Talking Points

- GBP/CAD responds to confluence support ahead of key CAD data

- Updated targets & invalidation levels

- Click Here to be added to Michael’s email distribution list.

GBP/CAD Daily

Technical Outlook: GBPCAD is responding to confluence support at 1.6357 where the 61.8% retracement of the October advance converges on the median-line of the embedded descending pitchfork extending off the November highs. The immediate short-bias is at risk while above this threshold and heading into tomorrow’s Canada employment report, the focus is against this key support zone. Resistance is eyed at the upper parallel (blue) with a breach above the August low-day close at 1.6641 needed to validate a breakout. That said, keep in the mind that the broader focus remains weighted to the shorts-side while within this larger descending channel formation off the January 2016 high.

GBP/CAD120min

Notes: The pair rebounded off the median-line with precision this week with the rally now approaching initial resistance at the 50-line around ~1.6455. Subsequent topside objectives are eyed at 1.6506 & the monthly open at 1.6580. Note that this level converges on the upper median-line parallel & may offer more rigid resistance – area of interest for possible exhaustion / short-entries. A breach above the 38.2% retracement / August low-day close at 1.6624/41 would be needed to suggest a more significant low is in place with such a scenario targeting 1.6742, the 61.8% retracement at 1.6813 & channel resistance (currently ~1.6940s).

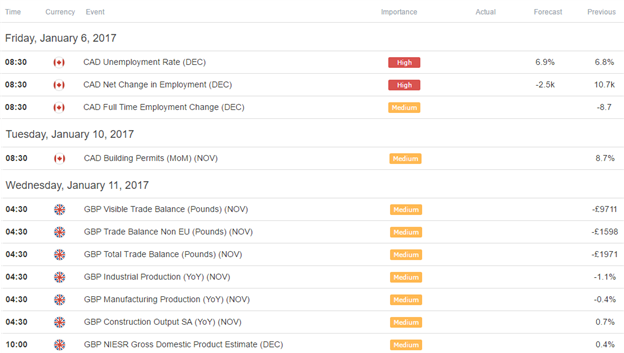

A break below the median-line invalidates the reversal play and puts the broader short-bias in play targeting the 76.4% retracement (which converges on the lower 50-line) at 1.6177. Keep in mind this is a wider range setup with a quarter of the daily average true-range (ATR) yielding profit targets of 35-40pips per scalp. Added caution is warranted heading into tomorrow’s Canada employment report with the release likely to fuel added volatility in the Loonie crosses. Consensus estimates are calling for a contraction of 2.5K jobs in December, pushing the headline unemployment rate up to 6.9% from 6.8% a month earlier.

Relevant Data Releases

Other Setups in Play:

- AUD/USD NFP Game Plan- Constructive Above of 7280

- NZD/USD at Key Inflection Point- Strength to be Sold Sub-7075

- AUD/NZD Responds to Multi-Year Slope- Short Bias at risk above 1.03

- Gold Weakness to Subside With Fed on Hold in First-Half of 2017

- Japanese Yen Poised to Fall Further for Two Key Reasons

Looking for more trade ideas? Review DailyFX’s 2016 4Q Projections

---Written by Michael Boutros, Currency Strategist with DailyFX

Join Michael for Live Weekly Trading Webinars on Mondays on DailyFX at 13:30 GMT (8:30ET)

FollowMichael on Twitter @MBForex or contact him at mboutros@dailyfx.com