Euro Forecast Overview:

- EUR/USD has fallen back into its bull flag, while EUR/JPY never left its flag in the first place.

- Emerging strength in the DXY Index may prove to be another headwind for EUR/USD, which itself is 57.6% of the DXY Index.

- Per the IG Client Sentiment Index, the Euro has a bearish bias in the short-term.

Euro Plagued by Brexit, Year-End Profit Taking

The Euro has been among the top performing currencies in 2020, surging to two year highs versus the US Dollar in recent days. But with the holidays around the corner, worrying news of a new coronavirus mutation making its way across the UK, and the potential for Brexit to go off the cliff edge, traders are rightfully taking profit in some of the high fliers of the year. Both EUR/USD and EUR/JPY rates, which were poised for breakout attempts just a few short days ago, may now need to wait until the new year before taking another stab at a bullish advances.

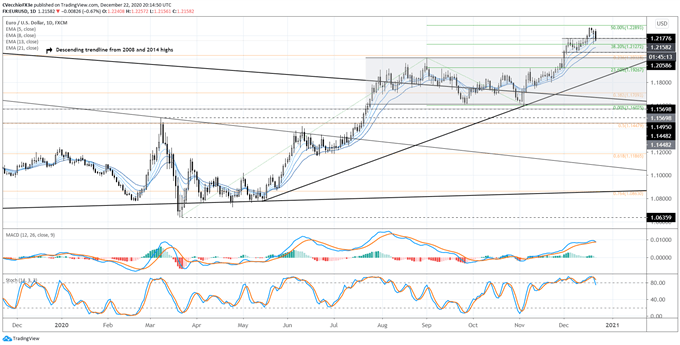

EUR/USD RATE TECHNICAL ANALYSIS: DAILY CHART (December 2019 to December 2020) (CHART 1)

EUR/USD rates are back in bull flag carved out in the first two-plus weeks of December, following the bullish breakout above sideways range resistance in place since late-June. It was previously noted that “the more near-term range carved out thus far in December between 1.2059 and 1.2178 (119-pips) suggests an immediate upside target of 1.2297.” EUR/USD reached a high of 1.2273 before turning lower last week. While near-term weakness suggests that EUR/USD could drop back to range support near 1.2059, it still holds that “final targets for a simple doubling of the broader range dating back to late-June would suggest gains through 1.2600 in the coming months.”

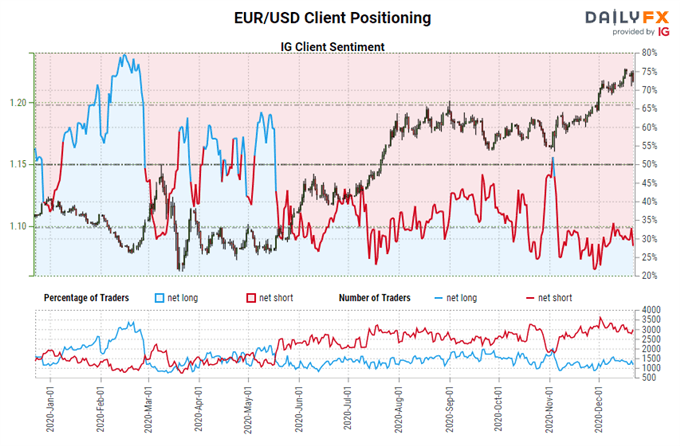

IG Client Sentiment Index: EUR/USD Rate Forecast (December 22, 2020) (Chart 2)

EUR/USD: Retail trader data shows 37.41% of traders are net-long with the ratio of traders short to long at 1.67 to 1. The number of traders net-long is 24.84% higher than yesterday and 19.06% higher from last week, while the number of traders net-short is 10.20% lower than yesterday and 20.76% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EUR/USD prices may continue to rise.

Yet traders are less net-short than yesterday and compared with last week. Recent changes in sentiment warn that the current EUR/USD price trend may soon reverse lower despite the fact traders remain net-short.

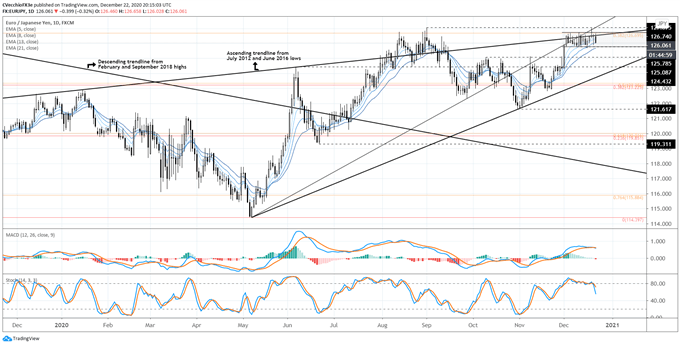

EUR/JPY RATE TECHNICAL ANALYSIS: DAILY CHART (December 2019 to December 2020) (CHART 3)

Unlike their counterpart, EUR/JPY rates never broke out of their bull flag; the consolidation continues. It thus still holds that “the more near-term range carved out thus far in December between 125.79 and 126.74 (95-pips) suggests an immediate upside target of 127.69.” Keeping it simple: until the range breaks, this pair is on the watchlist, nothing more. Unfortunately for traders, barring significant developments on Brexit, a EUR/JPY breakout may need to wait until the new year.

Longer-term, it is still the case that “a bullish breakout to fresh yearly highs above 127.08 would be a material accomplishment,” one that would warrant a longer-term bullish outlook for EUR/JPY rates.

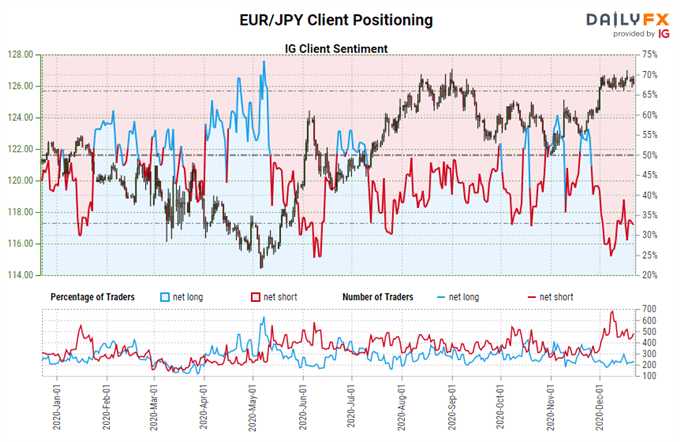

IG Client Sentiment Index: EUR/JPY Rate Forecast (December 22, 2020) (Chart 4)

EUR/JPY: Retail trader data shows 33.33% of traders are net-long with the ratio of traders short to long at 2.00 to 1. The number of traders net-long is 30.32% higher than yesterday and 20.71% lower from last week, while the number of traders net-short is 0.41% higher than yesterday and 4.70% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EUR/JPY prices may continue to rise.

Positioning is less net-short than yesterday but more net-short from last week. The combination of current sentiment and recent changes gives us a further mixed EUR/JPY trading bias.

--- Written by Christopher Vecchio, CFA, Senior Currency Strategist