Euro Forecast Overview:

- The Euro continues to give back some of its recent rally, but key technical levels suggesting that the bullish breakout attempts have failed have not been triggered.

- Both EUR/JPY and EUR/USD rates have seen topside wicks develop over the past several daily candlesticks, suggesting that overhead supply is keeping gains in check ahead of the December ECB meeting.

- Per the IG Client Sentiment Index, the Euro has a mixed if not bearish bias in the short-term.

Euro Treading Water Between Brexit and ECB

After an explosive first week of December, the Euro finds itself treading water and giving back gains at a modest clip midway through the second week of the month. That’s not to say that sellers have control; indeed, all of the major EUR-crosses are still above their daily 5-EMA, an indication of strong bullish momentum in the short-term.

Instead, traders have taken a more cautious approach following the Euro’s breakout attempts, as the specter of a ‘no deal, hard Brexit’ has crept back into the picture, while the December European Central Bank rate decision brings forth the prospect of some effort to try and cap the Euro gains (if not directly, indirectly vis-à-vis enhanced monetary policy operations). That said, these may be short-term concerns provoking the churn in EUR-crosses. Consistent with our Monday Euro forecast update, the pause in the Euro rally doesn’t necessarily mean that the bullish outlook has been negated.

Read more: FX Week Ahead: December ECB Rate Decision & EUR/USD Rate Forecast

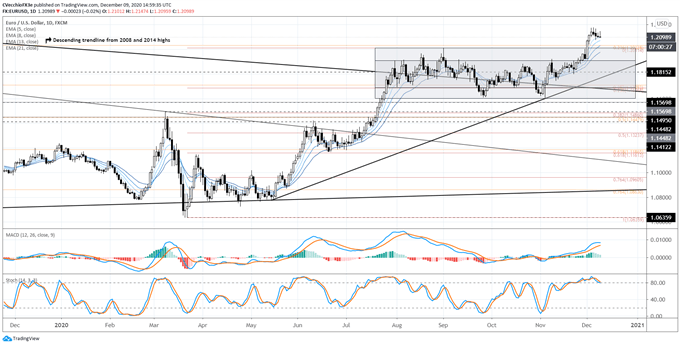

EUR/USD RATE TECHNICAL ANALYSIS: DAILY CHART (December 2019 to December 2020) (CHART 1)

EUR/USD rates have followed up Monday’s candle – not quite a doji, not quite a bearish engulfing bar – with modest weakness. The hammer candle on Tuesday proved to be an inside day, and price action has seen another long wick form on the topside thus far today. This may simply be the digestion phase of a pair that has recently experienced a bullish breakout above sideways range resistance in place since late-June. It still holds that final targets for a simple doubling of the broader range dating back to late-June would suggest gains through 1.2600 in the coming months.

Amid several weeks of EUR/USD rates maintaining their elevation above the downtrend from the 2008 and 2014 highs (from the all-time high), the short-term weakness does little to change the longer-term bullish outlook. EUR/USD rates are holding their daily 5-, 8-, 13-, and 21-EMA envelope, which is in bullish sequential order. Daily MACD is still trending higher above its signal line, while Slow Stochastics are pulling back but still remain in overbought territory.

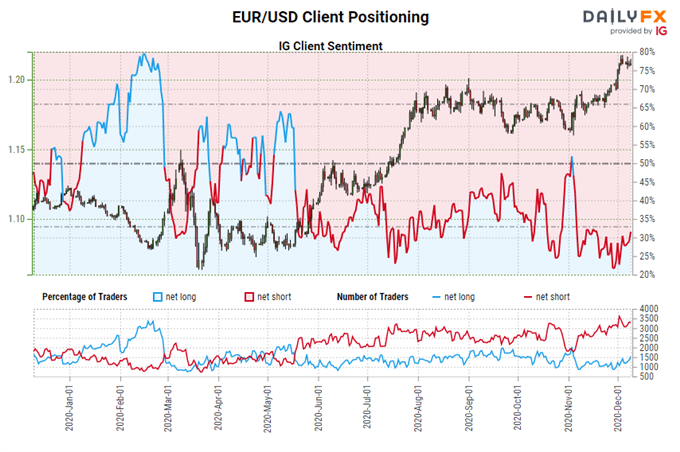

IG Client Sentiment Index: EUR/USD Rate Forecast (December 9, 2020) (Chart 2)

EUR/USD: Retail trader data shows 31.85% of traders are net-long with the ratio of traders short to long at 2.14 to 1. The number of traders net-long is 3.73% higher than yesterday and 25.93% higher from last week, while the number of traders net-short is 2.11% lower than yesterday and 10.83% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EUR/USD prices may continue to rise.

