Talking Points

- EURJPY targeting initial resistance at FOMC highs

- Long scalp bias at risk sub-131.80

- Event Risk on Tap ThisWeek

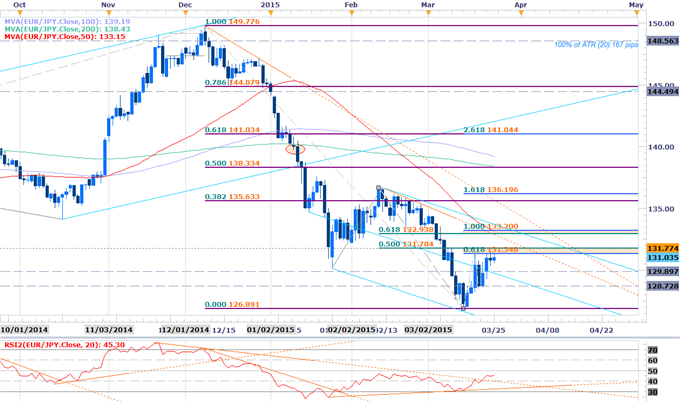

EUR/JPY Daily

Chart Created Using FXCM Marketscope 2.0

Technical Outlook

- EURJPY rebound now testing initial resistance 131.35/78

- Breach targets resistance objectives at 132.94-133.20 & Dec TL resistance

- Daily support at 129.89 / median-line (near-term bullish invalidation) backed by 128.73

- Look for a 50/60-hold in momentum into these resistance targets

- Pending RSI support trigger- divergence – Break below would be bearish

- Event Risk Ahead: Japanese Consumer Price Index (CPI) tomorrow

EUR/JPY 30min

Notes:EURJPY is testing a key near-term resistance zone defined by the FOMC spike high, the 61.8% extension of the advance off the monthly low, the 50% retracement of the February decline and basic TL resistance dating back to the March 24th high at 131.35/79. Longs into this region are at risk near-term (bearish invalidation) with a break below interim support at 130.60 / lower median-line parallel (blue) shifting the scalp bias to the short-side of the pair targeting the weekly open at 129.89 (also the exact 38.2% retracement). Subsequent support objectives eyed at 129.31 (weekly low & 50% retrace) & 128.75.

Bottom line: we’re looking for a reaction off this resistance level with a break of the pending RSI support trigger alongside a move sub-130.60 targeting the weekly open. A breach of the 131.79 barrier invalidates our near-term bias targeting objectives at 132.28 & key resistance at 132.95-133.20. Caution is warranted heading into CPI data out of Japan later this week with the release likely to fuel added volatility in Yen crosses.

* It’s extremely important to give added consideration regarding the timing of intra-day scalps with the opening ranges on a session & hourly basis offering further clarity on intra-day biases.

Relevant Data Releases

Other Setups in Play:

- Webinar: Scalps Favor Dollar Correction- EUR/USD Eyes FOMC Highs

- Bullish USD Outlook Mired Post FOMC- JPY, GBP & Gold in Focus

- GBPCAD at Support- Scalps Target 1.8785 Ahead of Key Data

- Scalp Webinar: USD, GBP Crosses in Focus Ahead of FOMC

- Scalping the GBPJPY Reversal- 180.30 Support Key

---Written by Michael Boutros, Currency Strategist with DailyFX

For updates on this scalp and more setups follow him on Twitter @MBForex

To contact Michael email mboutros@dailyfx.com or Click Here to be added to his email distribution list

Join Michael for Live Scalping Webinars on Mondays on DailyFX at 12:30 GMT (8:30ET)

Interested in learning about Fibonacci? Watch this Video