To receive Michael’s analysis directly via email, please SIGN UP HERE

- Bitcoin prices plummet nearly 50% off the highs- Breakdown approaching initial support targets

- Check out our 2018 quarterly projections in our Free DailyFX Trading Forecasts

- Join Michael for Live Weekly Strategy Webinars on Mondays at 12:30GMT

BTC/USD Daily Chart (Log)

Technical Outlook: Bitcoin broke a multi-month consolidation pattern off the December record highs with an objective break of the monthly opening-range lows / slope support unleashing a 30% sell-off in prices. The decline has taken out confluence support at 11160 with a near-term confluence support-zone eyed at 8354-8729. This is the first major hurdle for the sell-off and IF price is going to rebound, this would be the spot to look.

New to Bitcoin Trading? Get started with this Free Beginners Guide

BTC/USD 240min Chart (Log)

Notes: A closer look at near-term price action highlights a rebound today off the 61.8% retracement of the September advance at 9303 with price broadly trading within the confines of a descending pitchfork formation. Subsequent support targets rest just lower at 8643-8729 backed by 8337- both areas IF reached would be of interest for near-term exhaustion / long-entries. A break / daily close below this threshold would risk considerable losses with such a scenario targeting the 200-day moving average around ~7138.

Why does the average trader lose? Avoid these Mistakes in your trading

Interim resistance stands at 11160 backed by 11978 – and area of interest for re-entry on the short-side. Near-term bearish invalidation stands with the upper parallel at 13074- ultimately, a break above 15338 would be required to mark resumption of the broader uptrend.

Bottom line: the immediate decline is at risk as we approach near-term structural support with a rebound in price to offer more favorable short-entries targeting the aforementioned support targets. From a trading standpoint, look for signs of a near-term exhaustion low in price for the rebound - but ultimately looking lower.

For a complete breakdown of Michael’s trading strategy, review his Foundations of Technical Analysis mini-series

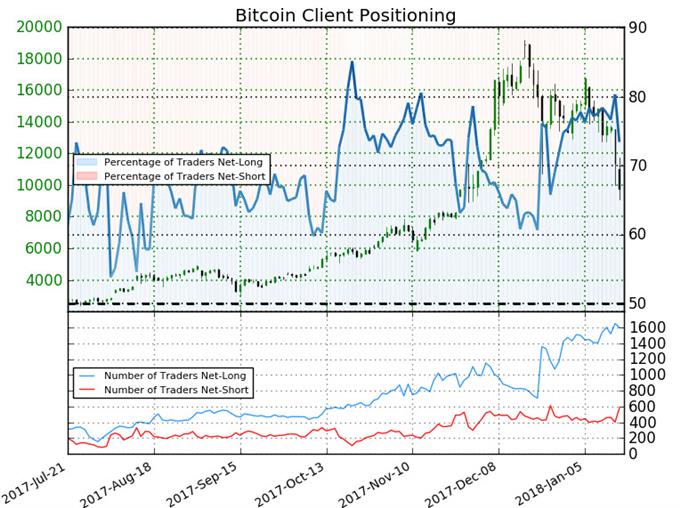

- A summary of IG Client Sentiment shows traders are net-long Bitcoin- the ratio stands at +2.76 (73.4% of traders are long) – bearishreading

- The percentage of traders net-long is now its lowest since Jan 2nd; Bitcoin traded near 14697

- Long positions are 2.3% lower than yesterday and 13.7% higher from last week

- Short positions are 39.9% higher than yesterday and 37.5% higher from last week

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests Bitcoin prices may continue to fall. Yet traders are less net-long than yesterday and compared with last week. Recent changes in sentiment warn that the current Bitcoin price trend may soon reverse higher despite the fact traders remain net-long.

See how shifts in Bitcoin retail positioning are impacting trend- Click here to learn more about sentiment!

---

Other Setups in Play

- Crude Oil Price Breakout Testing Initial Resistance Targets

- GBP/USD Monthly Range-Break Appears Imminent

- AUD/USD Price Rally Vulnerable- Pullback to Offer Opportunity

- Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michael on Twitter @MBForex or contact him at mboutros@dailyfx.com