Yet traders are less net-short than yesterday and compared with last week. Recent changes in sentiment warn that the current EUR/USD price trend may soon reverse lower despite the fact traders remain net-short.

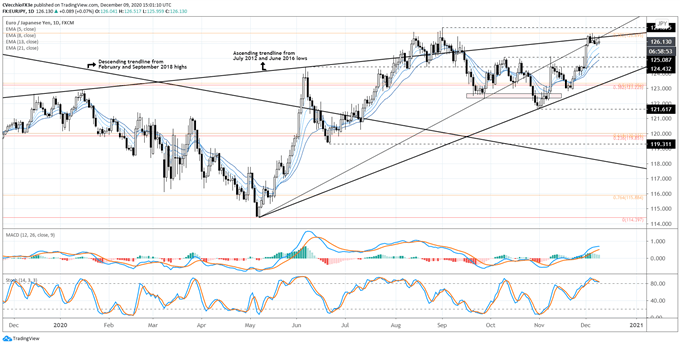

EUR/JPY RATE TECHNICAL ANALYSIS: DAILY CHART (December 2019 to December 2020) (CHART 3)

EUR/JPY rates, like their EUR/USD counterpart, have experienced light selling pressure in recent days as evidenced by the long wicks formed on the daily candles, indicative of sellers taking control by the end of the session. But momentum indicators remain bullish. EUR/JPY rates are still above the daily 5-, 8-, 13-, and 21-EMA envelope, which is in bullish sequential order. Daily MACD is trending higherabove its signal line, while Slow Stochastics are holding in overbought condition.

Despite near-term churn, EUR/JPY rates are holding near their highest level since early-September, having stalled just below the 38.2% Fibonacci retracement of the 2016 low/2018 high range at 126.70. Furthermore, EUR/JPY rates have found resistance at the ascending trendline from the July 2012 and June 2016 lows, a trendline that has been tested multiple times the past year. As a result, a bullish breakout to fresh yearly highs above 127.08 would be a material accomplishment – and one that can’t be dismissed, particularly if the ECB fails in its efforts to restrain the Euro on Thursday.

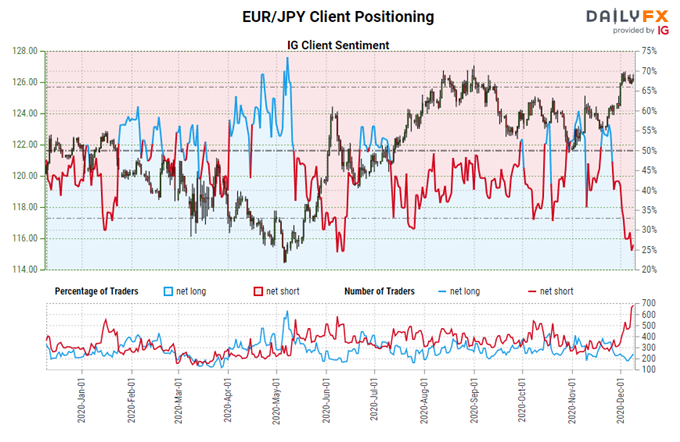

IG Client Sentiment Index: EUR/JPY Rate Forecast (December 9, 2020) (Chart 4)

EUR/JPY: Retail trader data shows 29.91% of traders are net-long with the ratio of traders short to long at 2.34 to 1. The number of traders net-long is 7.66% higher than yesterday and unchanged from last week, while the number of traders net-short is 12.92% lower than yesterday and 34.16% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EUR/JPY prices may continue to rise.

Positioning is less net-short than yesterday but more net-short from last week. The combination of current sentiment and recent changes gives us a further mixed EUR/JPY trading bias.

--- Written by Christopher Vecchio, CFA, Senior Currency Strategist

.jpg)