Talking Points

- USDCAD Fails ahead of 1.28-resistance

- Short scalps favored sub 1.2716/28

- Event Risk on Tap ThisWeek

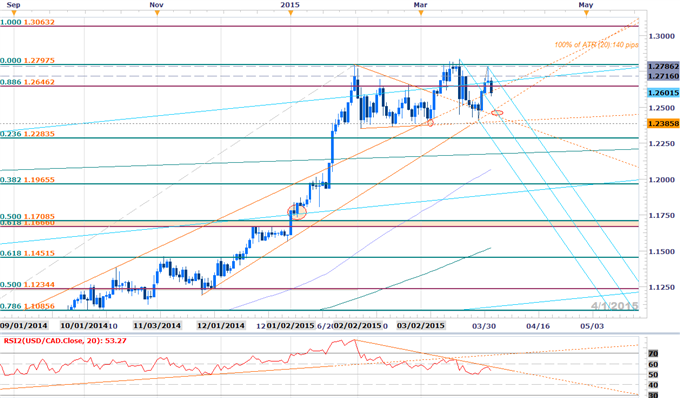

USD/CAD Daily

Chart Created Using FXCM Marketscope 2.0

Technical Outlook

- USDCAD Fails at March highs – High risk for reversal while sub-1.27

- Daily support at the ML off the highs near 1.2500 (bullish invalidation at 1.2385)

- Daily RSI holding sub-60 with resistance trigger pending

- Momentum break sub-50 with move sub 1.25 in price to validate reversal

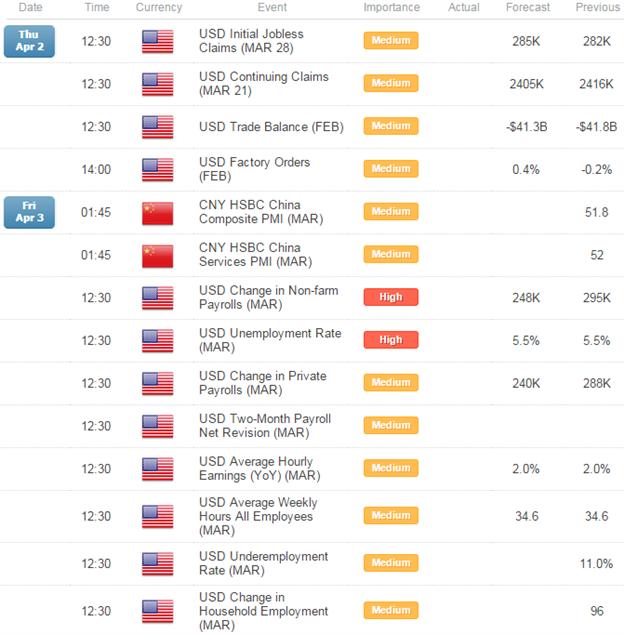

- Event Risk Ahead: US Non-Farm Payrolls (NFPs) on Friday

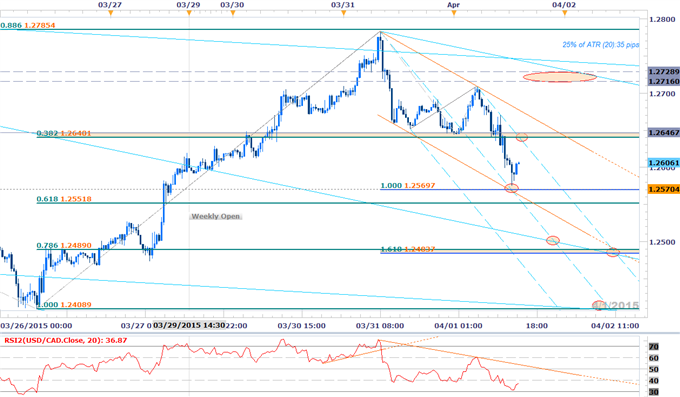

USD/CAD 30min

Notes:The turnover just ahead of the 2015 close-highs at 1.2786 has fueled a near-term reversal in USDCAD with the pair trading more than 200pips (-1.6%) off the highs before rebounding during US trade today. Note that intraday momentum has now marked its first 40-break of the week and we’ll look for hold sub-60 / support trigger breaks on subsequent rebounds with near-term resistance eyed at 1.2640/46 backed by basic TL resistance off the weekly high with our broader bearish invalidation eyed at 1.2716/28.

Bottom line: the pair remains at risk for a break lower while sub-1.2716/28 with a break below key support at 1.2483/90 needed to confirm a larger scale reversal pattern for the loonie. A breach above the broader upper median line parallel invalidates the short-bias with such a scenario targeting scalps into 1.2785 & 1.2830. A quarter of the daily ATR yields profit targets of 32-35 pips per scalp. Caution is warranted heading into key the April opening range here with Friday’s release of the US Non-Farm Payrolls report likely to generate added volatility in dollar crosses.

* It’s extremely important to give added consideration regarding the timing of intra-day scalps with the opening ranges on a session & hourly basis offering further clarity on intra-day biases.

Relevant Data Releases

Other Setups in Play:

- EURAUD Scalps Target Weekly Opening Range- Longs at Risk Sub-1.4175

- Scalp Webinar: USD Defends Support Slope- Bulls at Risk Ahead of NFP

- AUDUSD Reversal Scalp- Shorts Favored Sub 7850

- EURJPY Long Scalps at Risk Below FOMC High- Interim Support 130.60

- Webinar: Scalps Favor Dollar Correction- EUR/USD Eyes FOMC Highs

---Written by Michael Boutros, Currency Strategist with DailyFX

For updates on this scalp and more setups follow him on Twitter @MBForex

To contact Michael email mboutros@dailyfx.com or Click Here to be added to his email distribution list

Join Michael for Live Scalping Webinars on Mondays on DailyFX at 12:30 GMT (8:30ET)

Interested in learning about Fibonacci? Watch this Video