- USD/JPY breaks below downtrend support, near-term risk remains lower sub-110.23

- Check out our 2018 USD/JPY quarterly projections in our Free DailyFX Trading Forecasts

- Join Michael for Live Weekly Strategy Webinars on Mondays at 12:30GMT

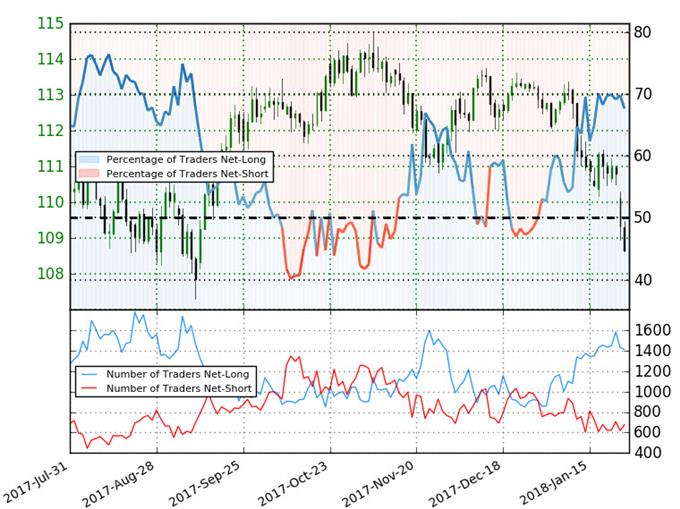

USD/JPY Daily Chart

Technical Outlook: Earlier this month we highlighted the break of a key range in USD/JPY, shifting the focus lower in the pair. A rebound off confluence support at 110.15/23 last week had us looking for a rebound to sell, while noting that “ultimately a rally should offer more favorable short entries near structural resistance of the current downslope. A break below the weekly opening range lows would mark resumption with subsequent support targets eyed at 109.86 and 109.55.”

Price has now dropped below our targets with the break of a downtrend support, keeping the risk lower in USD/JPY. Interim support is being tested here at the 50% retracement of the 2017 advance at 108.72and a daily close below this threshold would keep the focus on subsequent support targets at the 2017 low-day close at 107.84 and the 61.8% extension a 107.45/50.

New to Forex Trading? Get started with this Free Beginners Guide

USD/JPY 240min Chart

Notes: A closer look at near-term price action highlights an objective break of the weekly opening range on Tuesday with the downside break of multiple descending slope lines further accelerating the decline. Interim resistance now stands back at 109.55 with broader bearish invalidation now lowered to 110.15/23.

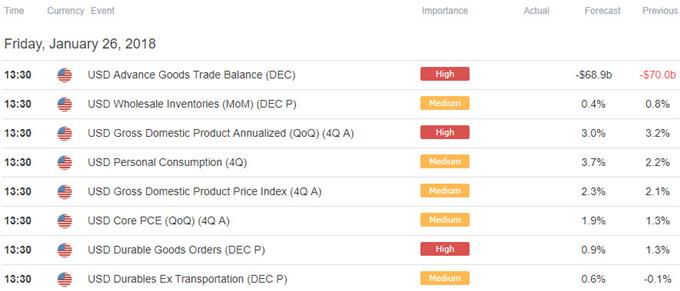

Bottom line: I’ll favor fading strength sub-109.54 for now, ultimately looking for a drop into near-term support objectives at 108.17, 107.84 and 107.45/50 – both levels of interest for possible exhaustion / long-entries IF reached. Keep in mind U.S. 4Q GDP (Gross Domestic Product) figures are on tap tomorrow with the release likely to fuel added volatility in the USD crosses.

For a complete breakdown of Michael’s trading strategy, review his Foundations of Technical Analysis mini-series

USD/JPY IG Client Sentiment

- A summary of IG Client Sentiment shows traders are net-long USDJPY- the ratio stands at +2.09 (67.7% of traders are long) – bearishreading

- Retail has remained net-long since Dec 29th; price has moved 4.0% lower since then

- Long positions are 2.8% higher than yesterday and 4.2% lower from last week

- Short positions are 10.8% lower than yesterday and 3.0% lower from last week

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests USDJPY prices may continue to fall. However, retail is more net-long than yesterday but less net-long from last week and the combination of current positioning and recent changes gives us a further mixed USDJPY trading bias from a sentiment standpoint.

See how shifts in USD/JPY retail positioning are impacting trend- Click here to learn more about sentiment!

---

Relevant USD/JPY Data Releases

Why does the average trader lose? Avoid these Mistakes in your trading

Other Setups in Play

- AUD/JPY Outlook Hinges on Break of Monthly Opening

- GBP/USD Breakout Underway - Topside Targets in View

- AUD/USD Rally Approaching Initial Resistance Targets

- Weekly Technical Outlook- USD Warning Signs of Stretched Price Action

- Written by Michael Boutros, Currency Strategist with DailyFX

To receive Michael’s analysis directly via email, please SIGN UP HERE

Follow Michael on Twitter @MBForex or contact him at mboutros@dailyfx.com