Talking Points

- AUDJPY testing support- outlook bearish sub-87.54

- Updated targets & invalidation levels

- Event Risk on Tap This Week

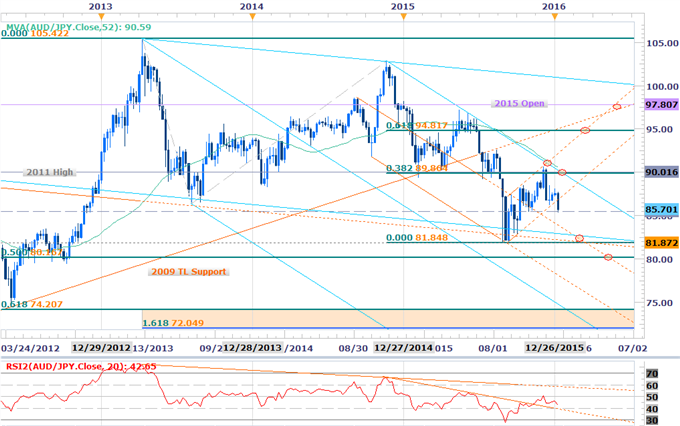

AUDJPY Weekly

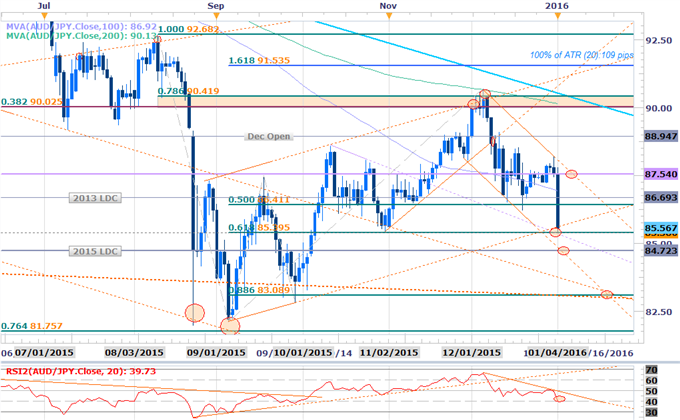

AUDJPY Daily

Chart Created Using FXCM Marketscope 2.0

Technical Outlook: AUDJPY is trading within the confines of a well-defined descending channel formation with today’s sell-off taking the pair into a key support range at 85.40/47. This region is defined by the 61.8% retracement of the September advance, the 2015 low-week reversal close and former trendline resistance. The immediate short-bias is at risk while above this level, but we’ll be looking to sell rallies / short-triggers on a rebound.

Resistance stands at 86.41/69 with our near-term bearish invalidation set to the 2016 open at 87.54. A breach above 90.02/42 would be needed to shift the broader outlook back to the topside for the AUDJPY. Note that daily RSI is now testing the 40-threshold as support and a break below alongside a move sub-85.40 keeps the short-bias in play targeting the 2015 low-day close at 84.72 / channel support and the highlighted confluence at 83.09.

Avoid the pitfalls of near-term trading strategies by steering clear of classic mistakes. Review these principles in the "Traits of Successful Traders” series.

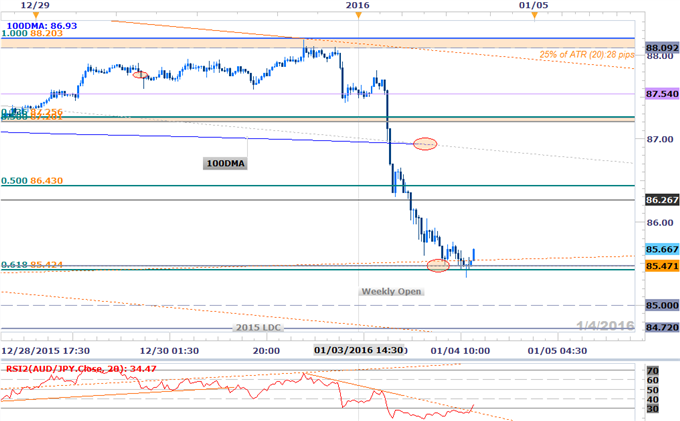

AUDJPY30min

Notes:Today’s abrupt market sell-off saw the pair break below the 100DMA before testing key support at 85.42/47. Momentum divergence into the lows followed by a resistance trigger break has us holding longs here, but we’re only looking to play the rebound. We’ll be looking to sell rallies / support triggers on a rebound with a break of support targeting 85 & 84.742.

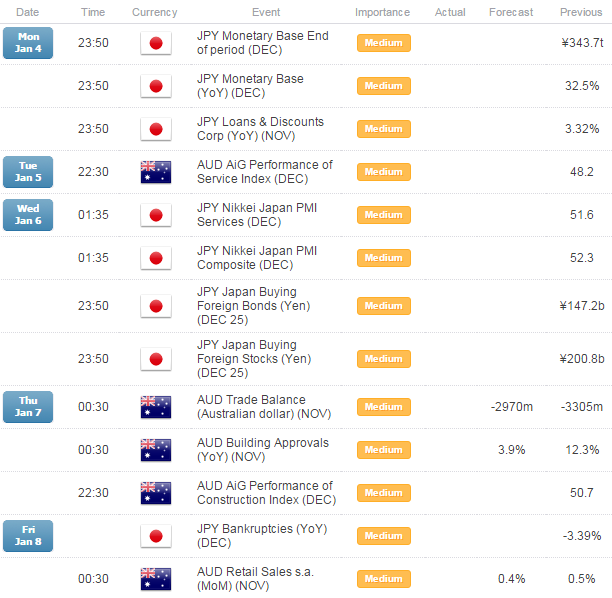

Interim resistance stands at 86.26/43 backed by the 200DMA at 86.93 & 87.20/25. Near-term bearish invalidation rests with the monthly/yearly open at 87.54. A quarter of the daily average true range (ATR) yields profit targets of 27-30pips per scalp. Added caution is warranted heading into Australian data later this week with Trade Balance & Retail Sales data on tap Ahead of Friday’s highly anticipated US Non-Farm Payrolls report.

For updates on this setup and more throughout the week, subscribe to SB Trade Desk and take advantage of the DailyFX New Subscriber Discount!

Relevant Data Releases

Other Setups in Play:

- EUR/AUD Coils Below 1.53 Resistance- Break Imminent?

- USDOLLAR Post-Fed Rally Eyes First Hurdle- Bullish Above 12146

- Webinar: All Eyes on FOMC- US Dollar Hangs in the Balance

- GBP/USD Rebound Targets Major Resistance Ahead of BoE

- GBP/NZD Rebound in Jeopardy as RBNZ/BOE Rate Decisions Loom

---Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michaelon Twitter @MBForex contact him at mboutros@dailyfx.com or ClickHere to be added to his email distribution list

Join Michael for Live Scalping Webinars on Mondays on DailyFX and Tuesday, Wednesday & Thursday’s on SB Trade Desk at 12:30 GMT (8:30ET)