Euro Forecast Overview:

- No news may be good news for the Euro over the coming days, given how generally disappointing economic data releases have been otherwise.

- Overnight index swaps are currently pricing in an 87% chance of no change in rates at the October ECB meeting. Overall, there is a 34% chance of 10-bps of rate cuts by the end of the year.

- Retail trader positioning, per the IG Client Sentiment Index, suggests that there may be more room for EURUSD gains.

See our long-term forecasts for the Euro and other major currencies with the DailyFX Trading Guides.

Euro’s Strong Start to October and Q4’19

The Euro has had a strong start to the new month and new quarter. Only one EUR-cross is lower through month-to-date, EURJPY, down by -0.20%. Otherwise, gains have been plentiful and have continued to build: EURCAD is the top performer, adding 1.32% thus far, while EURAUD and EURUSD rates are close behind, having gained 0.92% and 0.86%, respectively. The Euro’s gains are coming at a time when traders’ collective attention has turned back to Brexit and the US-China trade war.

Eurozone Economic Data Remains Weak, However

The forex economic calendar is rather empty on the Eurozone side of things this week. In context of recent data performances, that may be a positive development for the Euro: no news may be goods news. Eurozone economic data has continued to produce disappointing results over the past several months, at least when trying to look at economic data from an objective point of view. The Citi Economic Surprise Index for the Eurozone, a gauge of economic data momentum, is down to -76.7 today from -34.1 one-month ago on September 9 and -13 on July 8.

Eurozone Inflation Expectations Hold Near Yearly Lows

Outgoing ECB President Mario Draghi’s preferred measure of inflation, the Eurozone 5y5y inflation swap forwards, currently are trading at 1.131%, lower than where they were one month earlier at 1.245%, a drop of -11.4-bps. Eurozone inflation expectations are barely above the yearly low set last week on October 3 at 1.115%.

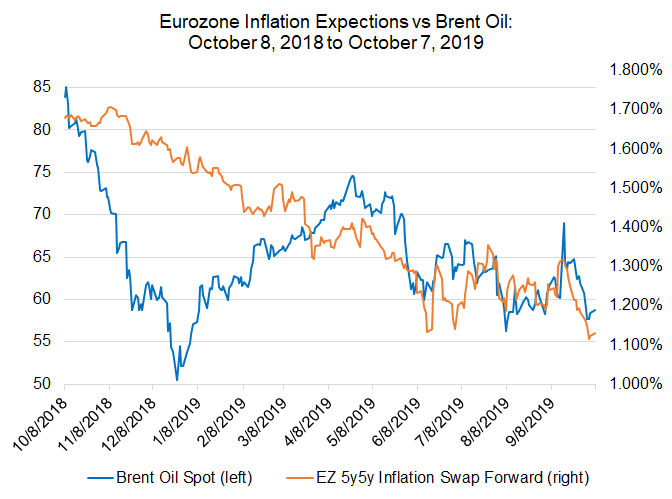

Eurozone Inflation Expectations versus Brent Oil Prices: Daily Timeframe (October 2018 to October 2019) (Chart 1)

The relationship between Eurozone 5y5y inflation swap forwards and Brent oil prices has tightened up over the past few weeks. The current 20-day correlation between Eurozone inflation expectations and Brent oil prices is 0.69; one month ago, on September 9, the 20-day correlation was a mere 0.14.

More ECB Easing is Coming – Waiting on Lagarde

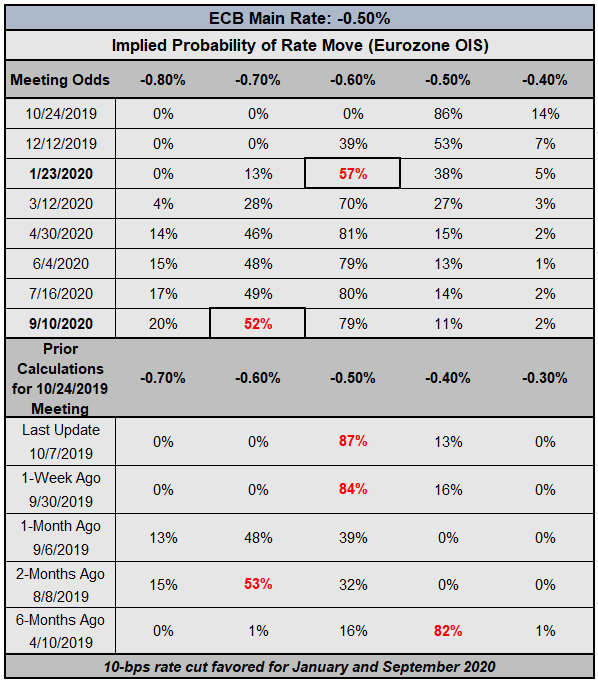

ECB interest rate expectations have evolved in weeks to the runup to outgoing ECB President Draghi’s exit at the end of the month. At the start of August, there was a 53% chance for the ECB to lower its main deposit rate to -0.60% at the October ECB meeting; at the start of September, these odds were 48%. However, there is now 0% chance of a rate cut later this month.

