To receive Michael’s analysis directly via email, please SIGN UP HERE

Talking Points

- AUD/USD testing slope support into the monthly / weekly open

- Check out our New 3Q AUD/USD projections in our Free DailyFX Trading Forecasts.

- Join Michael for Live Weekly Strategy Webinars on Mondays at 12:30GMT

AUD/USD Daily

Technical Outlook:AUD/USD reversed off trendline resistance extending off the 2016 highs last month with the decline testing the lower parallel of this ascending pitchfork formation as support for the past few days now. The focus now turns against this region heading into the start of the week. Note that daily momentum is also at support and highlights the risk for a rebound off this level.

AUD/USD 120min

Notes: A closer look at the 120min chart highlights an embedded descending channel and a breach above this formation (7631) would be needed to validate the reversal. For now, I’ll favor fading weakness while within this formation (today’s low) with a breach above of the weekly opening range highs targeting subsequent resistance objectives at 7658 & 7680.

Key support & broader bullish invalidation rests at 7560/67 - a break below this region risks a more significant correction towards the 200-day moving average at 7532 & 7517. Keep in mind the we’re pretty light on Aussie data this week so look for the dollar to drive price action with Janet Yellen’s semi-annual monetary policy testimony before congress highlighting this week’s event risk.

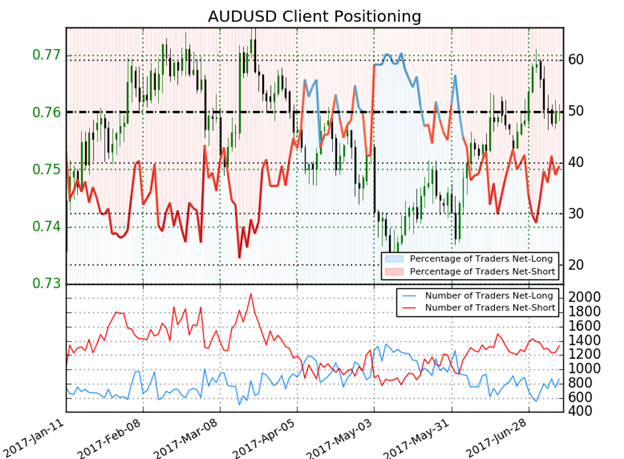

- A summary of IG Client Sentiment shows traders are net-short AUDUSD- the ratio stands at -1.54 (39.3% of traders are long) - bullish reading

- Retail has been net-short since June 4th; price has moved 2.4% higher since then

- Long positions are 13.3% higher than yesterday and 30.8% higher from last week

- Short positions are 7.4% higher than yesterday but6.7% lower from last week

- We typically take a contrarian view to crowd sentiment,and the fact traders are net-short suggests AUDUSD prices may continue to rise. That said, positioning is less net-short than yesterday and compared with last week and the recent changes in sentiment warn that the current price trend may soon reverse lower despite the broader bearish signal. Bottom line: Aussie could be at a make-or-break level.

Learn how shifts in AUD/USD retail positioning are effecting price- Click here for more!

---

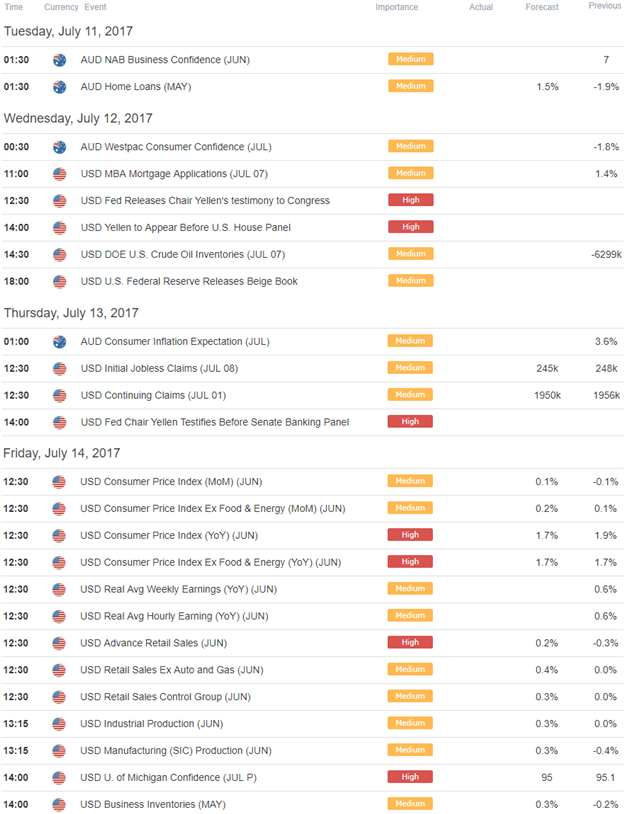

Relevant Data Releases

Other Setups in Play:

- Strategy Webinar: Dollar Crosses, Gold in Focus as Yellen takes Center Stage

- USD/CAD Breakdown Takes a Reprieve- Rebound to Offer Opportunity

- Strategy Webinar: Gold, Crude Prices in Focus as USD Rebounds

- AUD/USD Runs to Highs as Dollar Sell-off Deepens

- Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michael on Twitter @MBForex or contact him at mboutros@dailyfx.com.