketscope 2.0

- AUD/USD remains at risk for a larger rebound as it breaks out of the downward trending channel, while the RSI bounces back from oversold territory.

- Interim Resistance: 0.8020 (38.2% expansion) to 0.8040 (61.8% retracement)

- Interim Support: 0.7590 (100% expansion) to 0.7625 (2015 low)

Impact that Australia Employment Change has had on AUD during the last release

| Period | Data Released | Estimate | Actual | Pips Change | Pips Change |

|---|---|---|---|---|---|

| DEC 2014 | 01/15/2015 00:30 GMT | 5.0K | 37.4K | +69 | +91 |

December 2014Australia Employment Change

Australia Employment continued to top market expectations as job growth advanced another 37.4K in December, while the jobless rate unexpectedly narrowed to 6.1% from 6.3% even as discouraged workers returned to the labor force. However, fears of a slower recovery paired with the continued softening in China’s economy – Australia’s largest trading partner - may push the Reserve Bank of Australia (RBA) away from its neutral tone in an effort to further assist with the rebalancing of the real economy. Nevertheless, the Australian dollar strengthened following the better-than-expected print, with AUD/USD breaking above the 0.8200 handle and ending the Asian-Pacific session at 0.8229.

--- Written by David Song, Currency Analyst and Shuyang Ren

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.

Trade Alongsidethe DailyFX Team on DailyFX on Demand

Looking to use the DailyFX Trade Signals LIVE? Check out Mirror Trader.

New to FX? Watch this Video

Join us to discuss the outlook for the major currencies on the DailyFXForums