Talking Points:

- The Bank of England voted to hold rates 6-2 earlier today, and their updated economic projections were much more dovish than markets anticipated.

- Outside engulfing bars and key reversals in several GBP-crosses suggest that we may be at the end of the road of British Pound strength.

- See our Q3'17 forecasts for the British Pound, Euro, US Dollar, and more.

Upcoming Webinars for Week of July 30 to August 4, 2017

Friday at 8:15 EDT/12:15 GMT: Live Event Coverage: US NFPs (JUL)

See the full DailyFX Webinar Calendar for other upcoming strategy sessions

After the British Pound rallied for weeks on speculation that the Bank of England would join the growing chorus of central banks looking to tighten policy, it appears that Governor Mark Carney and the Monetary Policy Committee may have stopped bullish Sterling momentum in its tracks.

The BOE's 6-2 vote to keep rates on hold today was the more dovish of two most likely voting outcomes (the other being a slightly more hawkish 5-3 outcome). But the true reason for the British Pound's decline after the policy announcement has to do with the economic forecasts contained in the Quarterly Inflation Report itself.

Chart 1: GBP/USD Daily Timeframe (October 2016 to August 2017)

The BOE's QIR was notably more dovish than its prior May iteration. The BOE cut growth forecasts for 2017 and 2018, while only upgrading its 2017 inflation forecast by +0.1%. You can read Market Analyst Nick Cawley's summary of the August QIR and rate decision here.

Chart 2: GBP/JPY Daily Timeframe (October 2016 to August 2017)

In sum, the stance the BOE took today, particularly with respect to inflation, hits the mark in terms of our longer-term expectation that British Pound rallies should be sold. As we wrote in the July 9 British Pound weekly trading forecast, "given that the statistical base effect of the June 2016 Brexit vote has now washed away and the British Pound is no longer down in the neighborhood of -15% to -20% year-over-year, inflation may no longer have the strong tailwind it has enjoyed for the past several months."

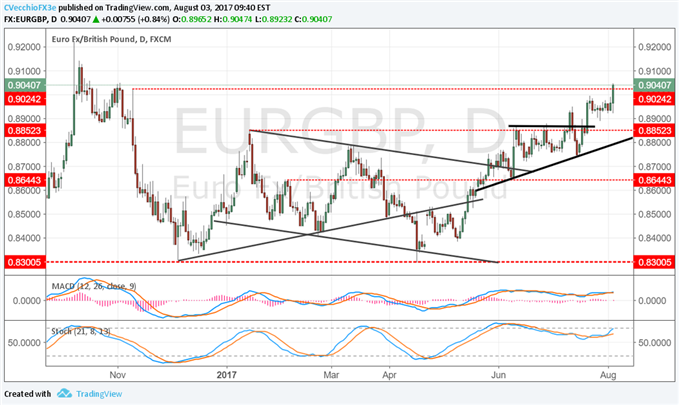

Chart 3: EUR/GBP Daily Timeframe (October 2016 to August 2017)

The developments today represent a subtle but meaningful shift in tone from the BOE, which in turn has spilled over to FX markets. Outside engulfing bars and key reversals in several GBP-crosses suggest that we may be at the end of the road of British Pound strength: EUR/GBP is working on a daily bullish outside engulfing bar; EUR/JPY is working on a daily bearish outside engulfing bar; and GBP/USD is working on a daily bearish key reversal.

See the above video for a technical review of the DXY Index, EUR/USD, GBP/USD, EUR/GBP, GBP/JPY, USD/JPY, AUD/JPY, Gold, Crude Oil, and US yields.

Read more: With USD/JPY at Support, EUR/JPY May Now Breakout

--- Written by Christopher Vecchio, Senior Currency Strategist

To contact Christopher Vecchio, e-mail cvecchio@dailyfx.com

Follow him on Twitter at @CVecchioFX

To be added to Christopher's e-mail distribution list, please fill out this form