European Central Bank Interest Rate Expectations (October 7, 2019) (Table 1)

Instead, overnight index swaps are pricing in a 87% chance of no change in rates at the October ECB meeting – and a 13% chance of a 10-bps rate hike. There is a 39% chance of a 10-bps rate cut before the end of the year, although overnight index swaps suggest that the next rate cut is most likely to come in January 2020 (57%). Of course, with outgoing ECB President Draghi set to be replaced by Christine Lagarde in a few weeks, it’s very possible that ECB rate expectations recalibrate once the new Governing Council takes shape.

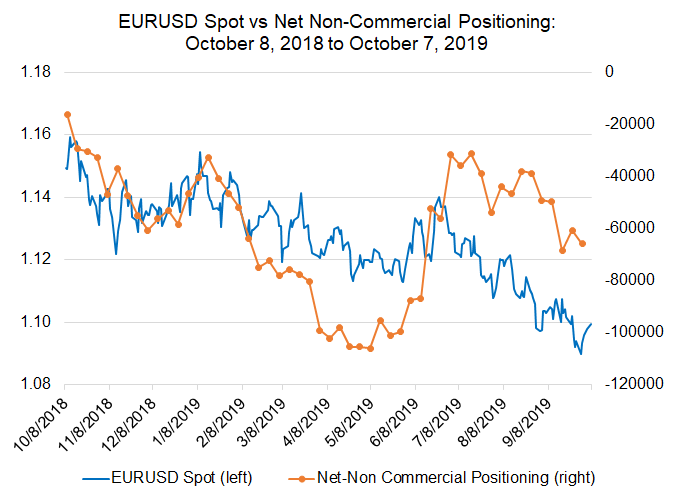

EURUSD Rate versus COT Net Non-Commercial Positioning: Daily Timeframe (October 2018 to October 2019) (Chart 2)

Looking at positioning, according to the CFTC’s COT report for the week ended October 1, speculators increased their net-short Euro positions from 60.7K to 66K contracts. But the period closed before the rebound by the Euro at the end of the week; it is likely that there is a reduction in net-short futures positioning in the next COT report update on October 11.

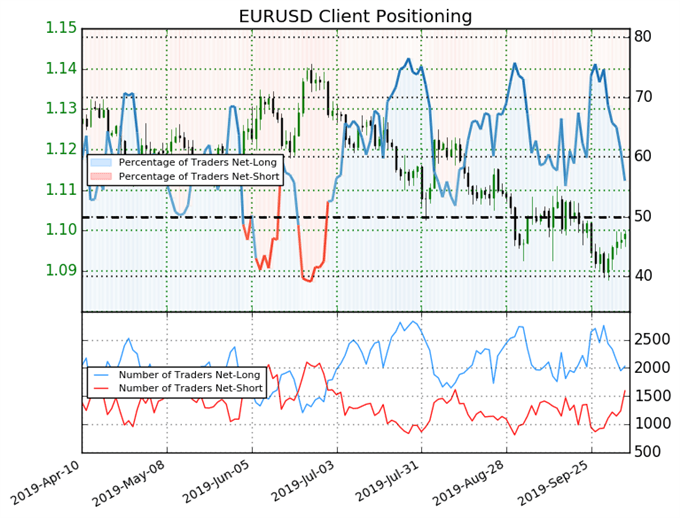

IG Client Sentiment Index: EURUSD Rate Forecast (October 7, 2019) (Chart 3)

EURUSD: Retail trader data shows 56.0% of traders are net-long with the ratio of traders long to short at 1.27 to 1. In fact, traders have remained net-long since July 1 when EURUSD traded near 1.1221; price has moved 2.0% lower since then. The percentage of traders net-long is now its lowest since Sep 18 when EURUSD traded near 1.10307. The number of traders net-long is 4.2% lower than yesterday and 23.9% lower from last week, while the number of traders net-short is 27.3% higher than yesterday and 51.7% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests EURUSD prices may continue to fall. Yet traders are less net-long than yesterday and compared with last week. Recent changes in sentiment warn that the current EURUSD price trend may soon reverse higher despite the fact traders remain net-long.

FX TRADING RESOURCES

Whether you are a new or experienced trader, DailyFX has multiple resources available to help you: an indicator for monitoring trader sentiment; quarterly trading forecasts; analytical and educational webinars held daily; trading guides to help you improve trading performance, and even one for those who are new to FX trading.

--- Written by Christopher Vecchio, CFA, Senior Currency Strategist

To contact Christopher, email him at cvecchio@dailyfx.com

Follow him in the DailyFX Real Time News feed and Twitter at @CVecchioFX