- USD/CAD threatens outside-weekly reversal off technical resistance- risk below monthly open.

- Check out our 2019 projections in our Free DailyFX USD Trading Forecasts

- Join Michael for Live Weekly Strategy Webinars on Mondays at 12:30GMT

The Canadian Dollar is up nearly 0.5% against the US Dollar after reversing off a key technical confluence zone. The turn off eleven-week highs threatens a larger decline in price while below the objective monthly open. Here These are the updated targets and invalidation levels that matter on the USD/CAD weekly price chart. Review my latest Weekly Strategy Webinar for an in-depth breakdown of this Aussie price setup and more.

New to Forex Trading? Get started with this Free Beginners Guide

USD/CAD Price Chart – Loonie Weekly

Chart Prepared by Michael Boutros, Technical Strategist; USD/CAD on Tradingview

Notes: In last month’s Canadian Dollar Weekly Outlook in we noted that a four week advance in USD/CAD was targeting critical resistance, “at the 61.8% retracement of the May decline / 2019 high-week close at 1.3355/70...” Price marked a seven-week advance before finally registering a high this week at 1.3382 with USD/CAD now poised to mark an outside weekly-reversal if we close at these levels.

The decline tested support on Thursday at the median-line of the descending pitchfork formation we’ve been tracking off the 2018/2019 highs. A break / close below this trendline is needed to suggest a more significant high is in place targeting the 61.8% retracement of the July advance at 1.3156- look for a bigger reaction there IF reached with weakness beyond this point threatening a drop towards key confluence support at 1.2972-1.3015 where the yearly lows and the 100% extension converges on the 2017/2018 trendline. A topside breach above 1.3355/70 would still have to deal with the highlighted resistance confluence near 1.3430s.

For a complete breakdown of Michael’s trading strategy, review his Foundations of Technical Analysis series on Building a Trading Strategy

Bottom line: USD/CAD turned from a technically significant resistance zone this week with the reversal of a near two-month long rally risking further losses for the Dollar. From a trading standpoint, expect sideways to lower from here- look for resistance ahead of the September open at 1.3314 IF price has indeed turned the corner here. I’ll publish an updated USD/CAD Trade Outlook once we get further clarity in near-term price action.

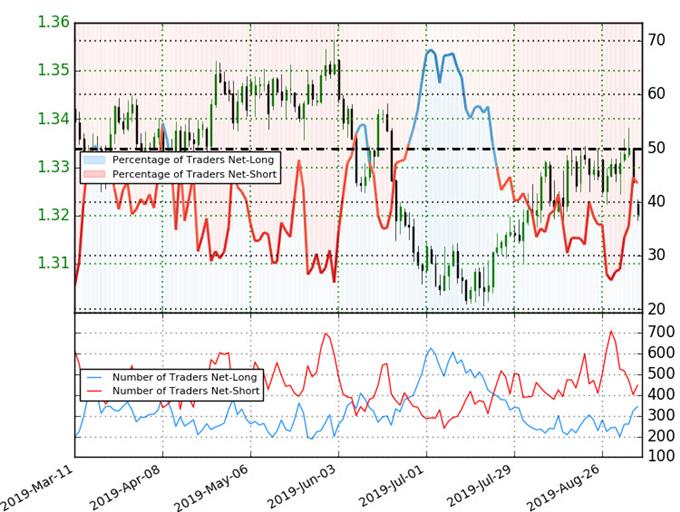

USD/CAD Sentiment – Loonie Price Chart

- A summary of IG Client Sentiment shows traders are net-short USD/CAD- the ratio stands at -1.3 (43.5% of traders are long) – weak bullishreading

- Traders have remained net-short since July 23rd; price has moved 1.2% higher since then

- Long positions are32.8% higher than yesterday and 41.0% higher from last week

- Short positions are 12.5% lower than yesterday and 36.3% lower from last week

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests USD/CAD prices may continue to rise. Yet traders are less net-short than yesterday and compared with last week. Recent changes in sentiment warn that the current USD/CAD price trend may soon reverse lower despite the fact traders remain net-short.

See how shifts in Loonie retail positioning are impacting trend- Learn more about sentiment!

---

Previous Weekly Technical Charts

- Euro (EUR/USD)

- Australian Dollar (AUD/USD)

- US Dollar Index (DXY)

- Sterling (GBP/USD)

- Gold (XAU/USD)

- Silver (XAG/USD)

--- Written by Michael Boutros, Technical Currency Strategist with DailyFX

Follow Michael on Twitter @MBForex